S&P 500 recorded the best 1st half in an election year since 1976. Weekly market recap, trading week 26/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

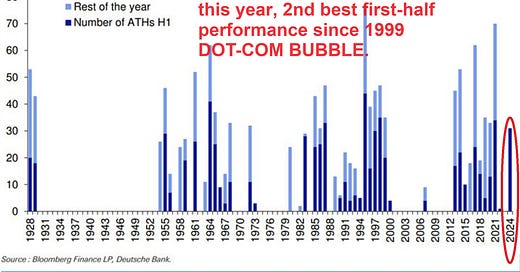

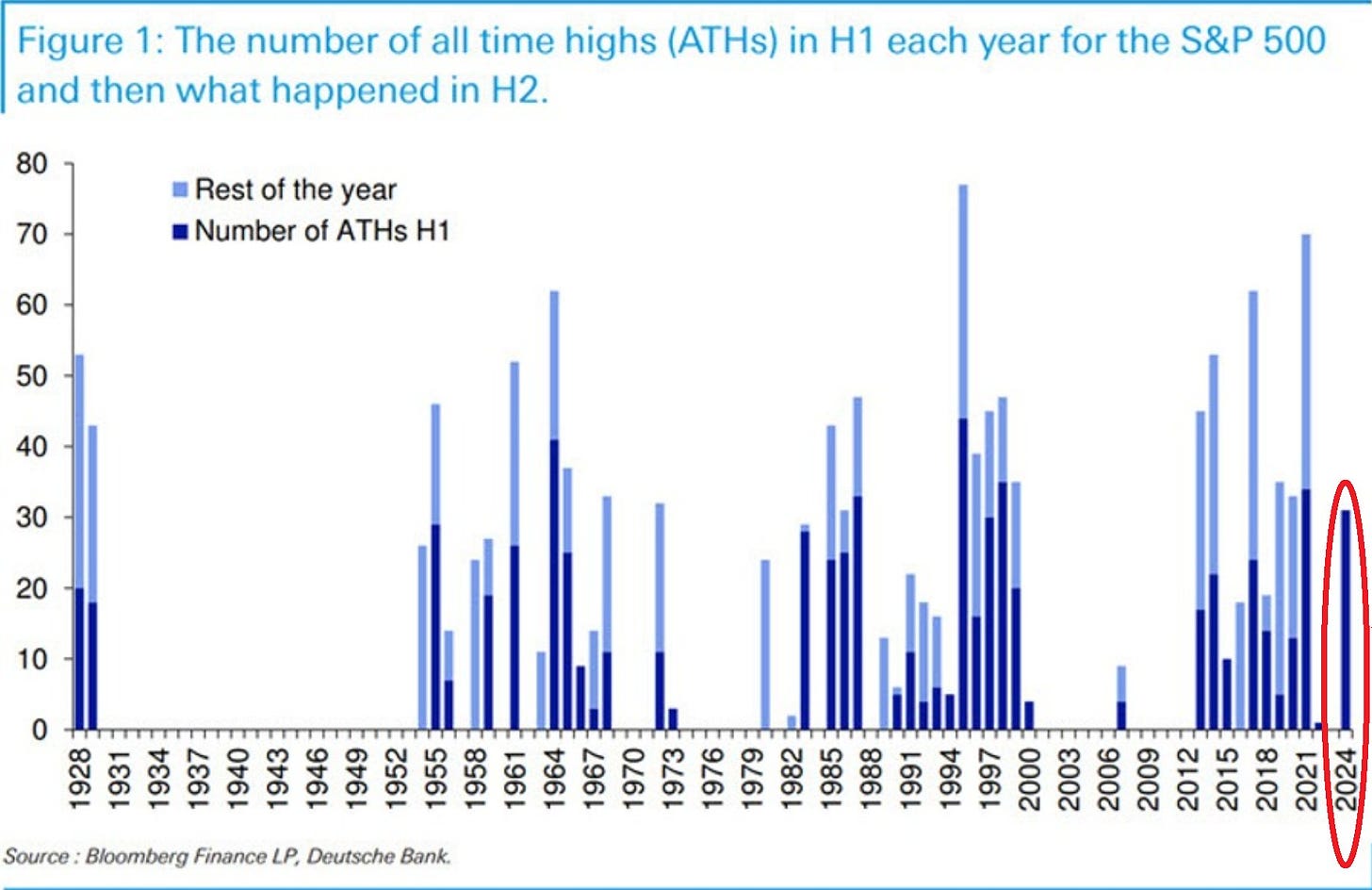

