Why the market has really rallied following the Fed decision?

A detailed look at the current state of the financial markets following the Federal Reserve decision

On Wednesday, the Federal Reserve held its last committee meeting of the year following which we have seen a massive market rally. The S&P 500 and Nasdaq rose 1.4%, Russell 2000 – the index of small-capitalization stocks increased 3.7% while Dow Jones Industrial Average reached an all-time high, rising 1.4%. Additionally, the US Dollar index dropped by 1% while gold and oil were up 2.2% and 1.8%, respectively. US government bonds also heavily advanced with the 2-year bond yields dropping roughly 30 basis points (0.3%) and 10-year bond yields around 20 basis points (0.2%). These are truly significant moves, especially in terms of the bond market where moves can be comparable to those which have happened in the past during some kind of crisis. Why therefore we have seen such an abrupt reaction?

This is because the real outcome from the Fed differed quite substantially from the market expectations. Let’s dig in a little bit more where the Fed was in line in the market and from where the largest difference came.

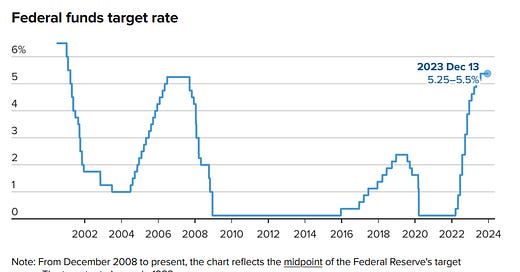

1) The market expected the Federal Reserve to leave the interest rates unchanged at the 5.25-5.50% level which was announced on Wednesday. This is the only part when investors and traders were not surprised by the central bank.

2) Next, the FOMC statement was expected to include at least a small pushback against the market expectations of almost four interest rate cuts in 2024. Guess what, there were none. The statement came with just a few small changes from the last meeting. That was the first positive for bonds, stocks, gold, and other risky assets.

