Top 5 financial posts of the trading week 12/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

That was an extremely busy week and this time you may see below a few more pieces of data than usual.

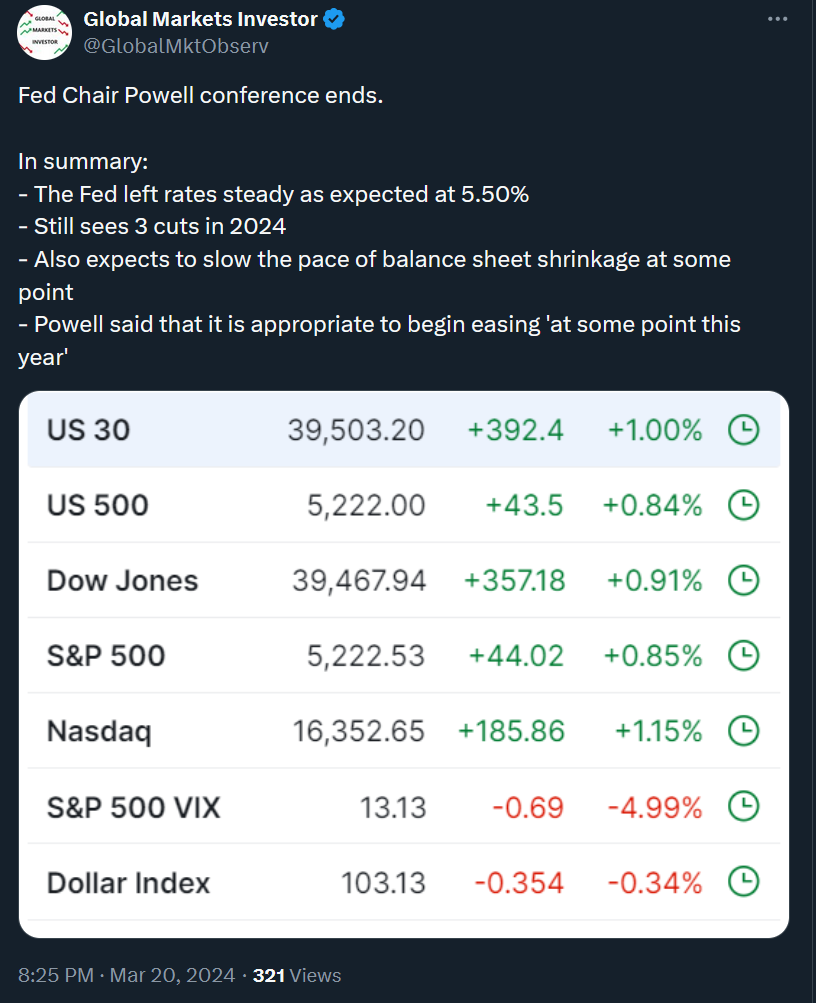

Weekly performance. In the below attachment, you can see last week’s performance of the major US indexes, the VIX volatility index, and Bitcoin. Following the Fed meeting,

