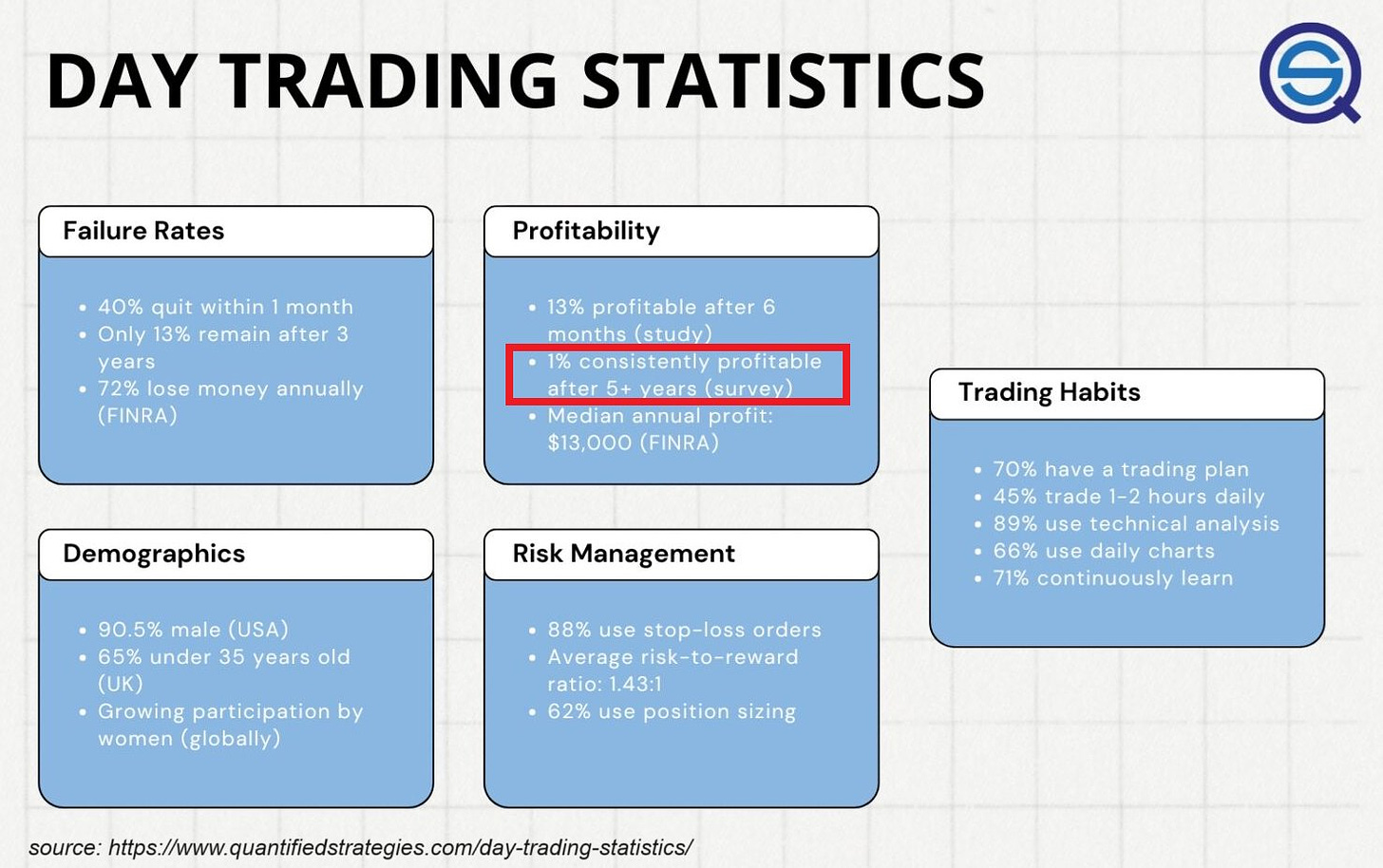

Chart of the week: Only 1% of day traders actually make money

Less is more in financial markets

One of the most underrated statistics in financial markets is about how many of the so-called day traders consistently make money. The reality is that not many of them.

As you can see in the below table, 99% of day traders consistently LOSE MONEY over 5 or more years.