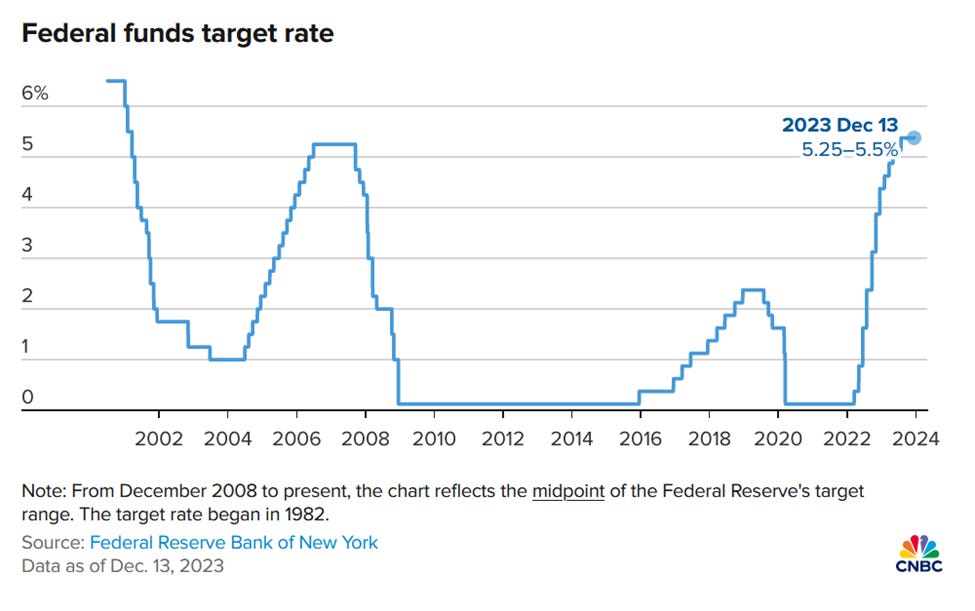

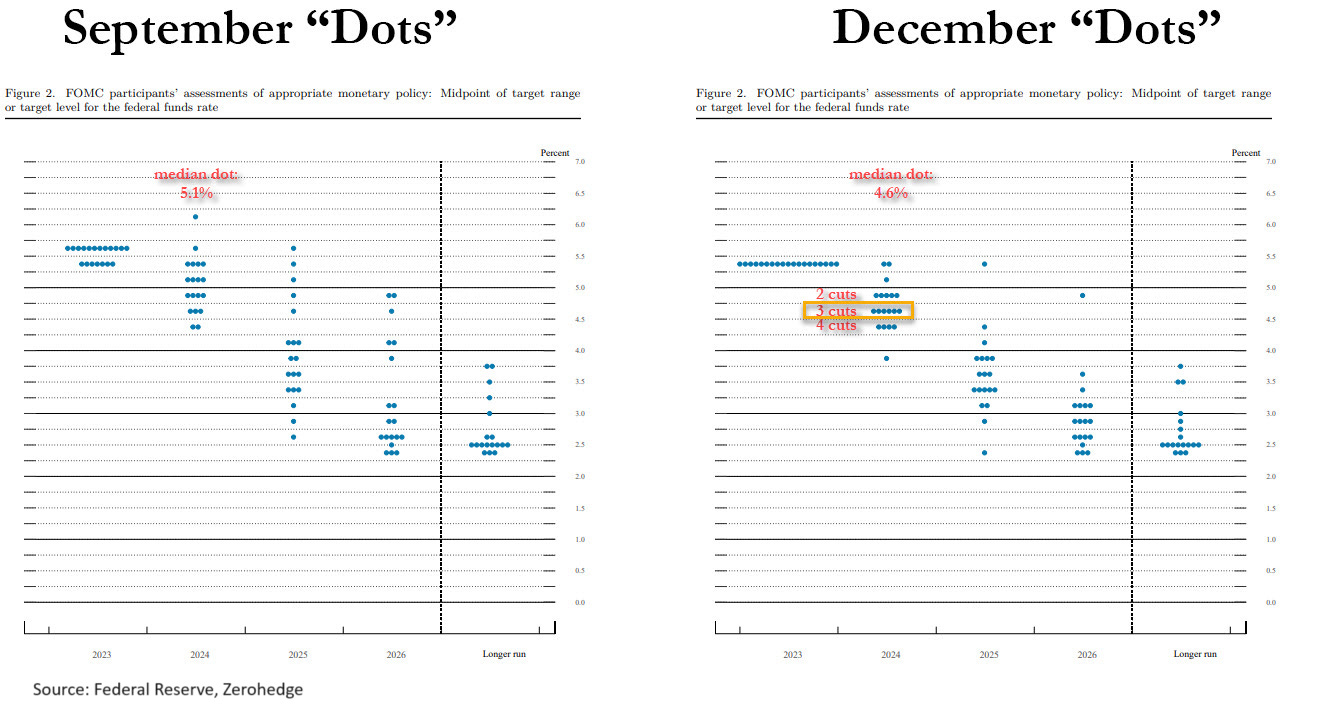

3) At the same time, the Fed has released its economic projections for the next few years where the focus was on the 2024 interest rates forecast or the so-called dot-plot. The dot plot simply shows each Fed committee participant's forecast of the US interest rates for the few years ahead. One dot in each period corresponds to one FOMC member. As you can see on the chart below, the dot-plot has moved from the median interest rate of 5.1% in 2024 to 4.6%, implying expectations of 3 interest rate cuts by the Fed next year, up from two reductions forecasted in September.

That was a substantial dovish shift which was not expected by the market. Quickly digesting this data the market rally has extended. In the end, it is worth mentioning that the central bank also expects 4 rate cuts in 2025. In any case, time to move to the last and the most important part of the event – Fed Chair Jerome Powell's press conference.

4) Most market analysts, investors, and watchers anticipated a pretty hard pushback from Powell against market expectations of substantial interest rate cuts next year. Especially, considering the fact that two weeks ago Fed Chair tried to do that but his wording appeared to be not strong enough. Instead, he gave a green light for investors or brought some bottle of tequila to Wall Street’s rate-cut party as Bloomberg put it. Although, he said that the central bank still has a way to go with the inflation fight as declaring a victory would be premature, he also said that the Fed committee discussed the timing of the interest rate cuts which exceeded the market euphoria. He also added that there was a general expectation within the committee that rate cuts would be a topic of conversation going forward. He completely ignored the part about the market financial conditions easing which was a key point for trying to articulate some pushback against rate cuts two weeks ago. In summary, this is a material pivot in the Fed policy towards easing.

