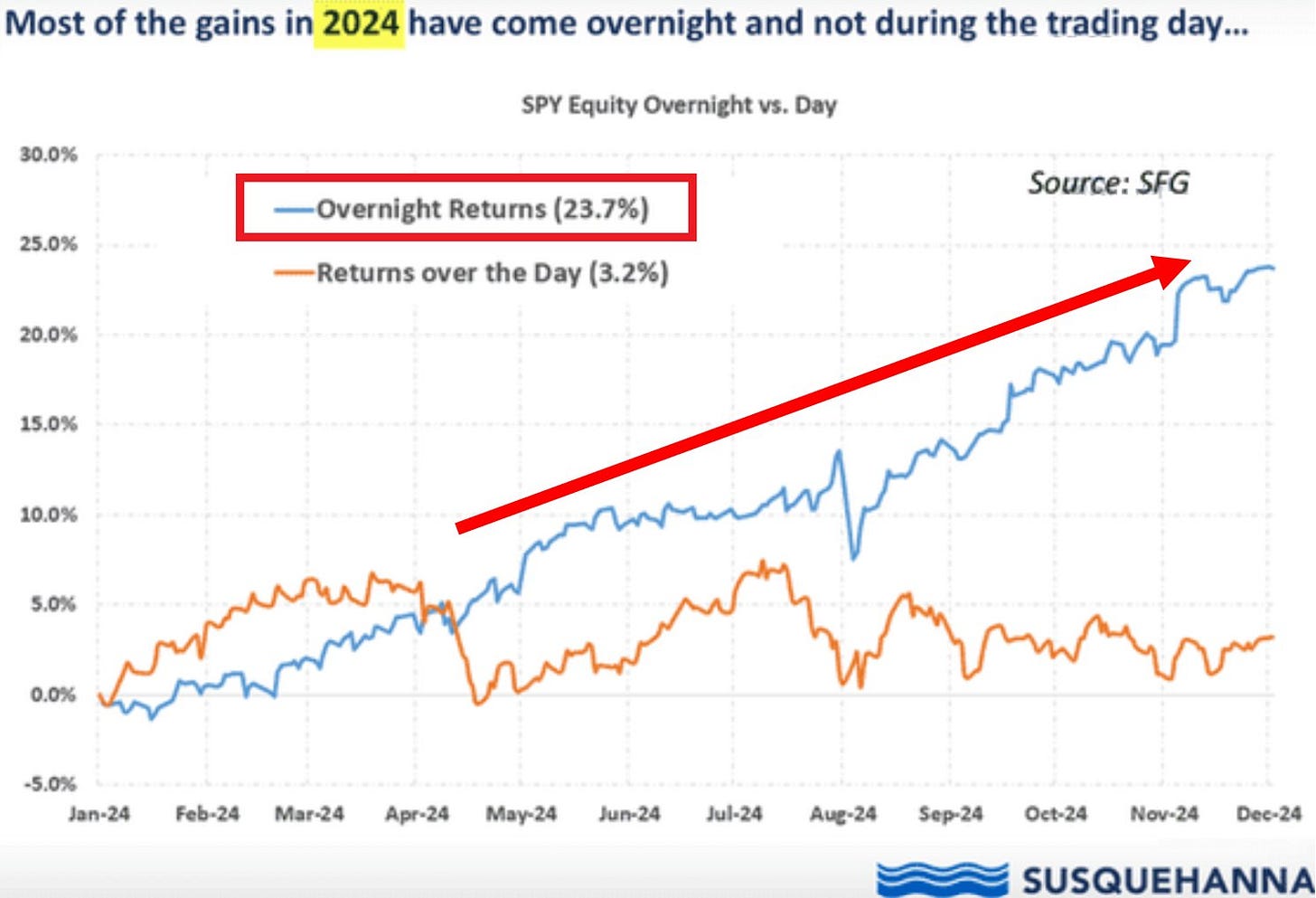

🚨The vast majority of stock gains come outside trading hours

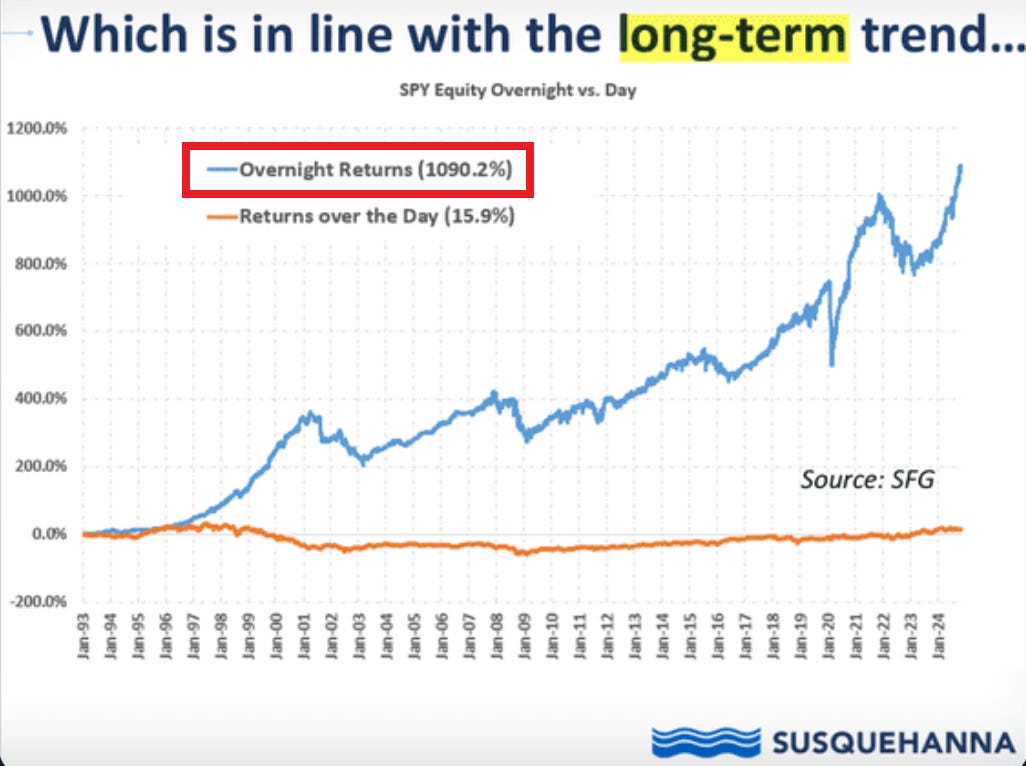

Over the last 31 years, 98% of the S&P 500 gains have occurred during overnight hours

56,500 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

Most of the S&P 500 gains this year came outside the trading hours. The index has advanced by 23.7% in overnight trading while only by 3.2% during trading days.

This trend has been even more evident in the long term. Over the last 3 decades, overnight returns have hit 1090%, compared to only 16% gains during the trading hours.

To put this differently, a strategy of buying at the close and selling at the open has widely outperformed buying at the open and selling at the close.

This is because most major events impacting the stock market take place outside of regular trading hours from 9:30 AM ET to 4 PM ET. This includes US economic data releases, earnings reports, and conference calls as well as news coming from Europe and Asia.

This is absolutely remarkable, to say the least.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?