The US national debt reached $34.5 trillion, an all-time record, but does it actually matter?

Why high level of debt is highly undesirable from ordinary people's and investors' perspective

Before you proceed with reading. I want to let you know that I wrote a huge update to this piece in June. If you like the below analysis please come back here and also check this:

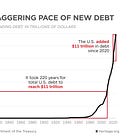

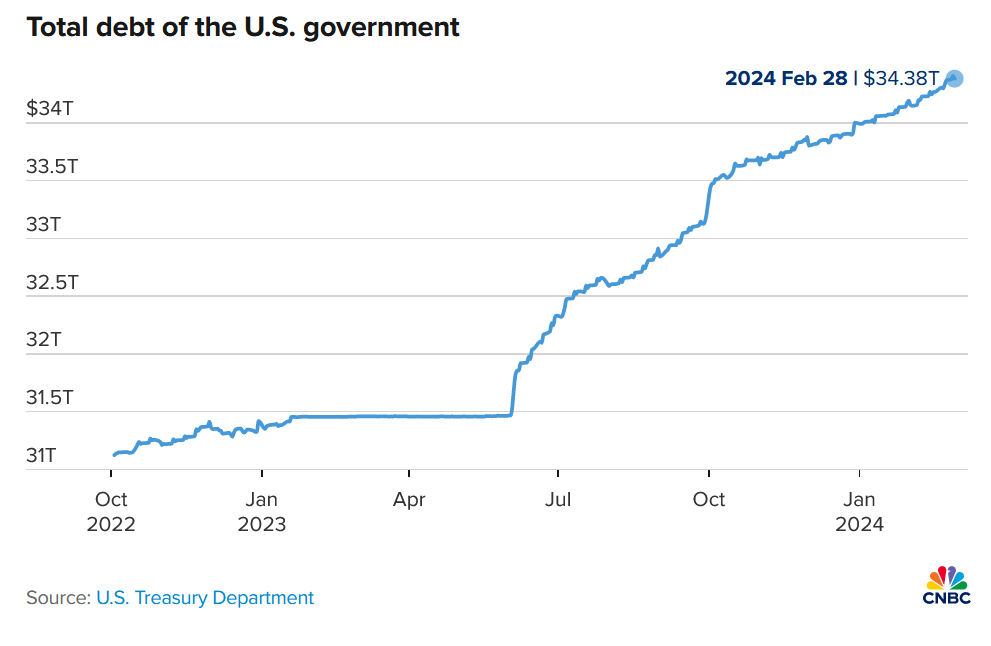

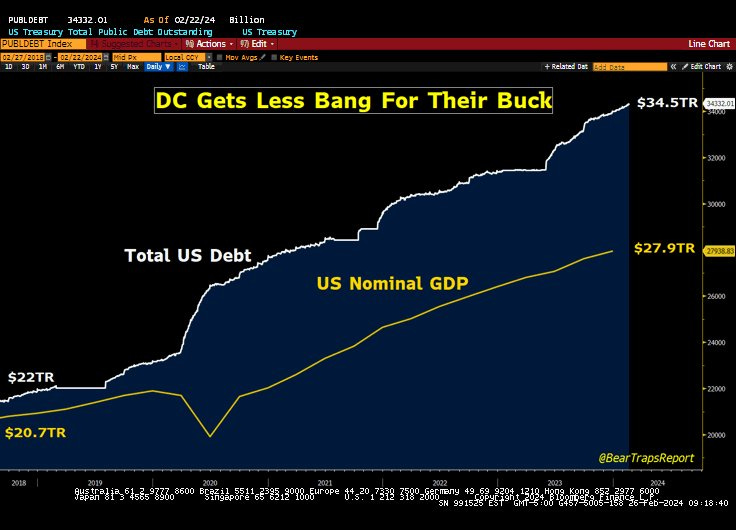

The US national debt hit ~$34.5 trillion at the end of February, the most ever recorded. Since June, the debt has been increasing by $1 trillion every 100 days. As a reminder, the level of debt increases when a country spends more than it earns from taxes and other revenue. As you can see on the chart, the total US government debt passed $32 trillion on June 15, 2023, $33 trillion on September 15, 2023, and $34 trillion on January 4. If the pace continues, the $35 trillion mark will be reached in April.