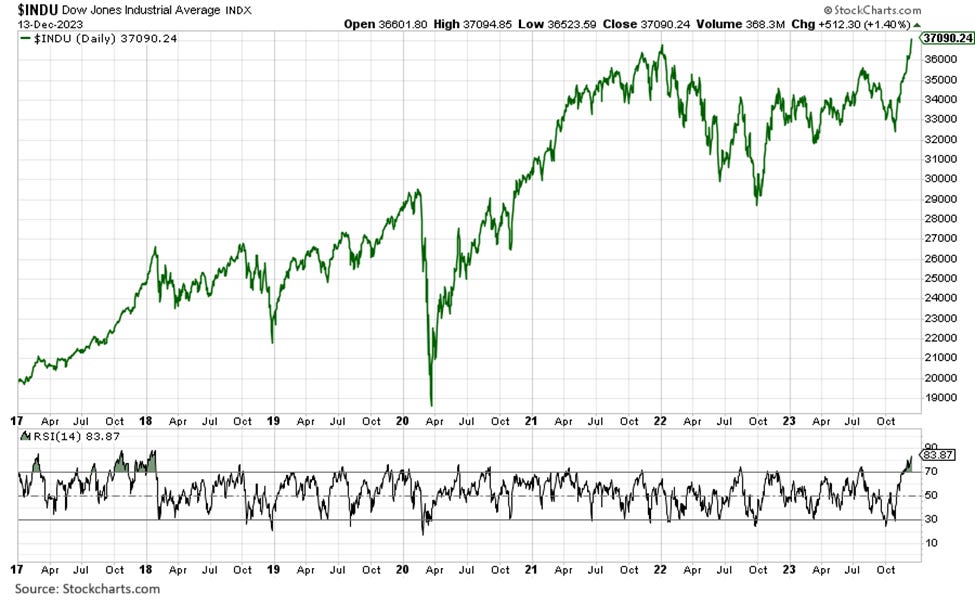

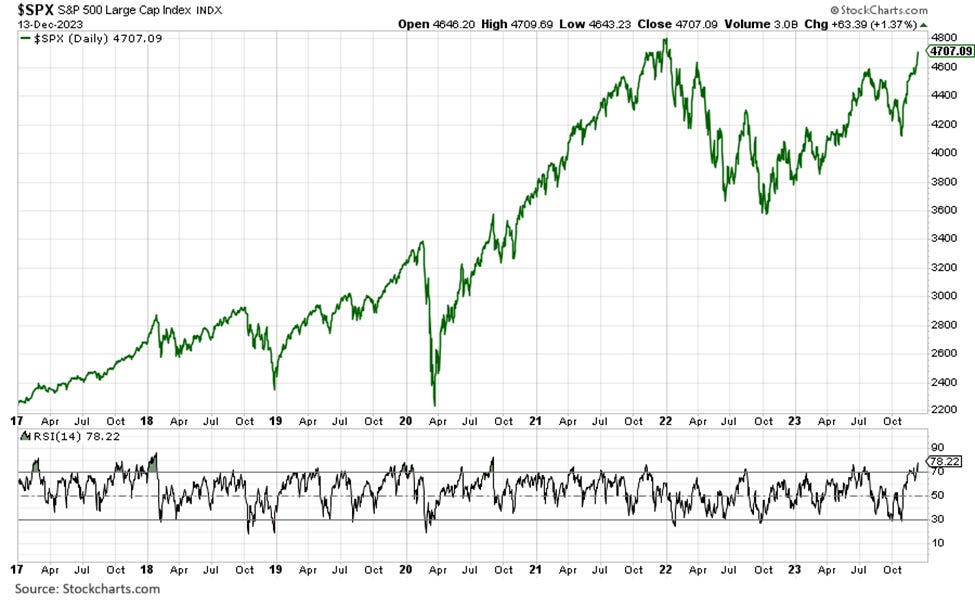

As a result, the market has extended its sixth-week rally and stocks are on track for a seventh-week winning streak. The Dow Jones Industrial Average has reached its all-time highs and is the most overbought since early 2018, as you can see in the figure below.

The S&P 500 is just 100-110 points from its all-time record and is the most overbought since September 2020.

