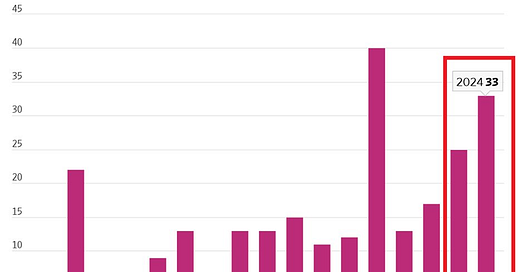

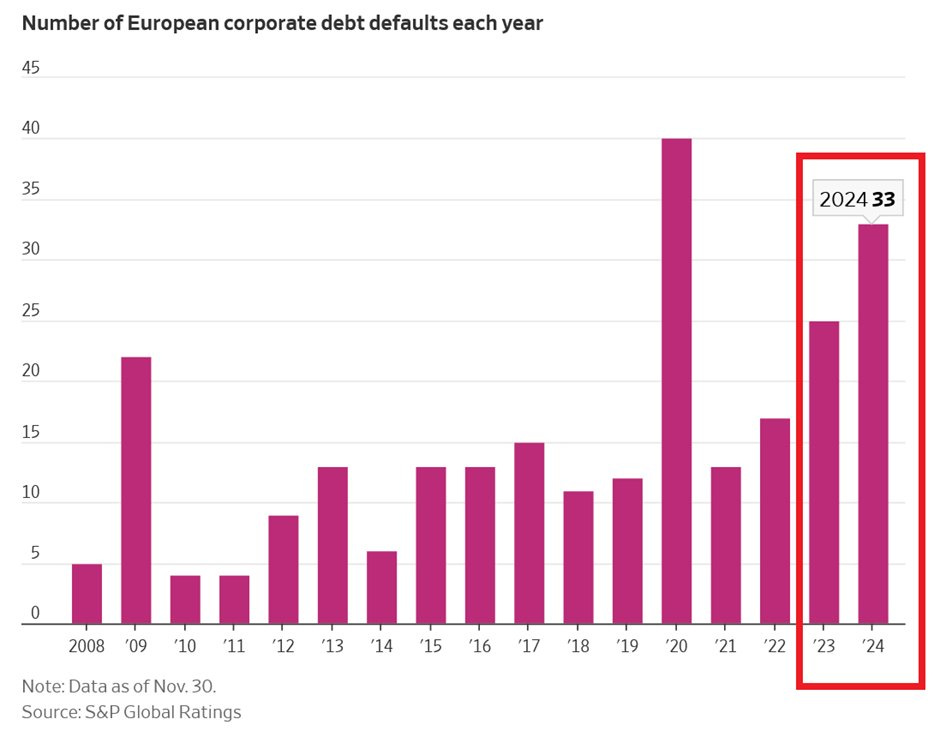

⚠️CHART OF THE WEEK: European corporate debt defaults hit the second-highest level on record

33 European companies have defaulted on their debt year-to-date, the most since 2020

59,000 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

There have been 33 corporate debt defaults in Europe year-to-date, the most since the 2020 Crisis. This is double the amount recorded in 2022 and 11 more than during the Great Financial Crisis in 2009.

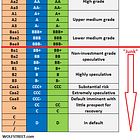

As a reminder, debt default occurs when one or more terms of a loan agreement are violated by a borrower. It could be missed interest or principal and interest on their issued bonds or other type of debt.

In the case of Europe, companies that have defaulted are issuers of the most-speculative and the riskiest type of debt. Nevertheless, this trend is concerning and worth watching going forward as the European economy is slowing.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?