S&P 500 hit its 57th all-time high this year. Weekly market recap, trading week 49/2024

Summary of the trading week using the most popular posts from the X platform

56,500 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

Another low liquidity week despite the November’s US job market report release on Friday. A full analysis of the labor market will be sent during the next week. Meanwhile, the S&P 500 hit its 57th all-time high, the third-best year this century. Interestingly, the Volatility index VIX fell below 13 for the first time since July.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 increased 0.9%

- Nasdaq index jumped 3.3%

- Dow Jones was down 0.6%

- Russell 2000 (small caps) declined 1.2%

- VIX fell by 6%

- WTI Crude Oil tumbled 1.2%

- Silver increased 1.3%

- Gold declined 0.9%

- Bitcoin rose by 4.8%

For the trading week ending December 12, key events are:

- Reserve Bank of Australia rate decision on Tuesday

- US Inflation CPI for November on Wednesday

- Bank of Canada rate decision on Wednesday

- US Inflation PPI for November on Thursday

- European Central Bank rate decision on Thursday

US inflation data and plenty of central bank rate decisions a week before the Fed meeting are key focus next week.

Inflation CPI is estimated to increase from 2.6% in October to 2.7% in November. Core CPI is forecasted to remain at 3.3%. In other words, inflation likely remained elevated.

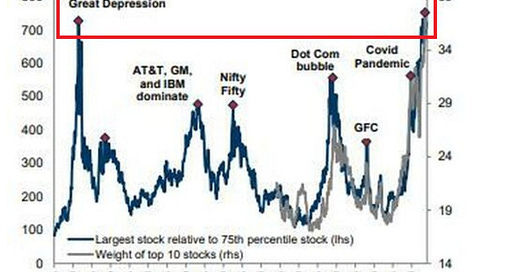

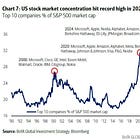

2) History lesson: every financial bubble bursts.