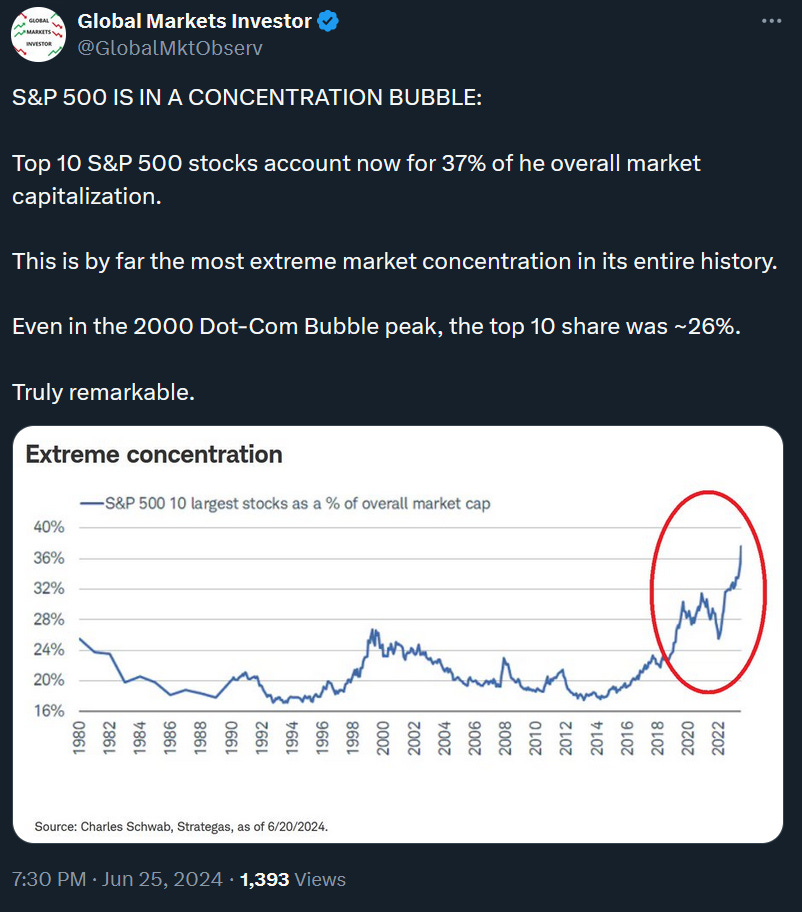

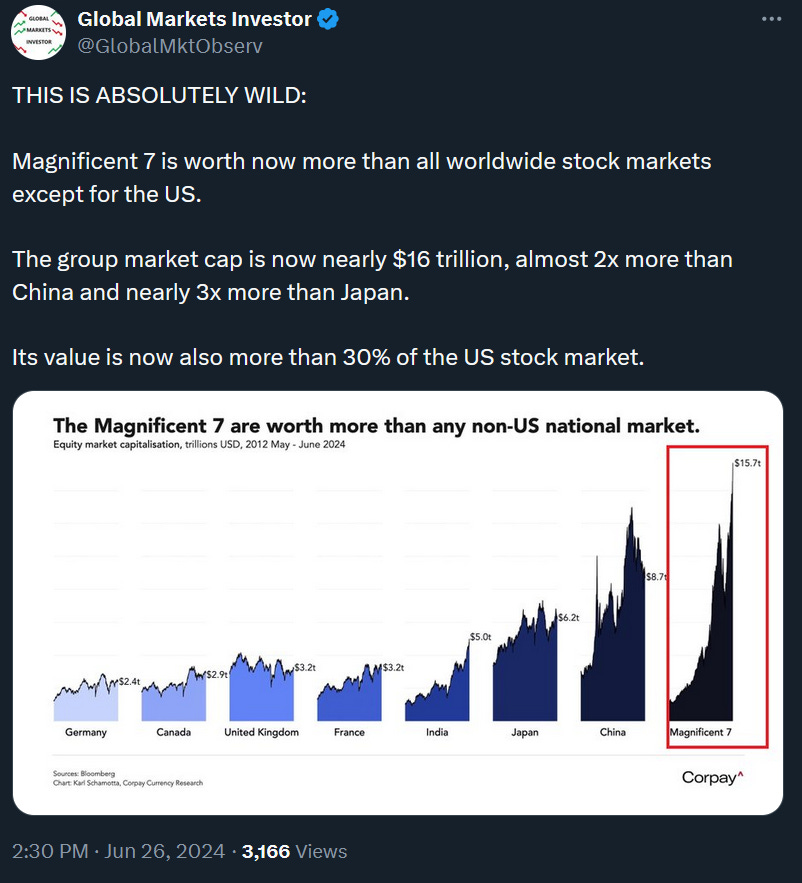

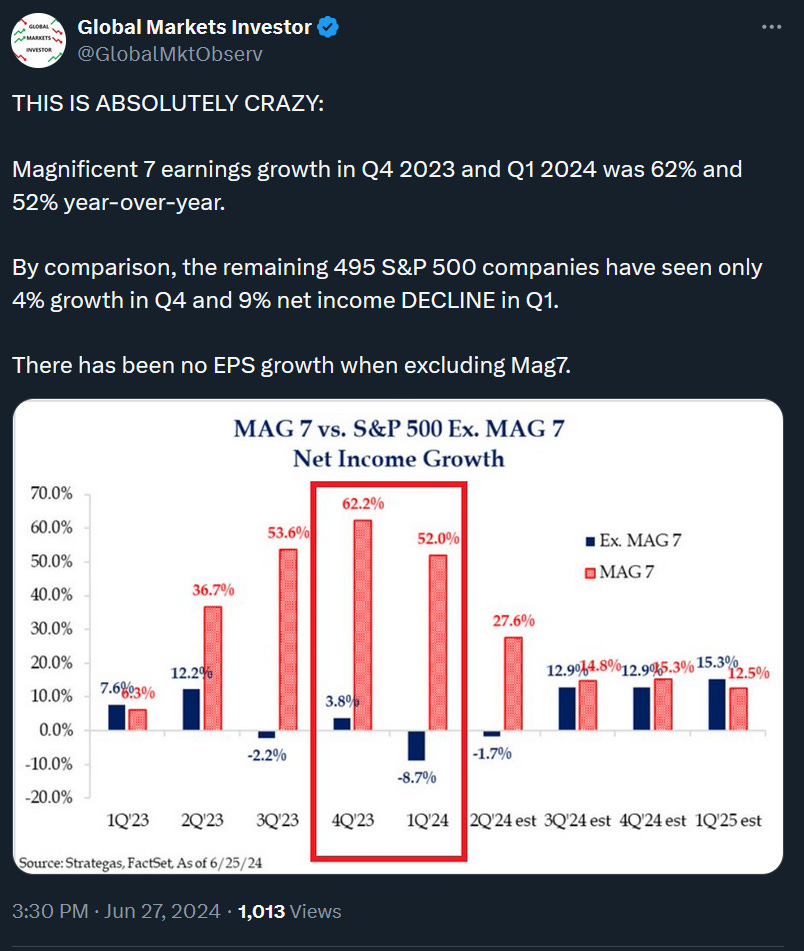

S&P 500 just had the best 1st half in an election year since 1976, gaining 15%. The index also has reached 31 all-time highs, 2nd best first-half performance since 1999 DOT-COM BUBBLE.

It has been driven by an incredible rally of the Technology and Communication Services sectors which are up 28% and 26% year-to-date.