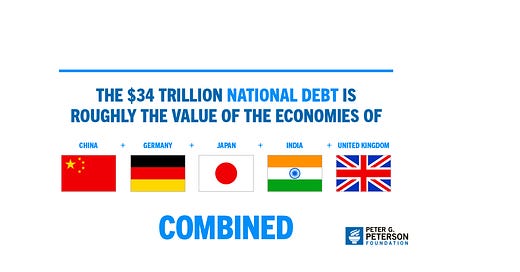

Furthermore, since February 2019, the US national debt has increased by $12.5 trillion, or roughly $2.5 trillion a year. On the other hand, the US economy (GDP) has grown by $7.2 trillion in the same period, or approximately $1.44 trillion a year. It means that in the last five years for one unit of economic growth (GDP), the US government has created 1.7 units of debt. In other words, the US economy has been becoming less productive and more indebted as time passes.

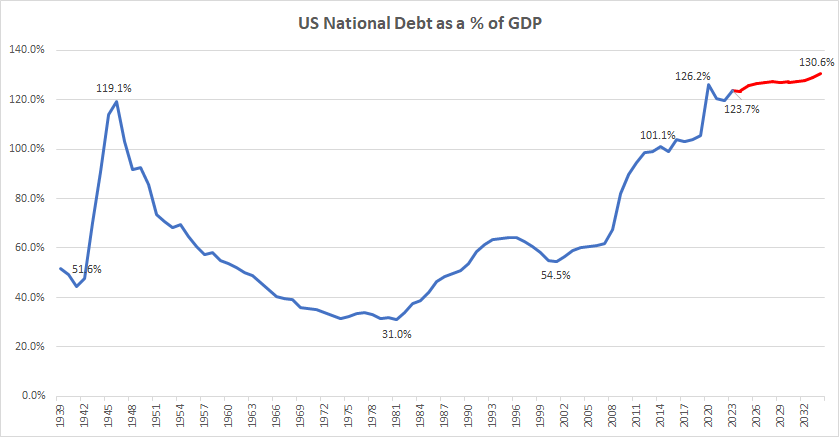

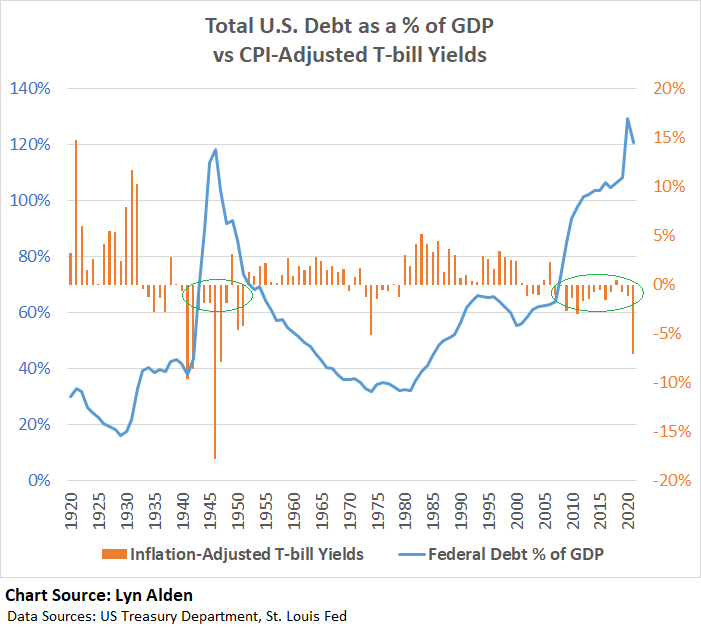

When we look at a country’s debt, the most important metric is debt as a % of the economy’s gross domestic product (GDP) as it helps to understand a country's ability to service and pay back its debts (interest and principal). Currently, the US debt-to-GDP ratio stands at 123.7%, near the all-time record of 126.2% achieved during the pandemic as the US GDP dropped dramatically during that time and debt spiked due to lockdowns. As is shown on the graph, this ratio has been quickly rising since 2007 from roughly 60%. It is estimated by the Congressional Budget Office that in 2034 it will reach 130.6%.

It is important to note that the US Congressional Budget Office never forecasts a recession for obvious reasons and the ratio will be much higher if one occurs as economic downturns always result in larger government deficits and drops in GDP.

WHY SUCH A HIGH LEVEL OF DEBT MATTERS

History shows that when a country passes through a 100% threshold for debt-to-GDP ratio there is a small probability that the government will avoid some sort of default. Default in a sense of inability to fulfill an obligation, also considered here as the situation when the government pays consistently lower interest on their bonds than inflation. In other words, investors (creditors) lose their money on an inflation-adjusted basis or lose their purchasing power. In normal conditions, in such an environment investors demand higher interest to compensate for the risk of higher indebtedness within the country. However, in most cases when the debt gets “too high” approximately 100% of GDP and above a central bank steps in and begins buying massive amounts of government bonds at the same time suppressing the level of yields (interest).

This phenomenon is perfectly shown by the analysis done by Lyn Alden showing that after the Great Financial Crisis, from 2009 to 2020 the Treasury-bill (maturity of one year or less) yields adjusted for CPI inflation had negative returns. The same happened in the 1940s’ when the US national debt to GDP ratio was also above 100%.