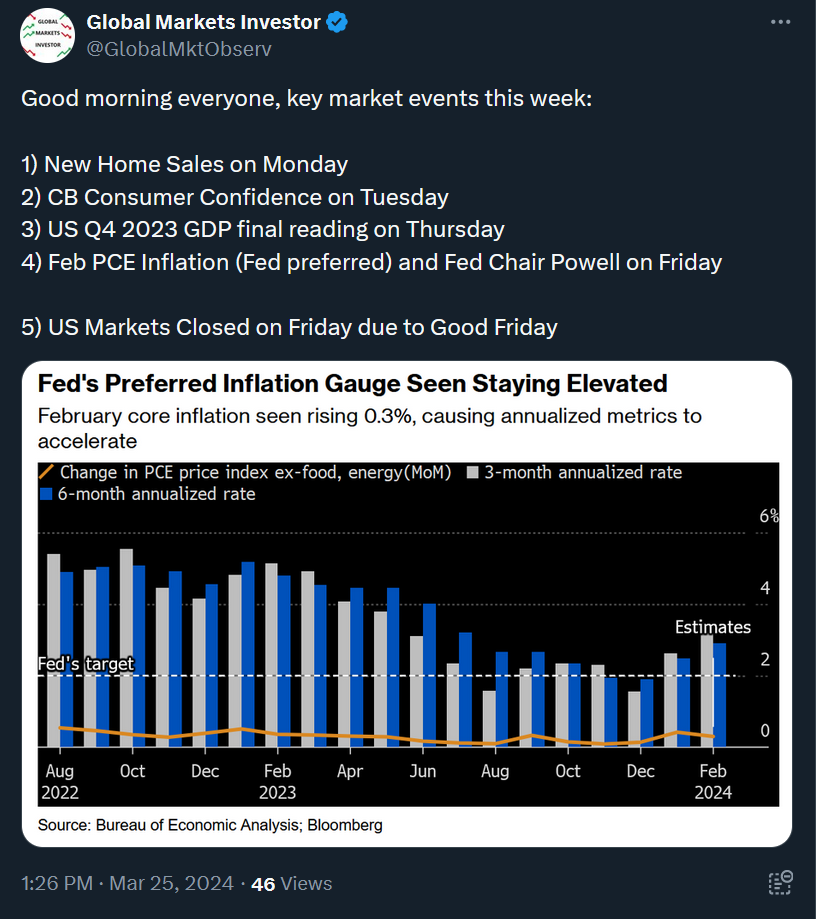

US stock finished up more than 2% with volatility falling more than 10%. Notable Bitcoin ended the week lower by more than 8%. Going forward, the most important data due is the core PCE inflation in the US on Friday (the Fed’s most preferred inflation gauge) which is expected to increase 0.3% month over month with 3-month and 6-month annualized rates to jump to 3.5% and 2.9%, respectively. Fed Chair Jerome Powell is also expected to deliver a speech on Friday while the markets will be closed due to the Good Friday holiday.