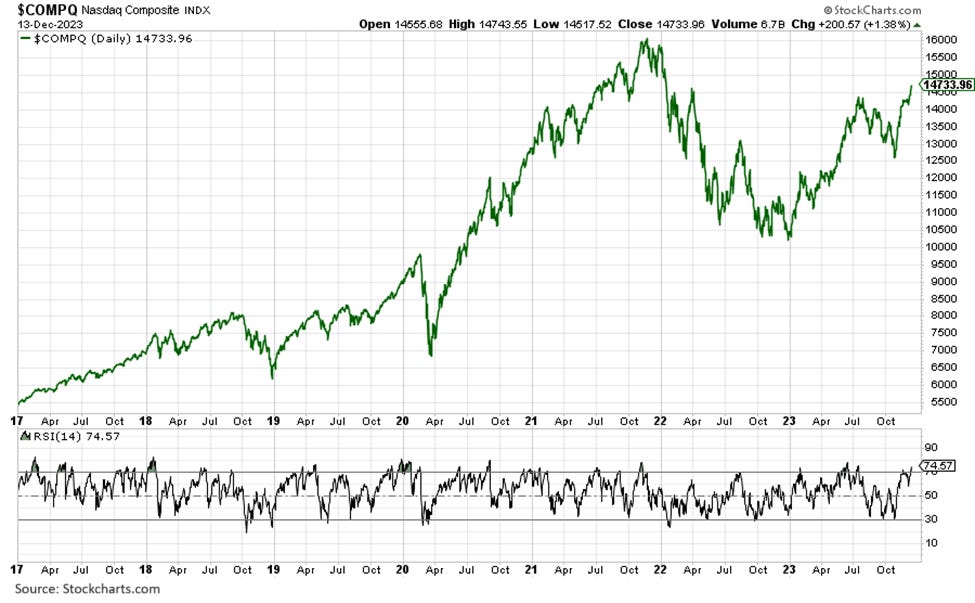

Nasdaq needs roughly 150 points to reach its all-time peak and it also overbought pretty notably, the most since July.

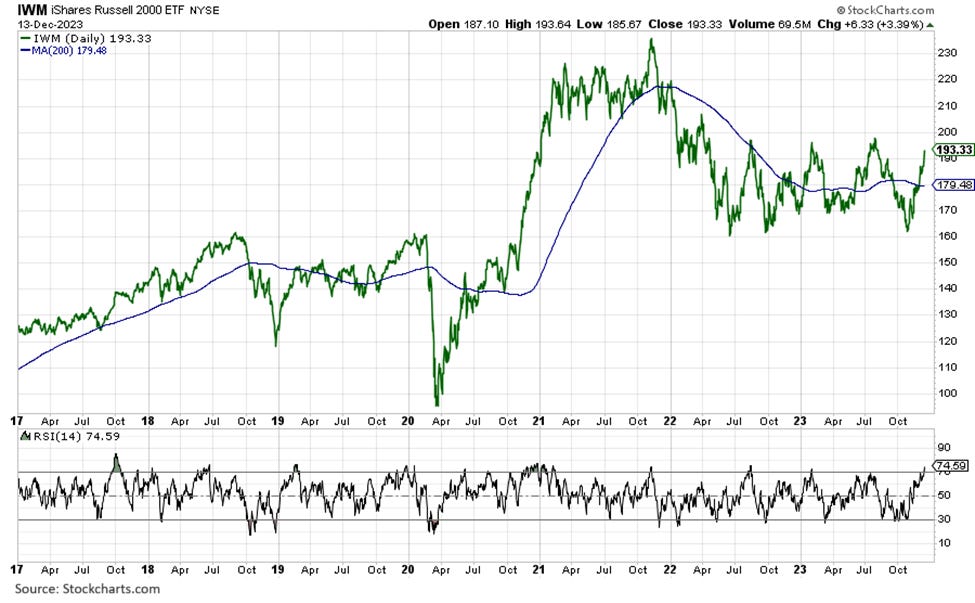

Russell 2000, the index of small-capitalization stocks which have rallied the most yesterday is trading above its 200-day moving average towards key levels of 2000 points. It is also the most overbought since August 2022.

The Volatility Index VIX, or the so-called fear index measuring the sentiment in the US stock market has fallen to the lowest levels in almost four years, expressing an enormous positive excitement in the stock market.

10-year US government bond yield is testing its 200-day moving average after its unprecedented move from almost 5% to sub-4%. As you can see, this fall is comparable to the one during the onset of the pandemic crisis in early 2020.

The US dollar index has broken its 200-day moving average once again and it looks like it is going towards 100.