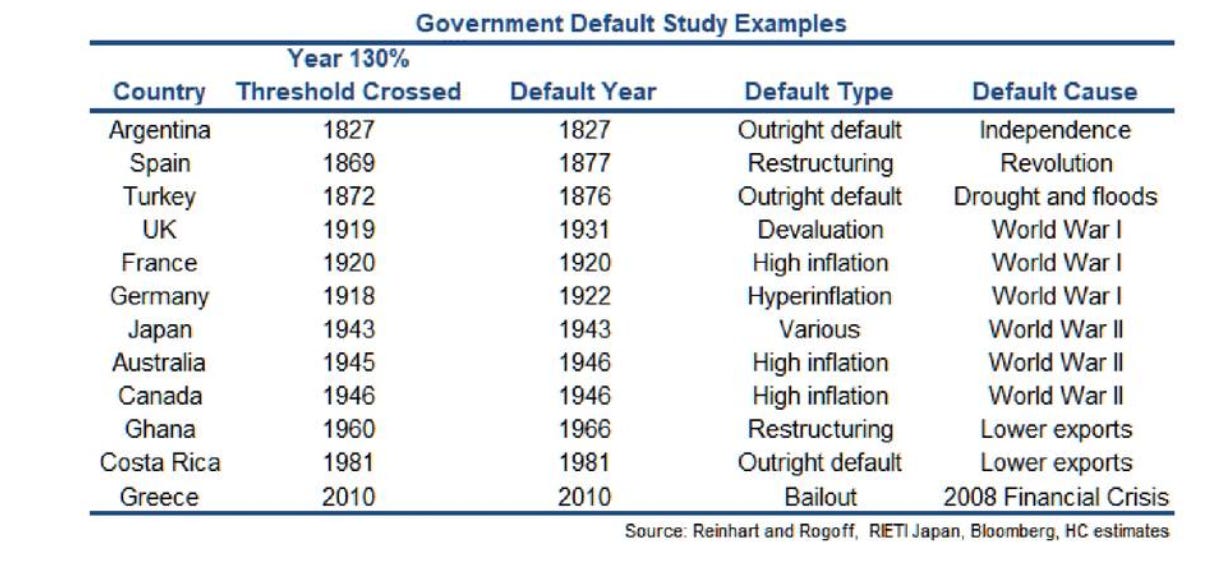

Looking further in the past we can see that losing purchasing power by the bondholders is not the worst possible scenario during periods of high debt-to-GDP ratios in a country. According to the analysis conducted by Hirschman Capital based on the International Monetary Fund studies since 1800, 51 out of 52 countries with debt-to-GDP ratio above 130% have defaulted, either through restructuring, devaluation, high inflation, or outright default. The only exception was Japan.

It does not necessarily mean that the US will default soon, especially given the fact that the country owns a reserve currency and the US dollar will be demanded due to that by foreigners unless something dramatic happens. However, there’s almost a certainty that in the years ahead cash and bond holders (if held to maturity) will be losing money on an inflation-adjusted basis once the Federal Reserve normalizes its monetary policy. This is called financial repression.

Apart from losing purchasing power, there are a few more negative implications for ordinary people resulting from a high level of debt in relation to GDP in a country:

