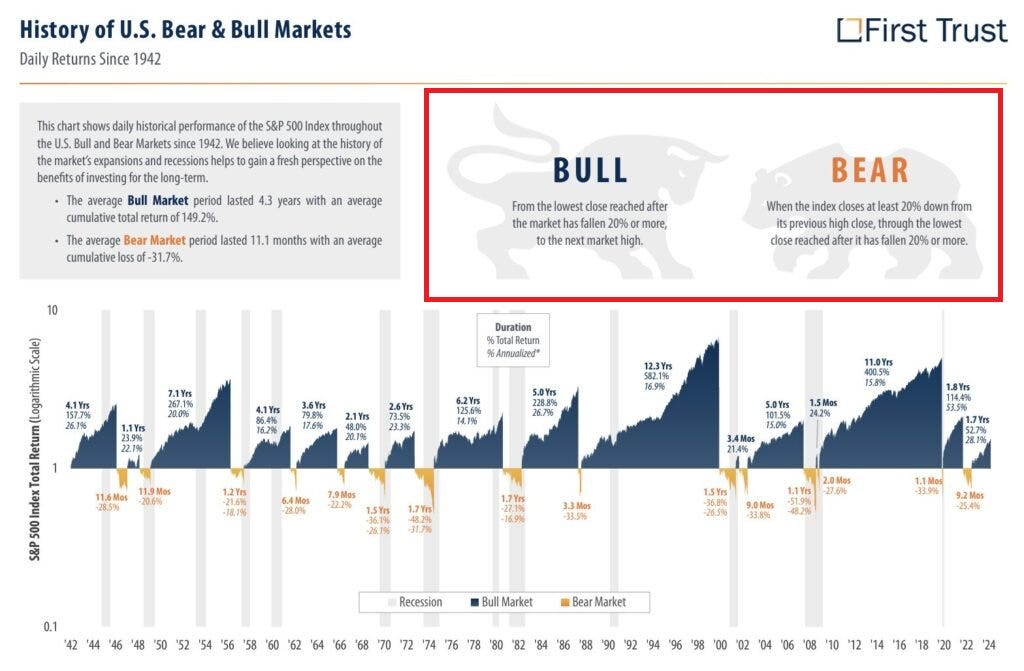

Investing is a long-term 'game'

Over the last century bull markets lasted for much longer than bear markets

This is a gentle reminder that pullbacks and bear markets are GREAT investing opportunities:

In 2020, the S&P 500 dropped by ~35%, and in 2007-2009 almost 60%. In 2000, the S&P 500 fell by almost 50%, and in 1987 by 34%. Over time, one of the most watched stock indexes in the world managed to recover. In other words, the investing horizon matters.

These statistics, however, are not adjusted for inflation. When we take inflation into account it usually takes longer to recover.

As you can see on the above chart, over the last century, the average bull market lasted for 4.3 years with an average total return of 149.2%. On the other hand, the average bear market lasted for 11.1 months with an average loss of 31.7%.

This is why staying invested long-term almost always provides positive returns.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?