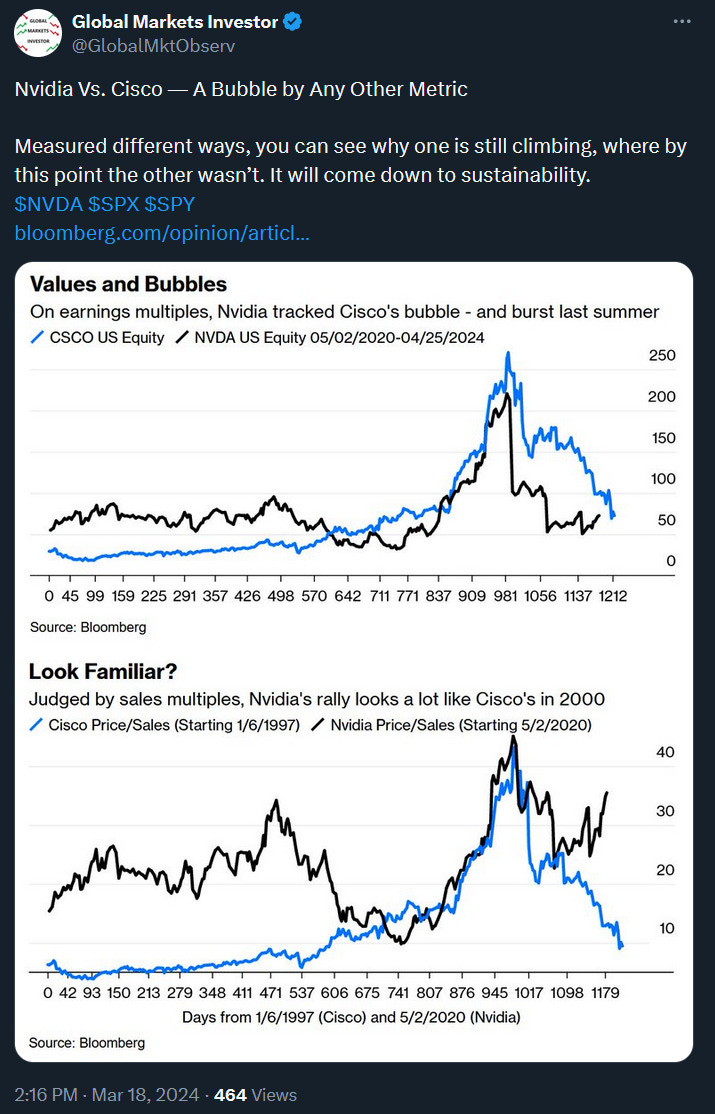

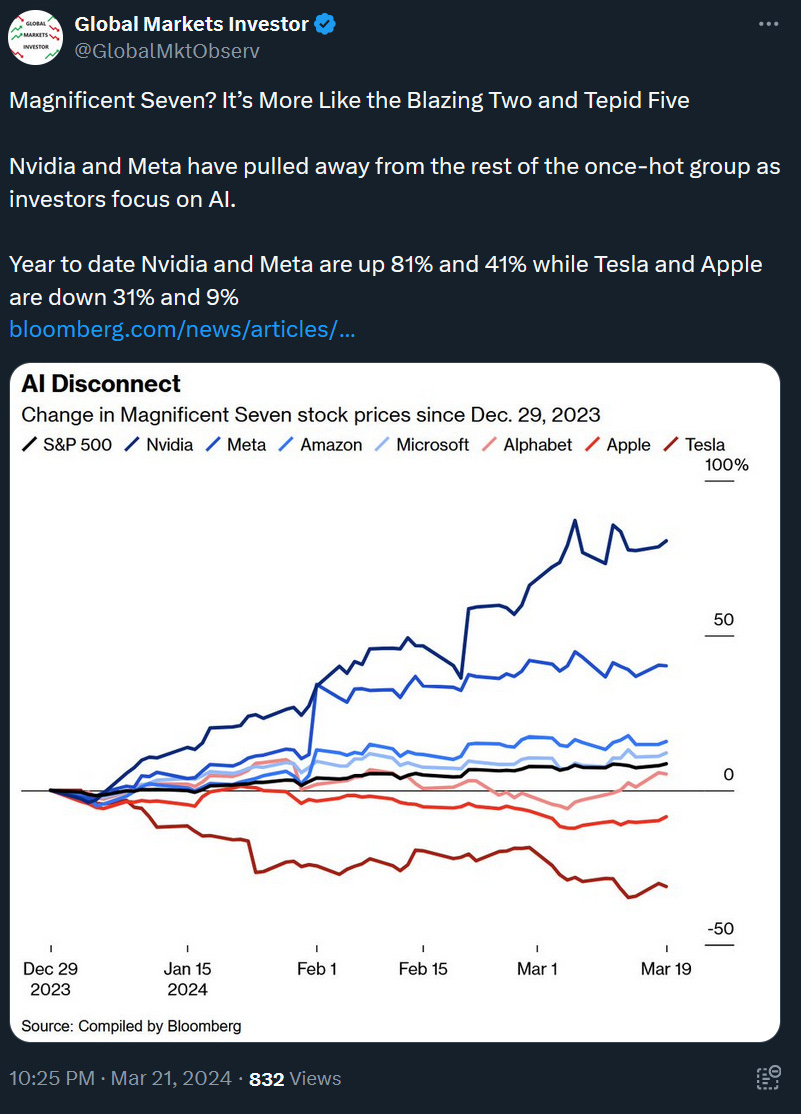

There’s been an ongoing debate about whether Nvidia is in a bubble or not. According to Bloomberg analysis, Nvidia’s bubble may have already burst by looking at the Price/Earnings ratio (first chart below), though based on the Price/Sales ratio it has not and the multiple still rises. One is certain, the Nvidia run in the last several months has been impressive. Year to date, the stock has risen by more than 80%. On the other hand, one of its Magnificent Seven peers - Tesla has fallen by more than 30% so far this year.

Finishing the section about US technology, the third attachment shows that the US tech stock prices are almost 2x larger relative to the S&P 500, the largest difference ever. Even bigger than during the dot-com bubble.