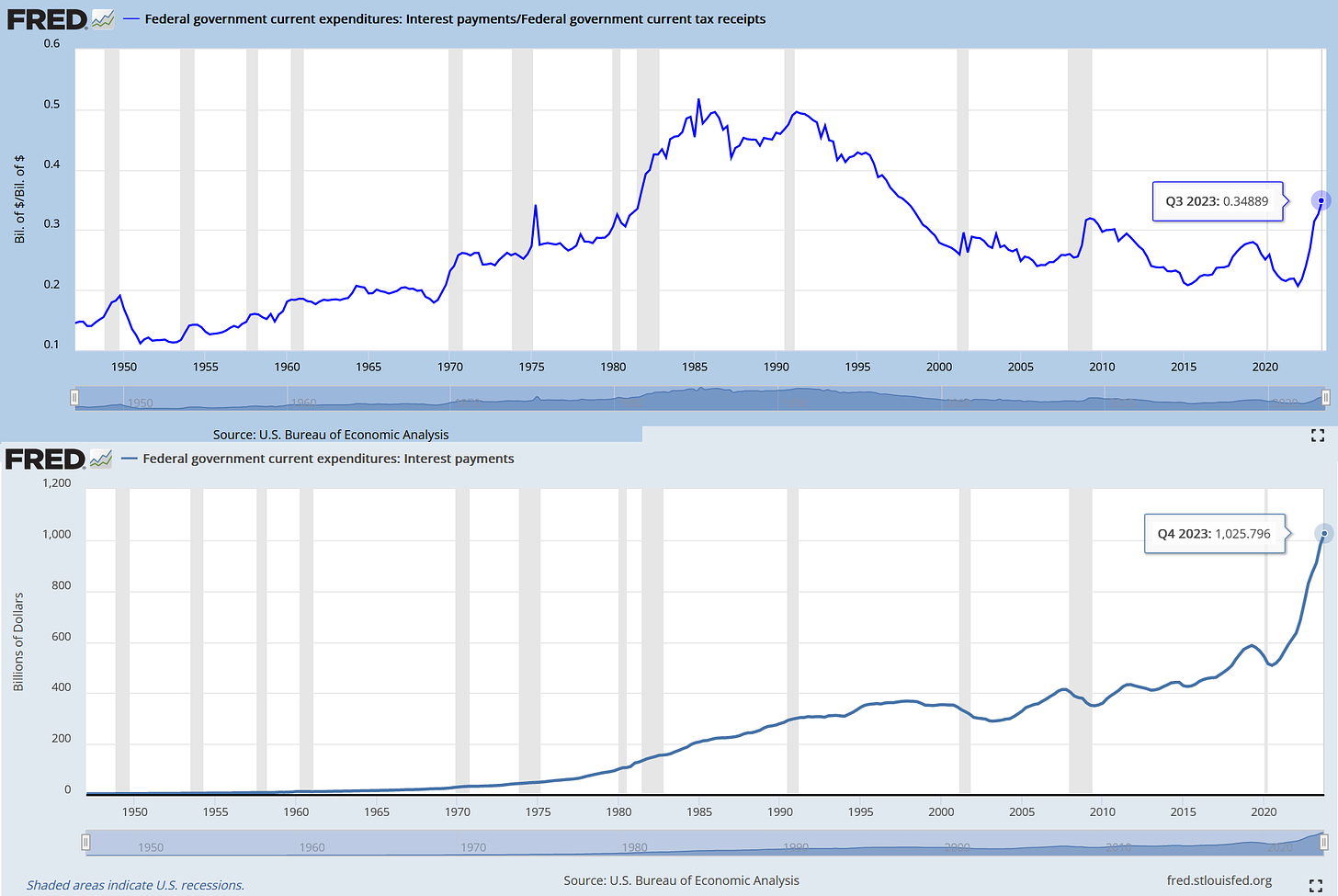

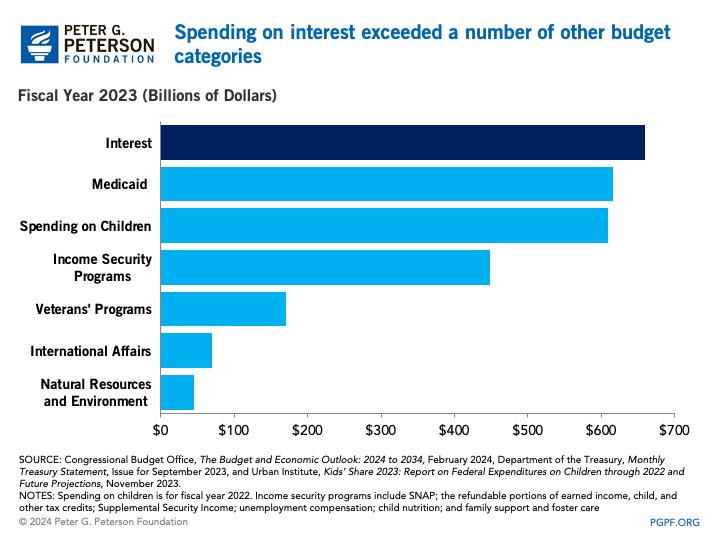

High-interest payments, especially in relation to tax receipts could limit (crowd out) future investment spending on education, infrastructure, healthcare, or social security and in effect lower future economic growth and worsen the quality of life. Interest costs have already passed $1 trillion nominally on an annualized basis and account for 35% of tax receipts, the most in more than 25 years.

Moreover, in Fiscal 2023, interest spending was higher than Medicaid and other budget categories.

A high level of debt provides less flexibility in responding to a recession or a crisis. In other words, if an event like the Great Financial Crisis occurred then the government would have less room for issuing debt and the post-crisis recovery would be slower due to less ability to fund it as well as new investments.