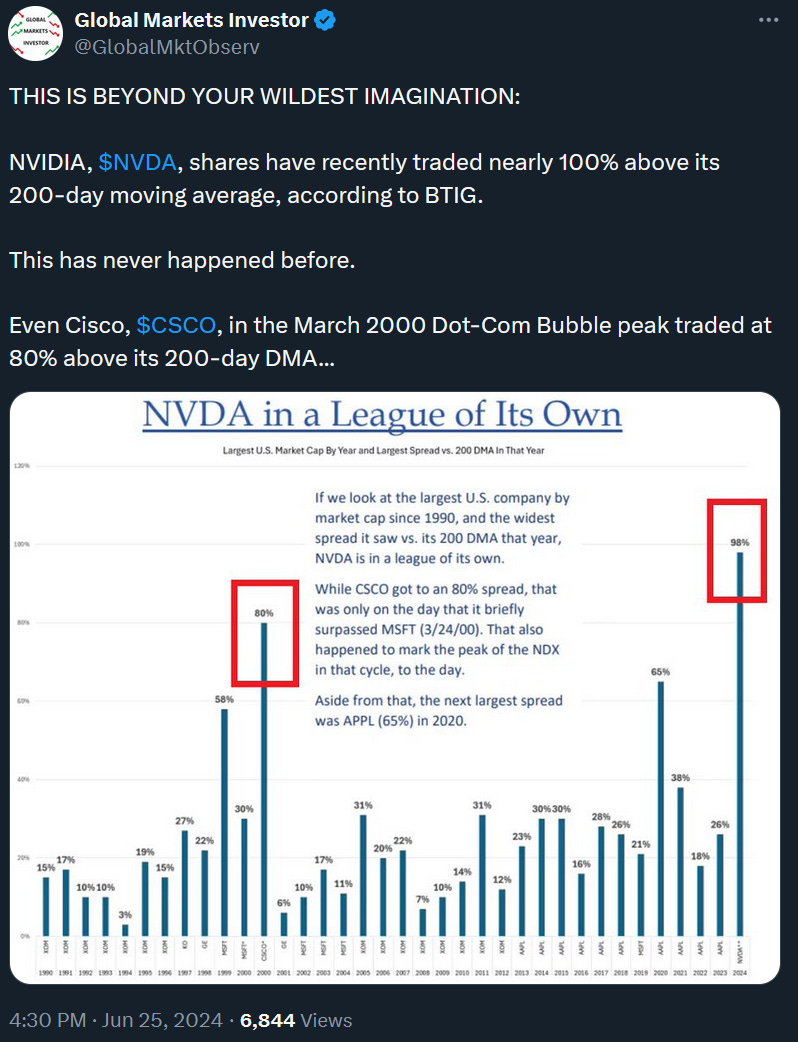

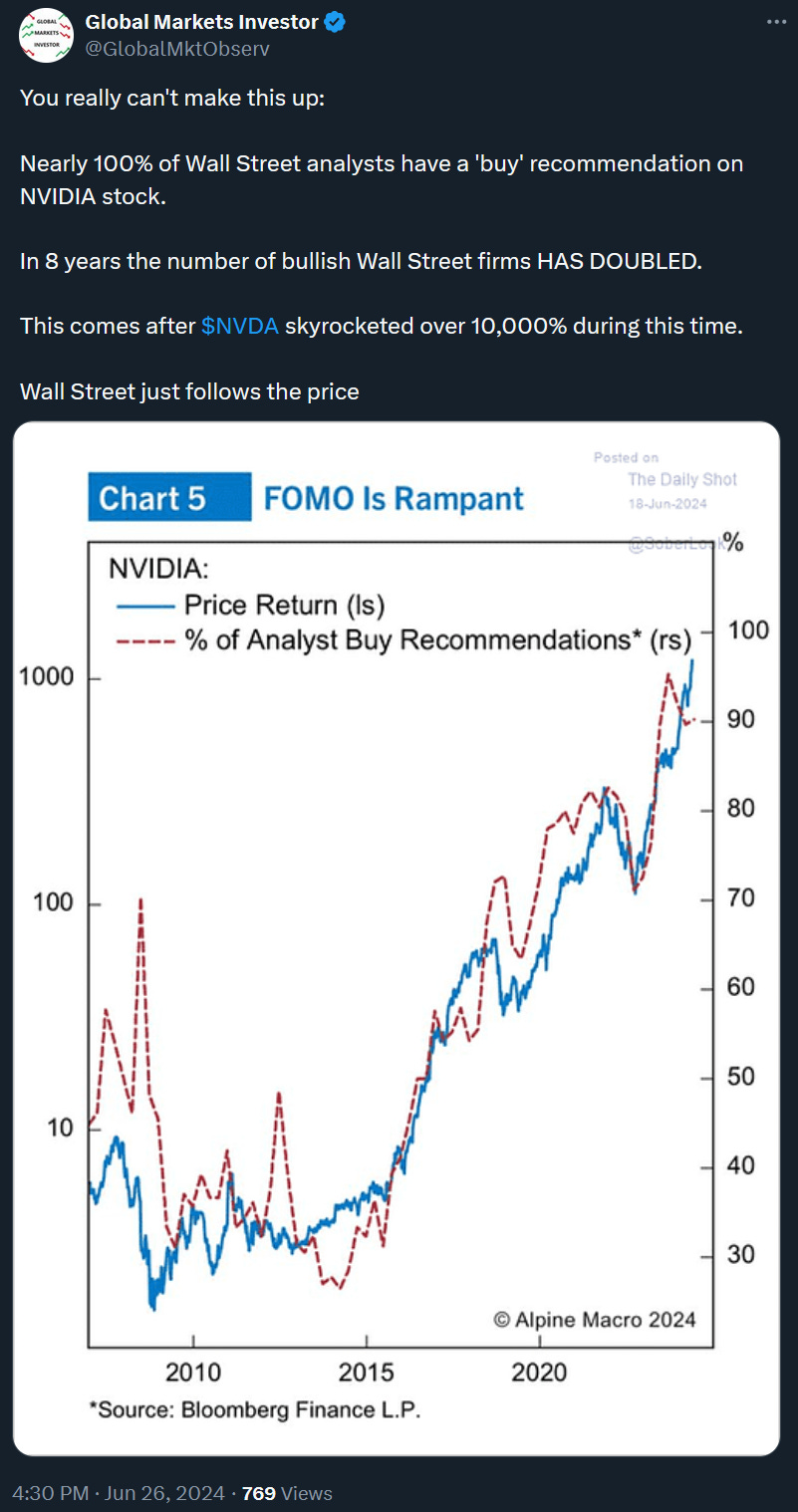

The best S&P 500 performer was NVIDIA with a whopping 150% surge. Notably, NVIDIA shares saw a lot of volatility and eventually ended the week down 2.4%.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 ended the week slightly down by 0.1%.

- Nasdaq 100 index was up 0.2% as Nvidia posted 2nd consecutive weekly decline.

- Dow Jones was down 0.1%.

- Russell 2000 (small caps) ended the week +1.0%.

- VIX was down by 5.8%

- Gold rose by 0.8%.

- Bitcoin saw a 5% loss.

For the trading week ending July 5, key events are:

- US ISM Manufacturing PMI data for June on Monday

- Fed Chair Powell’s Speech on Tuesday

- US Job Openings and Labor Turnover Survey (JOLTS) on Tuesday

- Fed meeting minutes on Wednesday

- US Jobs Report for June (Non-Farm Payrolls) on Friday

- At least 5 Fed speeches

As a reminder, the stock market is closed on Thursday due to the 4th of July Holiday.

Investors’ eyes will be focused on Fed Chairman Jerome Powell’s Speech looking for hints about the timing of future rate cuts as well as on the non-farm payrolls report. Wall Street estimates that the US economy created 180,000 new jobs in June after 272,000 in May and the unemployment rate remained at 4.0%. Data roughly in line and below expectations should be positive for stocks, bonds, and gold.

Remember, however, that the labor market shape is not that bright under the surface. Read the details below.

2) Is the Japanese Yen heading to 170 against the US dollar?