Top 5 financial posts of the 3/2024 trading week

Summary of the trading week in 5 posts with the most interactions

In this series, I will be bringing out 5 financial posts of the week with the largest number of interactions from my feed on the X platform. I am aware that not everybody uses X regularly so I thought it could bring some value to your analysis and investment process.

Trading week recap. The S&P 500 ended the week at its all-time record. Interestingly, only 10 out of 11 sectors have experienced the same achievement while small-caps have been still more than 20% below their peak. In other assets, gold and bitcoin (following 11 ETFs approvals) have been consolidating waiting for the next trigger.

As you can see, the top 10% of Americans owned 93% of all stocks in as of 3Q 2023. One of the flaws of the financial system also fueled by the Fed where the rich getting richer and poor getting poorer. This is why financial education is key.

The chart below shows that the price of food needed at home has increased in the US by more than 25% since 2019. The question is how has your salary/income increased over the same time?

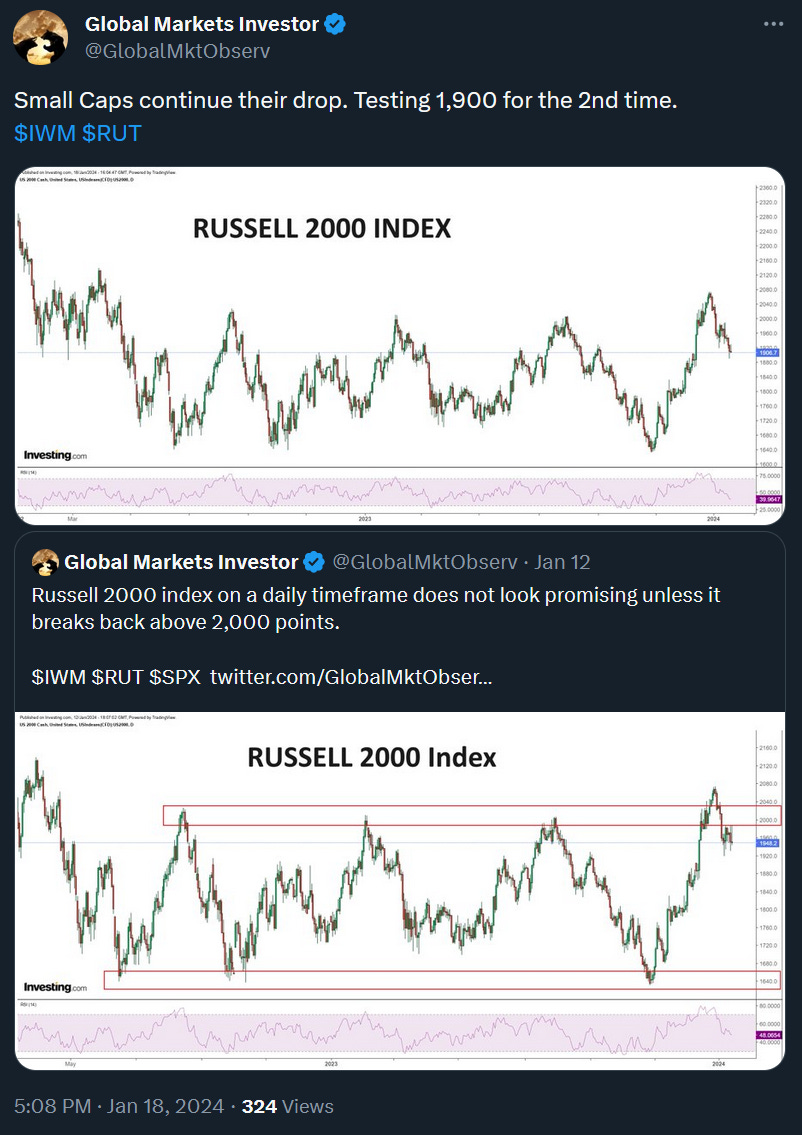

Russell 2000, the index of small-capitalization stocks in the US has tested 1,900 points of support once again and defended it. Below 2,000 bears stay in control, if it breaks above and retests bulls may start to slowly celebrate.

Some wisdom from Warren Buffet at the end. Be patient, enjoy, make it a life and it will be a pleasant journey. There will be ups and downs but eventually, on the net you will be up.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: