Top 5 financial posts of the trading week 10/2024

Summary of the trading week in 5 posts with the most interactions on X

In this series, I’ve been bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

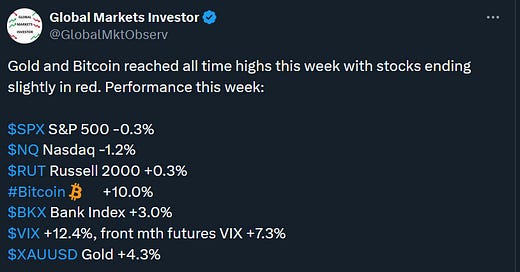

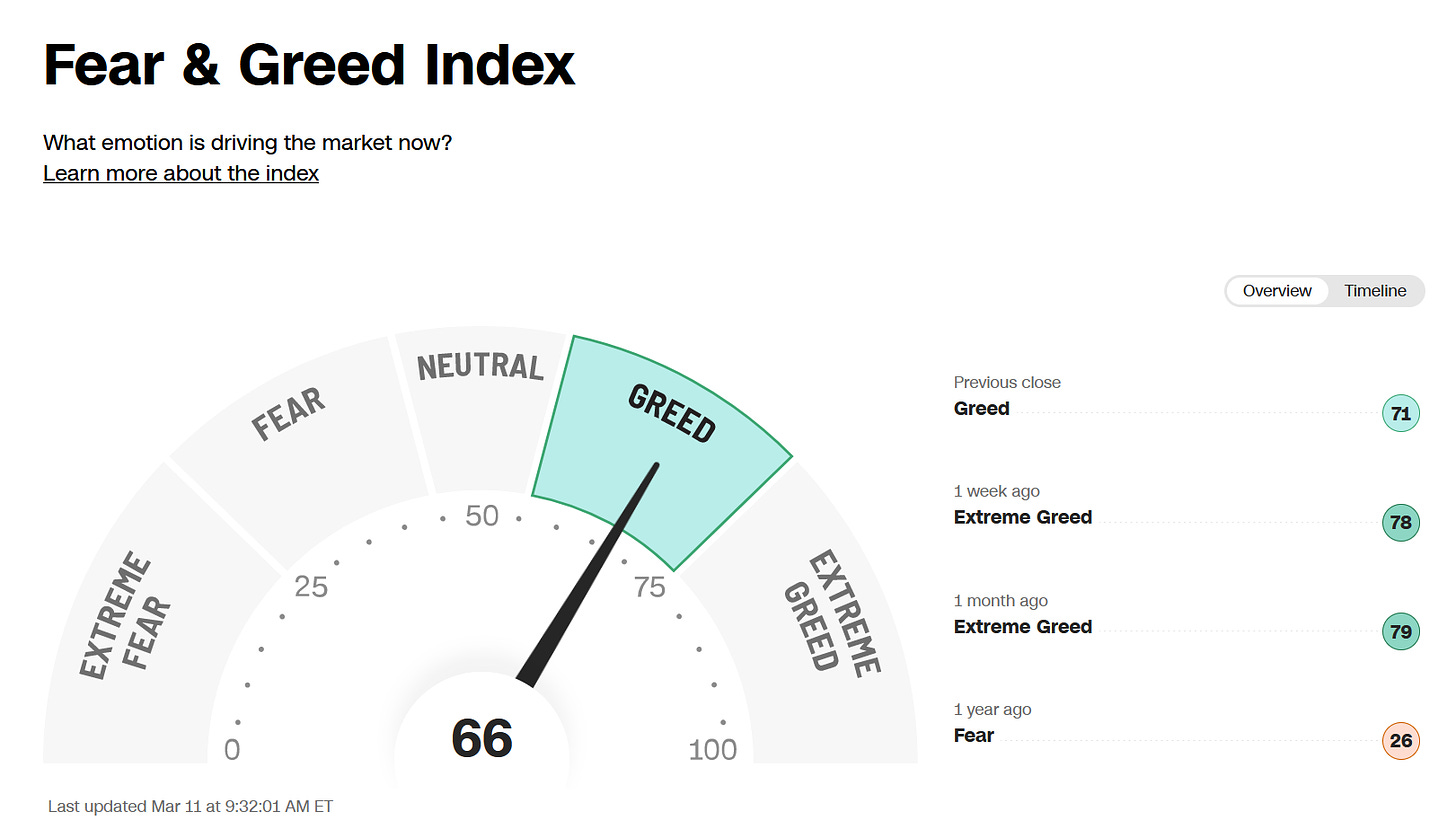

Weekly performance. In the attached tweet you can see last week’s performance of the major US indexes, the VIX volatility index, Bitcoin, and gold. Bitcoin and gold have been unstoppable in recent weeks, both reaching new all-time highs. Notably, stocks saw some modest declines with volatility picking up as Nvidia ended Friday deeply in red (though finishing the week up by 6.4%). The question for the week was whether Fed Chair Jerome Powell could push stocks even higher during his testimony before Congress along with the Fear & Greed Index. He did that but it lasted only for two days after which profit-taking came in on Friday and the Fear & Greed indicator fell to “greed” territory again. Going forward, the most important and market-moving data will be released on Tuesday (February US CPI Inflation) and Thursday (February US PPI Inflation). It will be interesting to see whether the inflation data rebound has continued in February.