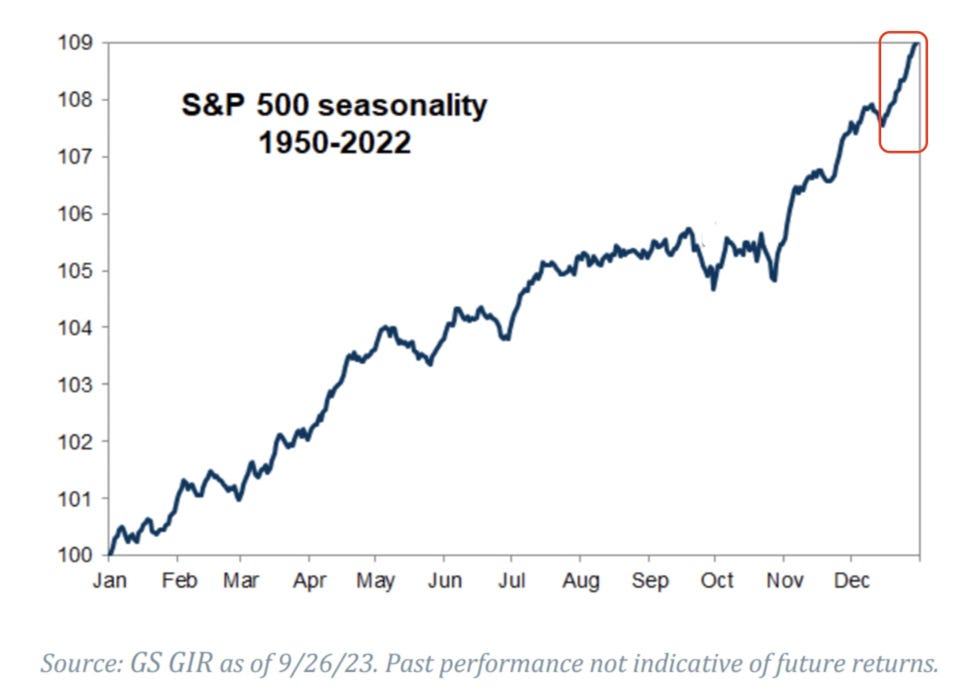

As you can see, the market is really stretched right now and priced to the limits as it currently expects almost six interest rate cuts of 0.25% in 2024 with the first one taking place in March. On the one hand, there is a green light from the Fed while investors and analysts expect the Santa Rally to continue as it has been the case in the past. The chart below shows the S&P 500 seasonality in the 1950-2022 period. We can read from it that the last two weeks of December saw at least 2% gains on average in the last seven decades.

On the other hand, with so many indicators pointing to the overbought conditions any small piece of negative news might trigger a sharp correction. In other words, that might be a good point to book some profits.

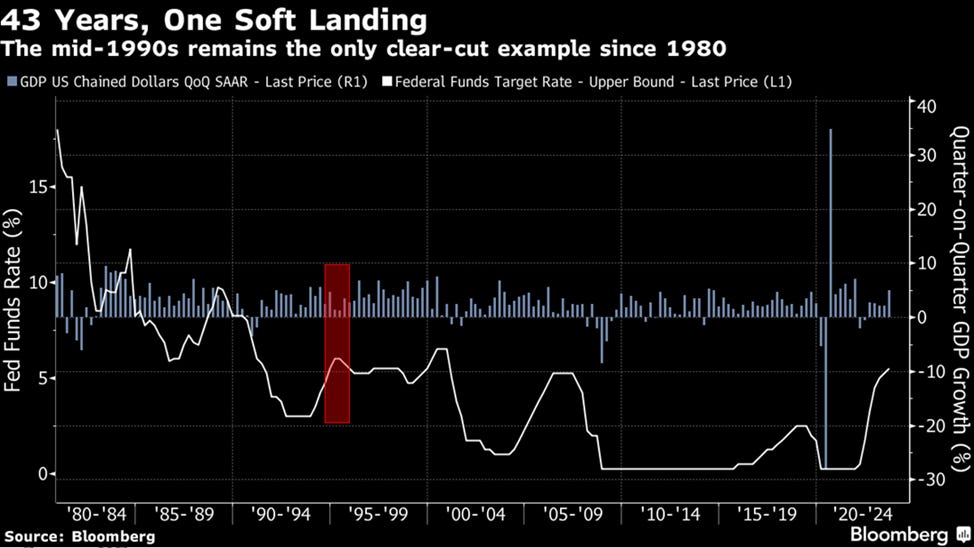

In conclusion, financial markets have been positively surprised by the Federal Reserve. Not many market participants had expected such strong messaging toward interest rate cuts from the largest world central bank. It appears that Jerome Powell is embracing the idea of a soft landing and is going to predicate his decisions on that premise. However, over the last 43 years, the US economy has been able to achieve only one soft landing and it occurred in much different economic conditions.

Therefore, if anything goes wrong and inflation picks up again it would be the largest policy mistake in this century, similar to the one in the 1970s’ when Arthur Burns, former Fed Chairman let inflation run rampant, resulting in the worst economic downturn in the United States since the Great Depression.

If you find it informative and helpful you may consider buying me a coffee:

Excellent work! And, good luck with your hedge fund aspirations.