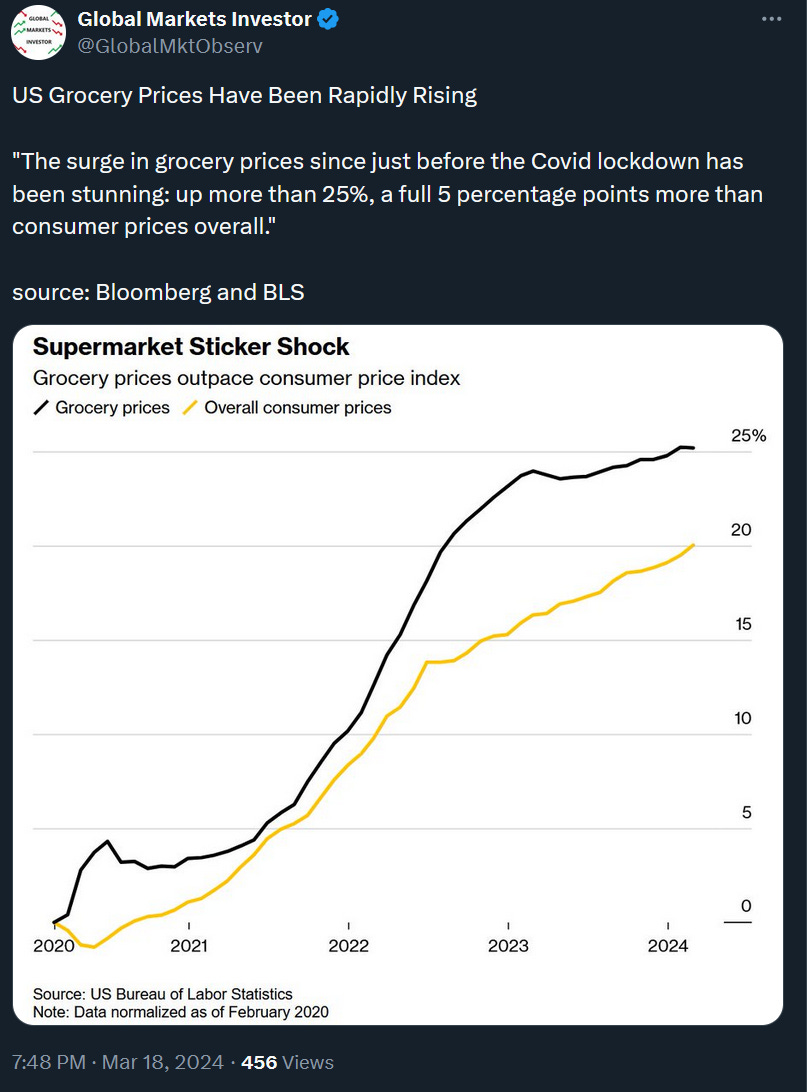

As inflation in the US has not gone away the cost of living has been continuously rising (even falling inflation means that prices are rising but at a slowing pace. Anyway, the most important - the grocery prices have increased by more than 25% since early 2020, 5 percentage points more than the official CPI inflation data.