Furthermore, after 6 months of trading, only 13% of day traders are profitable. This is because the more you trade markets, the higher the chance of losing money. We can call it overtrading.

In other words, day trading is nothing else like making money for a broker. Even casino gamblers are more successful than people who trade daily. According to some studies from ~10 years ago, 13 out of 100 gamblers leave the casino as the winner.

No wonder why 40% of day traders quit within a month, and only 13% stay playing this zero-sum game after three years.

All things considered, I would never advise to trade. Statistics are brutal and this will never change.

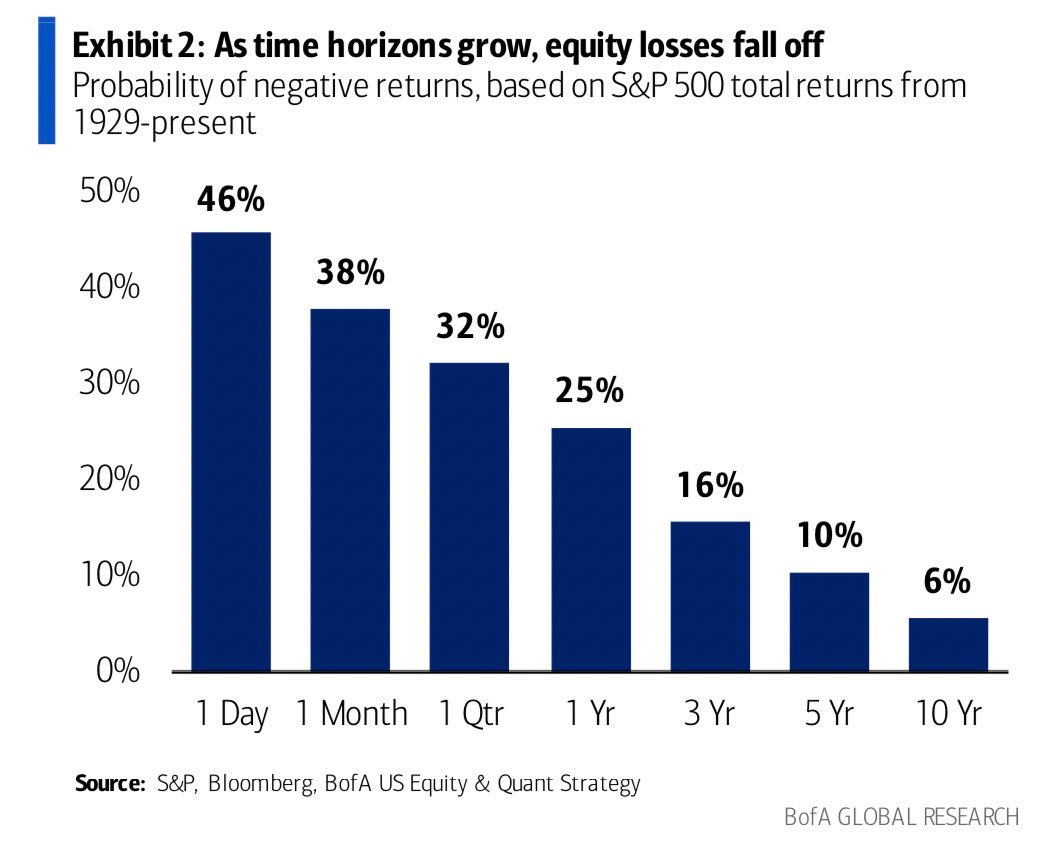

Lastly, as we are focused on investing. I brought out here an interesting analysis from the Bank of America research department. It shows that the longer you hold stocks there is less probability of a loss. This is based on the S&P 500 total returns measured since 1929.

The chance of a loss if holding stocks just for one day is a whopping 46% versus 25% for 1 year period. If one would hold for 10 years there would be only a 6% probability of losing money.

This is also in line with the article about how returns could look like when you buy the S&P 500 at all-time highs. For more details click the link below:

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), buying me a coffee, and following me on Twitter:

Why subscribe?

My take is that there is unlimited money to earn by counter-trading long-term.

Im glad someone wrote this article