S&P 500 dropped for the second consecutive week. Weekly market recap, trading week 51/2024

Summary of the trading week using the most popular posts from the X platform

59,700 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

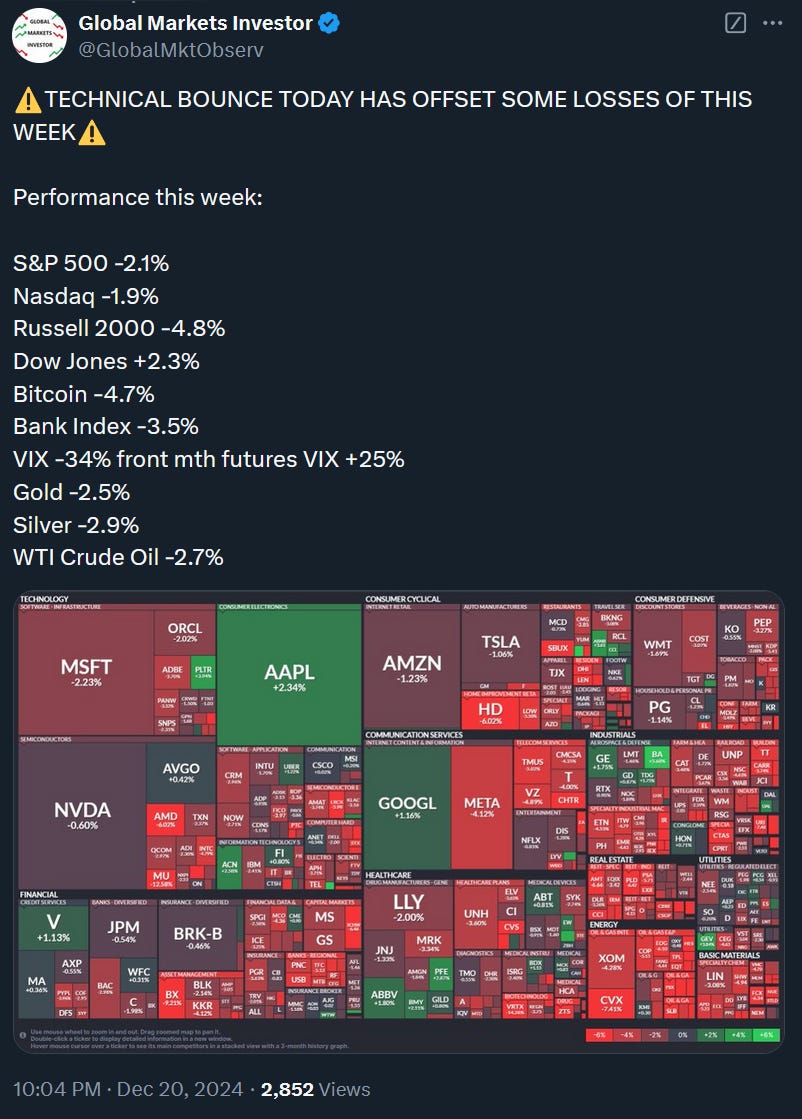

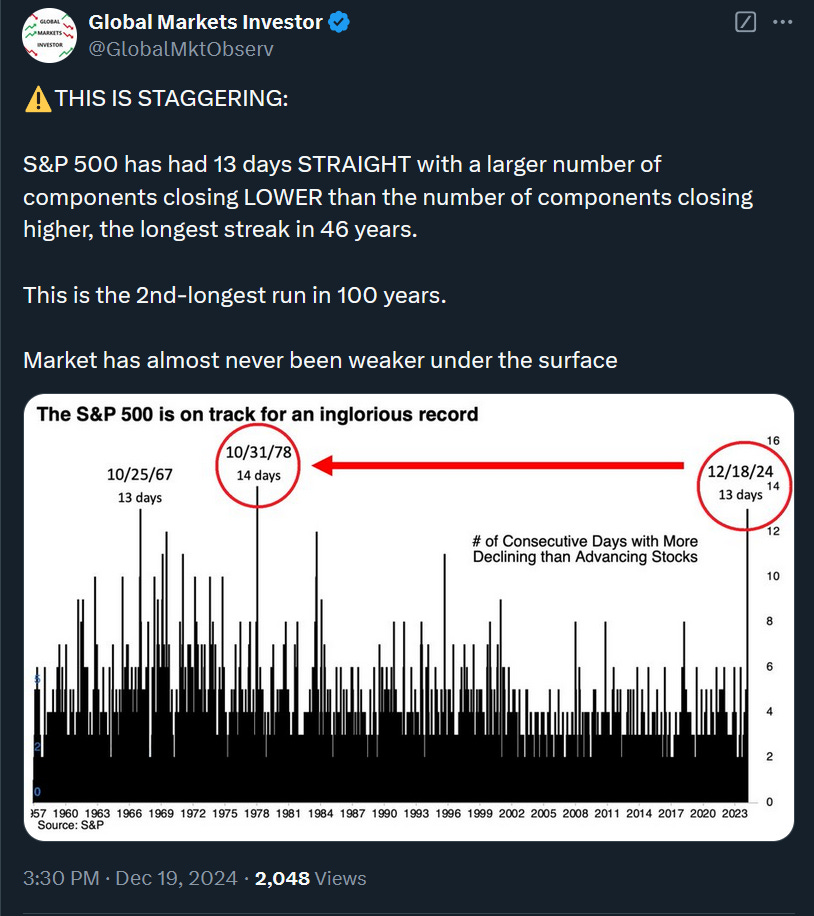

US stocks dropped for the second consecutive week with a very volatile last three days. On Wednesday, the S&P 500 plummeted 3.0%, the biggest drop in the decision Fed day since the March 2020 crash. Subsequently, on Thursday stocks ended flat and bounced by 1.1% on Friday following better than expected inflation PCE data.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 dropped 2.1%

- Nasdaq index fell 1.9%

- Dow Jones was down 2.3%

- Russell 2000 (small caps) declined 4.8%

- VIX fell by 34%

- WTI Crude Oil decreased 2.7%

- Silver fell 2.9%

- Gold dropped 2.5%

- Bitcoin tumbled by 4.7%

For the trading week ending December 27, key events are:

- US Conference Board Consumer Confidence for December on Monday

- US Durable Goods Orders for November on Tuesday

- US New Home Sales for November on Tuesday

- Markets Closed due to Christmas Day on Wednesday

- US Initial Jobless Claims on Thursday

After the last Federal Reserve meeting on Wednesday and US inflation PCE data on Friday investors will be assessing a potential future impact of the central bank decision and subsequent data. Many funds especially pension and insurance will be rebalancing their portfolios before the year ends.

2) It turns out that indicators from the last week have predicted a market pullback.