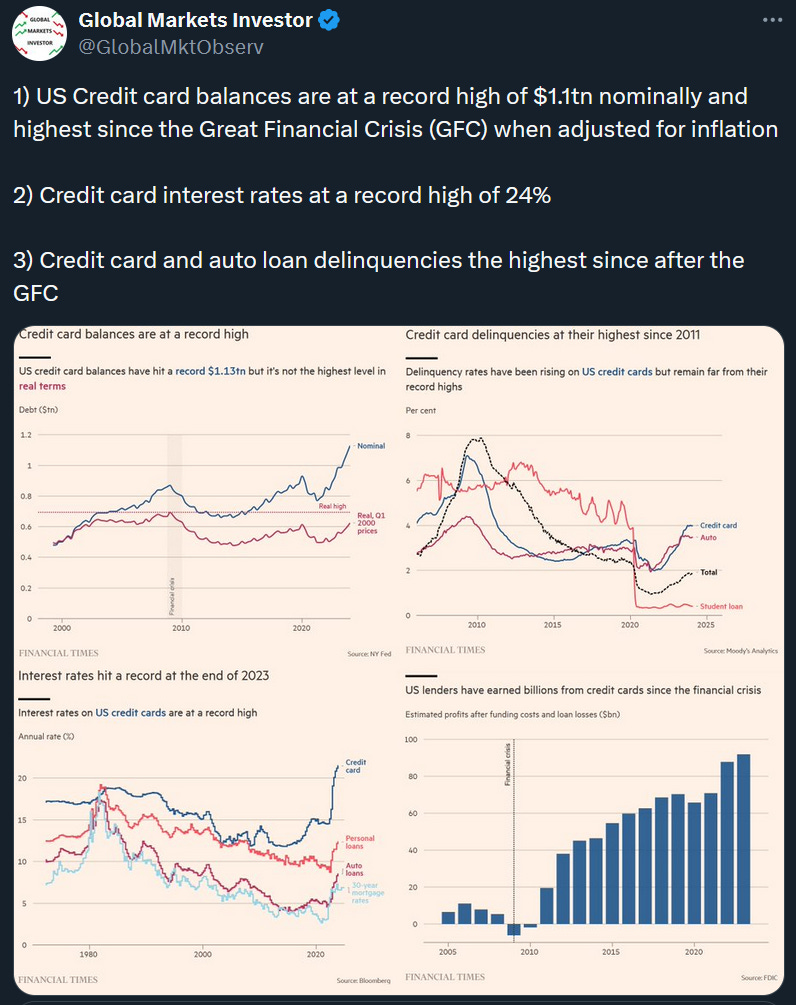

As those essential product prices have been rising, 1) US Credit card balances are at a record high of $1.1 trillion nominally and highest since the Great Financial Crisis (GFC) when adjusted for inflation; 2) Credit card interest rates are at a record high of 24%; 3) Credit card and auto loan delinquencies the highest since after the GFC.

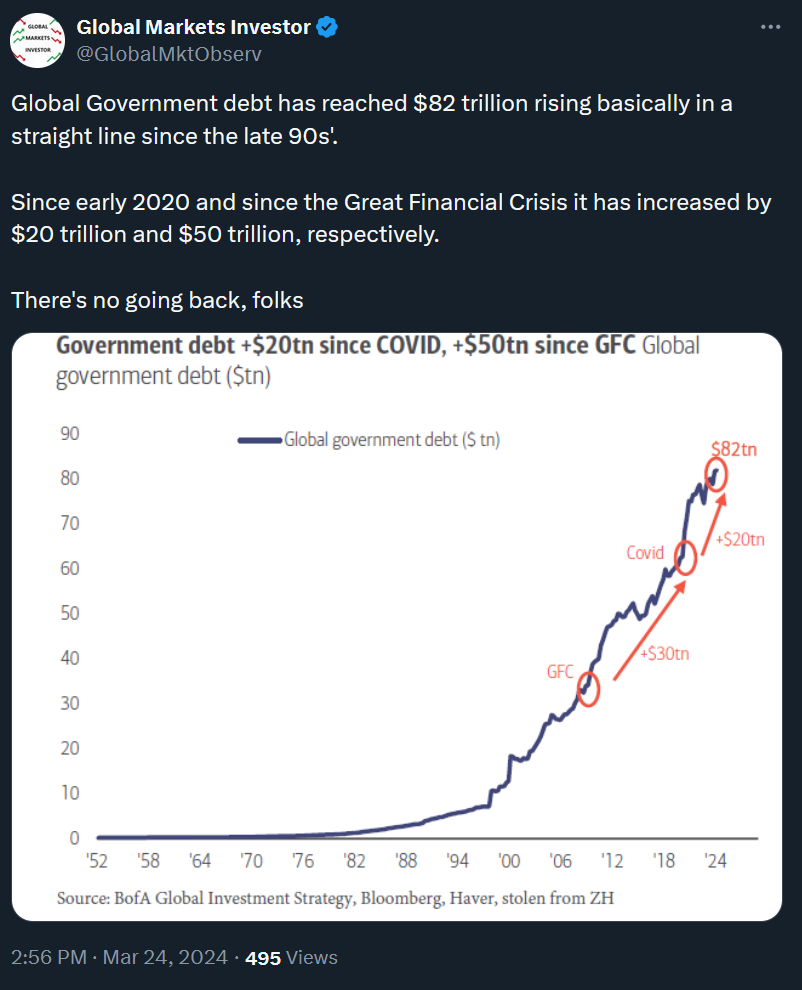

Global Government debt has reached $82 trillion. Since early 2020 and since the Great Financial Crisis it has increased by $20 trillion and $50 trillion, respectively. On the other hand, total major central banks’ balance sheets have been shrinking and are expected to fall below $20 trillion in 2025. However, do not get fooled by this temporary asset reduction. In the long term, due to such high levels of debt, it will get back above the $27 trillion high. You can read about the consequences of high indebtedness in the below article.

Lastly, small updates from other world central banks. After 17 years the Bank of Japan ended its negative interest rates policy and hiked by 0.25% on Tuesday reaching a 0% rate level. On the flipside, the Swiss National Bank made a first-rate cut by 0.25% to a 1.5% level, the first such reduction for one of the world’s 10 most-traded currencies since the pandemic subsided.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: