S&P 500 ended the week slightly negative after dropping 2.9% on Monday. Weekly market recap, trading week 32/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

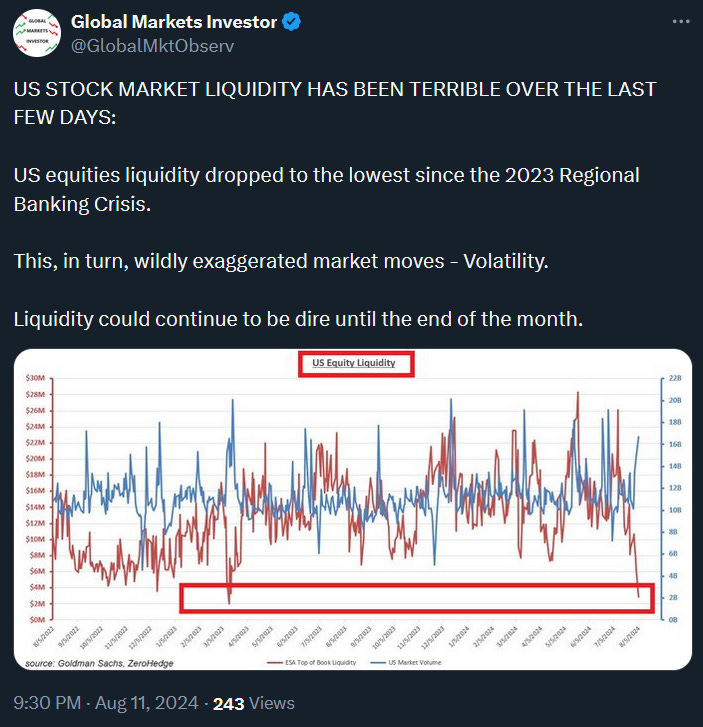

This week experienced one of the largest rollercoasters since the 2020 COVID crisis. The best summary would be using the Volatility index VIX. On Monday, it spiked by as much as 190% to the 3rd largest level in its entire history, only below 2008 and 2020. Subsequently, over the next for days it has declined by 70% to levels not considered so scary anymore. Below you can find out some further analysis and recaps of this week’s events.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 ended the week down by 0.1%. That was also the 4th consecutive week of declines.

- Nasdaq index was down by 0.2%, marking the 5th straight week of decreases, the longest streak since September 2022.

- Dow Jones fell by 0.6%

- Russell 2000 (small caps) ended the week down 1.5%.

- VIX FELL 12%.

- Gold was unchanged for the week.

- Bitcoin saw a slight decline of 0.1%.

For the trading week ending August 16, key events are:

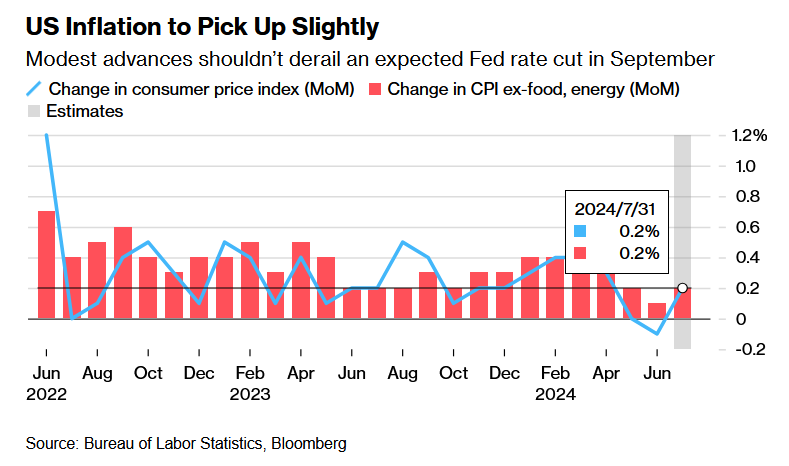

- US PPI Inflation data for July on Tuesday

- US CPI inflation data for July on Wednesday

- US Retail Sales data for July on Thursday

- US NY Fed Manufacturing Survey and Philly Fed Manufacturing Survey on Thursday

- US Consumer Sentiment on Friday

- Q2 2024 earnings reports with Walmart reporting on Thursday

All investors’ eyes will be focused on US CPI inflation and retail sales data. Inflation is expected to decline to 2.9% in July from 3.0% in June with the core inflation (excl. food and energy) to decrease to 3.2% from 3.3%. Month-over-month, both metrics are anticipated to pick up to 0.2%.

As always, a significant beat above forecasts could spark a market sell-off. Data in line or slightly above should be fine for the markets. However, if inflation comes in substantially below expectations that could trigger additional recession fears and stocks could decline in this scenario as well.

2) Warren Buffett’s Berkshire Hathaway cash pile as a % of total assets is historic.