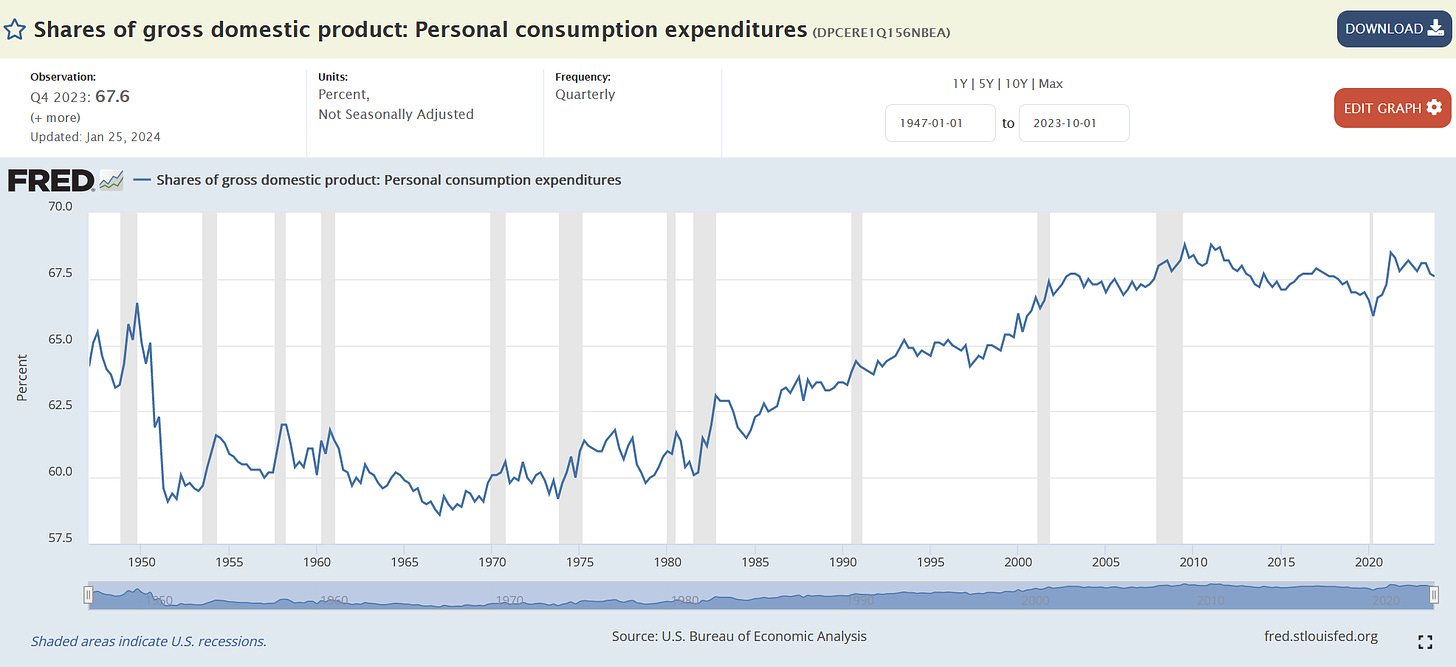

A government may decide to raise taxes to fund more spending or to decrease/eliminate the budget deficit. If taxes go higher that would mean less income available for people and the private sector to spend on goods and services. That would again mean less economic growth, particularly in the country as the United States as consumer spending accounts there for 67.6% of GDP:

SUMMARY

The US national debt has been rapidly rising in the past few years, not only nominally but also as a share of GDP. Every 30 seconds $1 million is added, a pace which has never been seen before. It will pose many challenges for the government and future generations to deal with this issue. In the past to fight such high levels of debt financial repression policies were conducted leaving ordinary people and bond investors financially worse off for decades. It has been done even recently in the United States in the past decade, following the Great Financial Crisis. Following the pandemic, however, inflation has gotten out of control and a couple of years are needed to get back to such an environment again. All things considered, the best thing everybody can do is to educate themselves financially and allocate their capital wisely to protect their future. In this case, high-quality stocks, real estate, and precious metals (particularly gold) perform the best in the long run. For LESS risk-averse investors (Risk aversion is the tendency to avoid risk and have a low-risk tolerance.), some cryptocurrencies such as Bitcoin and Ethereum depending on risk tolerance would also be suitable in a portfolio.

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter:

The dollar's days are over now

Look, the words have just been added

The pound's days will now be over

Opposite the dollar's place.

😘

डॉलर के दिन अब पूरे हो गए

दिखने शब्दो लगा है अभी

पाउंड के दिन अब सुधरेंगे

विपरीत डॉलर के चले वहीं।।

😘