S&P 500 just hit its 34th all-time high this year. Weekly market recap, trading week 27/2024

Summary of the trading week in several posts with the most interactions on X

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

That was a pretty intensive week despite the July 4 Independence Day in the United States and closed US markets on Thursday. The S&P 500 has hit its 34th all-time high this year, and the US economy has shown more signs of slowing. Some of the events have been covered in the below three pieces:

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

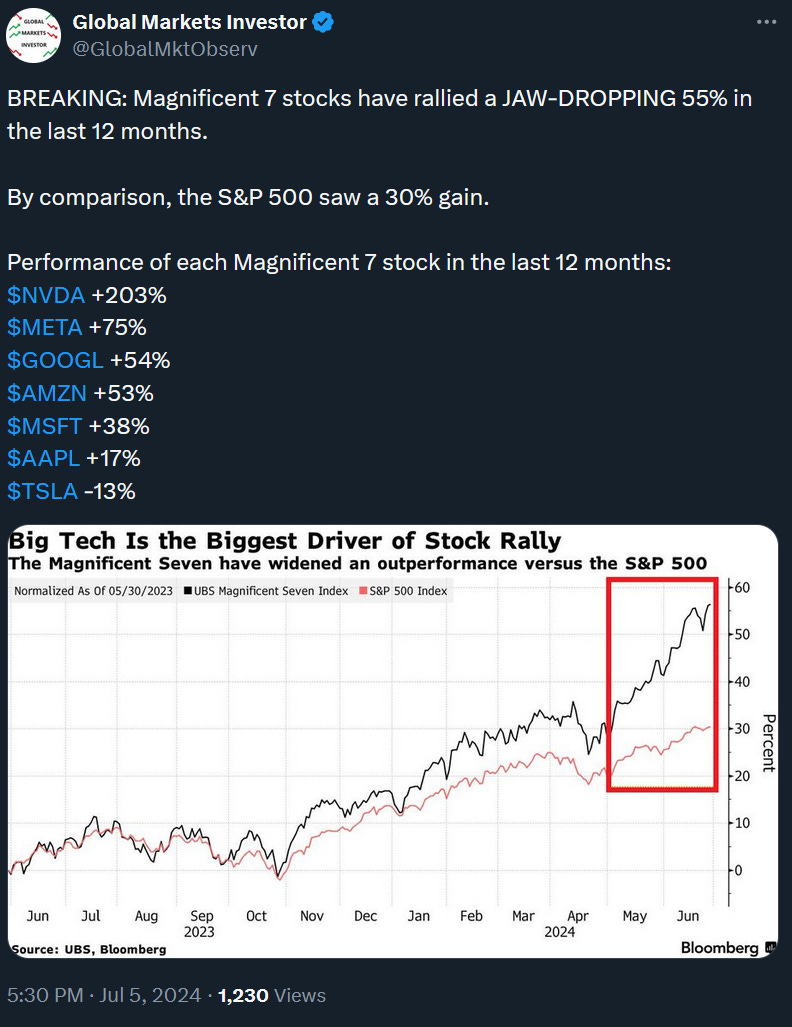

- S&P 500 ended the week up +2%. Notably, the index has not seen a 1% drop or more in 45 trading sessions, the 2nd longest streak since before the COVID crash of 2020. Interestingly, 40% of S&P 500 stocks are DOWN year-to-date.

- Nasdaq 100 index was up 3.5% and also hit a new record.

- Dow Jones was up +0.7%

- Russell 2000 (small caps) ended the week down 1.1%

- VIX was slightly up by 0.1%.

- Gold rose by 2.5

- Bitcoin saw a 7.5% loss and fell for the 5th consecutive week. It is now over 20% below its peak.

For the trading week ending July 12, key events are:

- Fed Chair Powell’s Testimony on Tuesday and Wednesday

- Treasury Secretary Janet Yellen’s Testimony on Tuesday

- US CPI inflation data for June on Thursday

- US PPI inflation data for June on Friday

- University of Michigan Consumer Sentiment on Friday

- At least 9 Fed speeches

The key investors’ and market watchers’ focus will be on Jerome Powell’s comments as well as CPI inflation data. Core CPI inflation (excluding food and energy) is expected to rise 3.4% year-over-year in June and 0.2% month-over-month, in line with the May reading. Headline CPI is forecasted to increase 3.1% year-over-year and 0.1% month-over-month.

If this data comes significantly above expectations it should spark a stock market sell-off. Otherwise, the market should stay constructive and continue grinding higher as investors will be somewhat assured in the short term that the fight with inflation towards the 2% Fed target is on the right path.

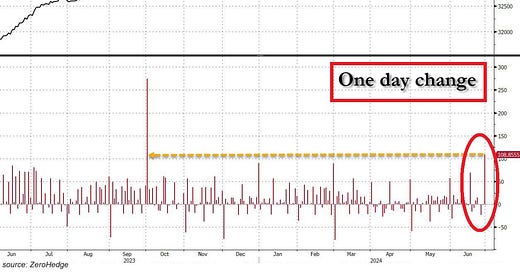

2) The US government spends money as if there is a crisis.