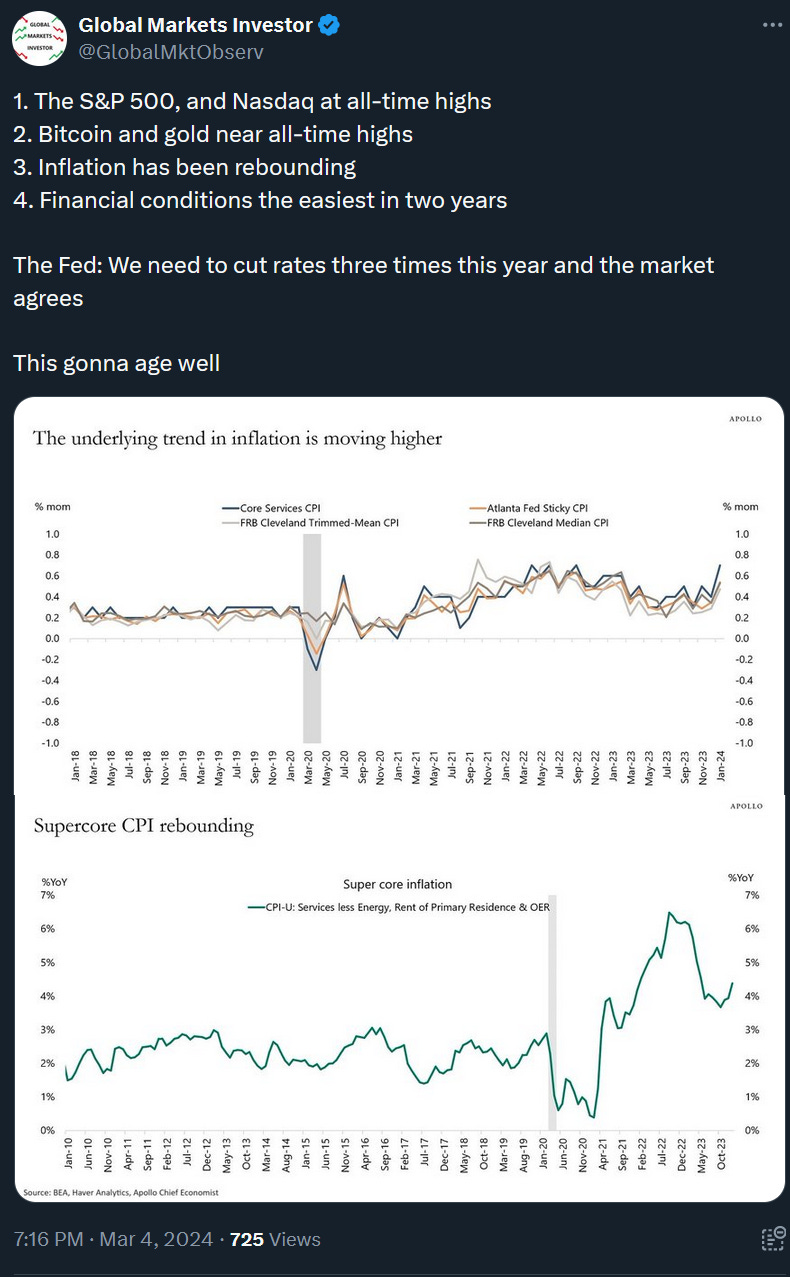

Speaking about Powell. He did not give much of a new insight and reiterated last week that the Fed needs more positive data and more confidence in order to start cutting rates. It looks like the market still ignores the possibility of delayed rate cuts this year or even a lack of them. However, a realization will finally come into play when more “official” inflation data shows a lack of further progress.

This is because already some measures have been showing inflation coming up again, especially if you read beyond the headlines (see the two charts below). We need to remember, however, that the market will start reacting more tangibly only when this higher-than-expected inflation data is also visible in the official data headlines.

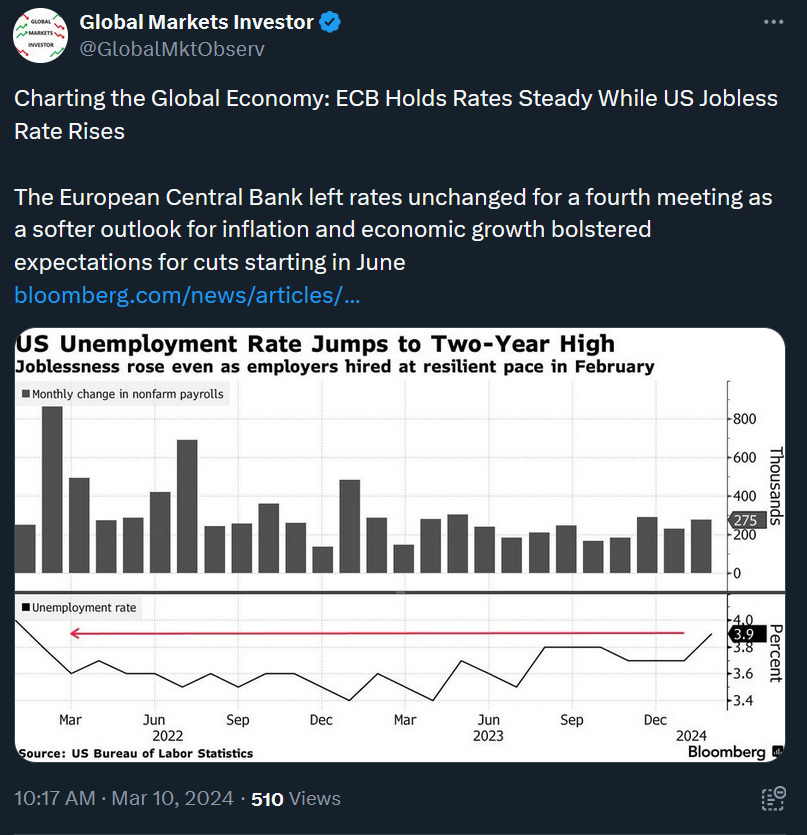

The same is true with the US labor market data. Although February non-farm payrolls beat Wall Street expectations again on Friday, the data under the surface has been dismal with tons of downward revisions and unproductive job creation. I will be releasing an article about the reality of the US labor market this week.

In the end, despite all of these, the United States economy has been much stronger than the European Union, UK, Japanese, and Chinese economies. This is also true when looking at their stock markets. This is because the US has much more innovative firms on its stock exchanges. Moreover, the economy and the financial market’s liquidity have been more strongly supported by the US central bank and the US government than in other countries.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: