Tomorrow is going to be huge for markets

The Fed is expected to keep interest rates steady at 5.5% but investors will be looking for other important things at the event

Tomorrow at 2 p.m. ET, the Fed is set to announce its interest rate decision, followed by the central bank Chair Jerome Powell’s press conference at 2.30 p.m. Please find below the full preview of the event including the market expectations for the entire 2024.

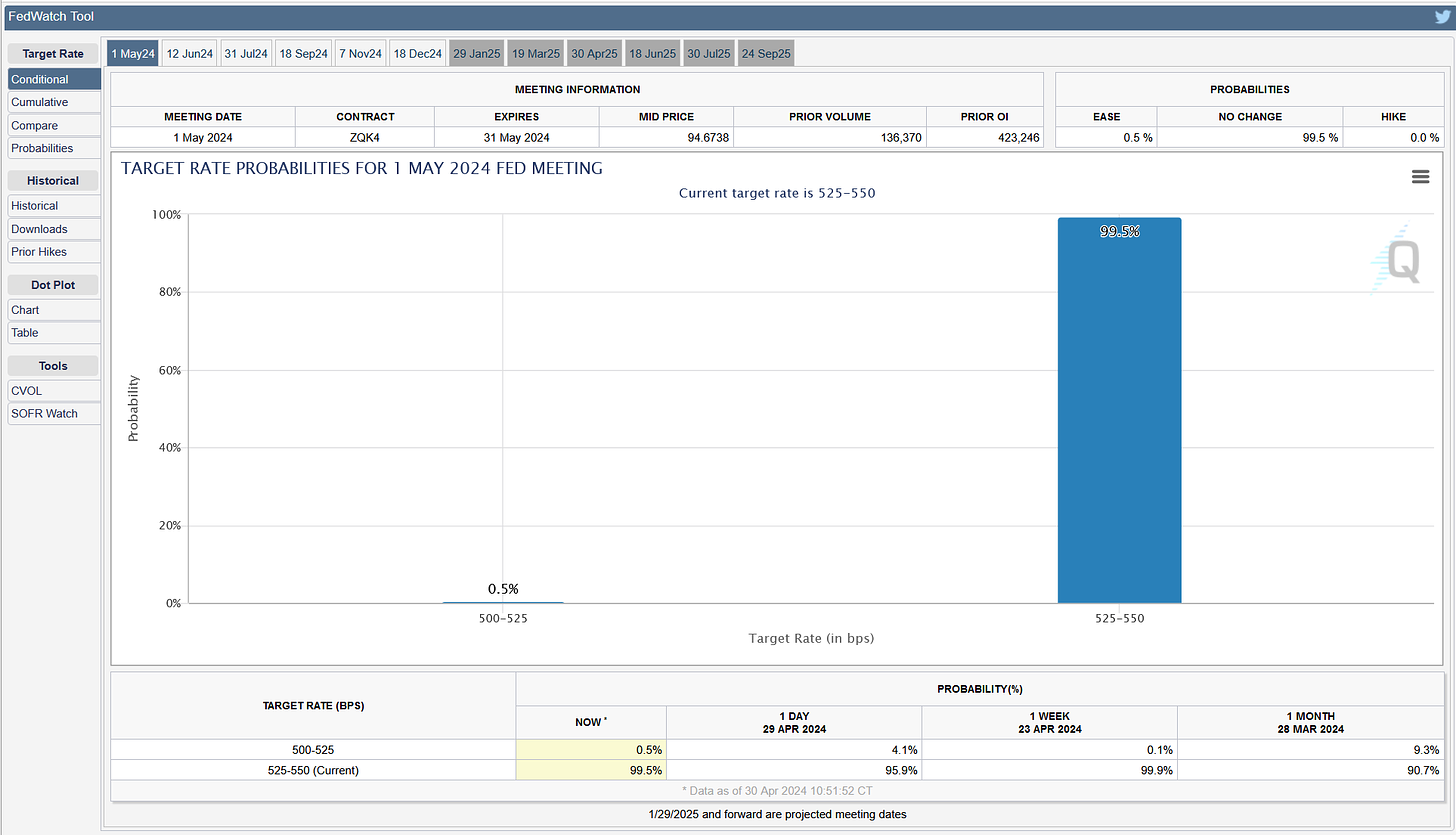

For this particular meeting, we know that the market currently sees a 100% chance that the Fed will keep its interest rate steady for a 6th consecutive meeting.

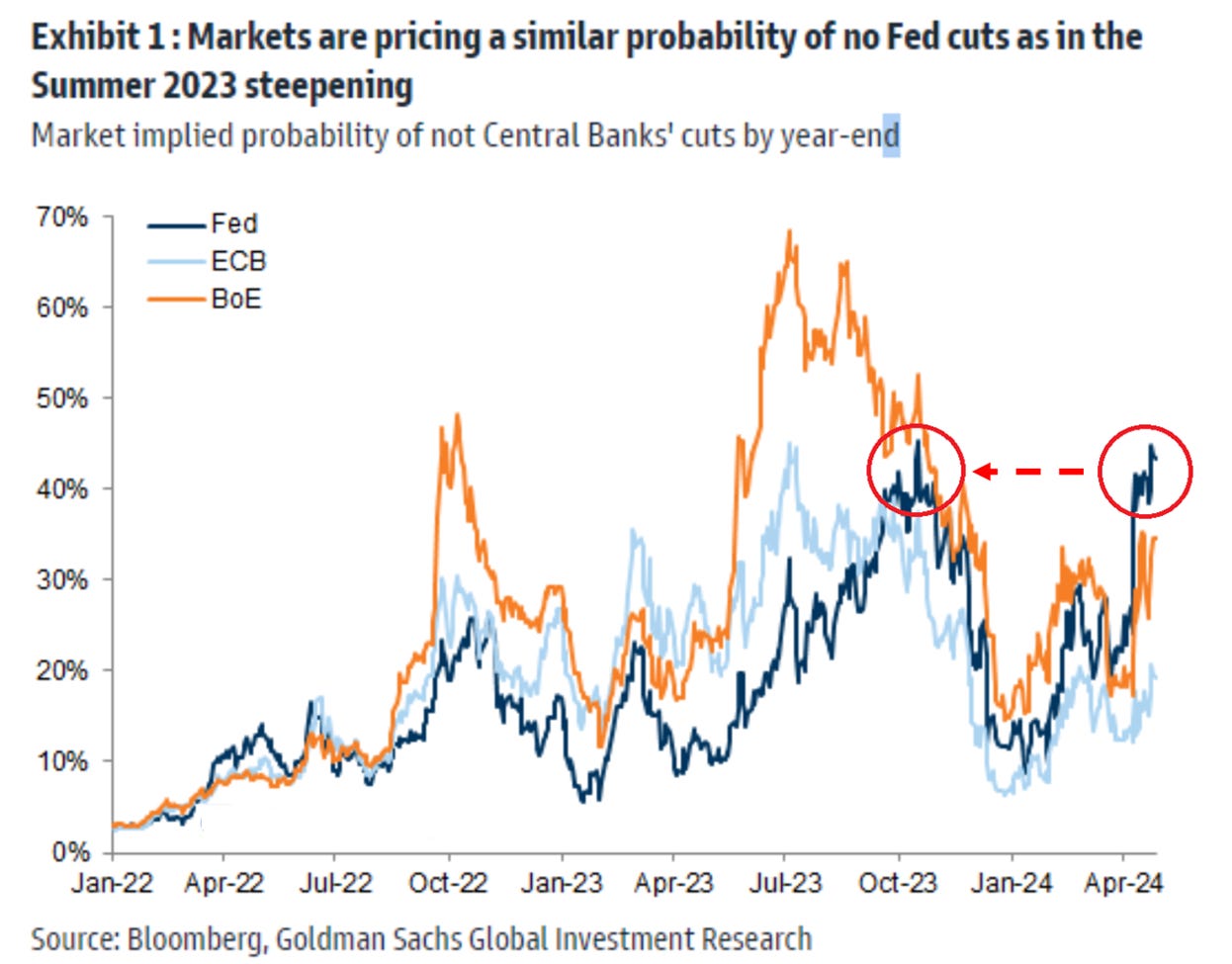

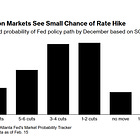

The market is expecting just 1 Fed rate cut as a base case and a 45% probability of ZERO interest rate cuts in 2024. This is the level last time seen in October 2023, when the S&P 500 has bottomed.

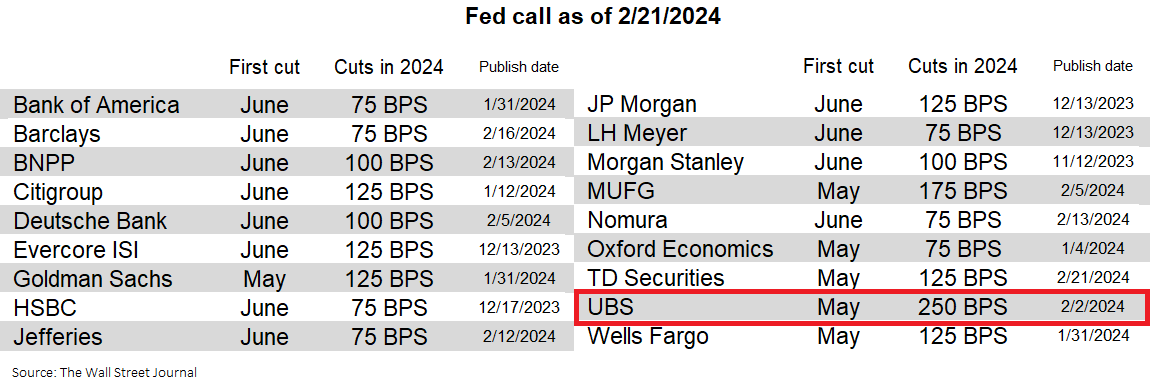

This is one of the most rapid shifts in expectations ever and caught almost the entire Wall Street off-guard. The table below shows what Wall Street thought about the cuts in December - February.

As you can see, not a single bank was close to the current market expectations.

UBS was even expecting total rate reductions of 2.5% (10 cuts equivalent). This is unbelievable. Probably a lot of their clients left a huge bulk of money on the table because of that.

If you have been following the articles, you have seen that we talked about the possibility of those types of risks and even a rate hike back on February 22. See the full piece below:

Having said that, it would be beneficial to get to know what’s really important for investors and the US economy during Wednesday’s Fed meeting and ahead. Read the details below:

If you find it informative and helpful you may consider starting a premium subscription or buying me a coffee, and following me on Twitter:

Why subscribe?

I suspect these predictions are generally not in good faith. That is, these rate cut predictions in general, and the banks' rate cut predictions in particular, are part of a propaganda campaign to influence the Fed to lower rates back to "good old days" of ZIRP.