S&P 500 hit its 50th all-time high this year. Weekly market recap, trading week 45/2024

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

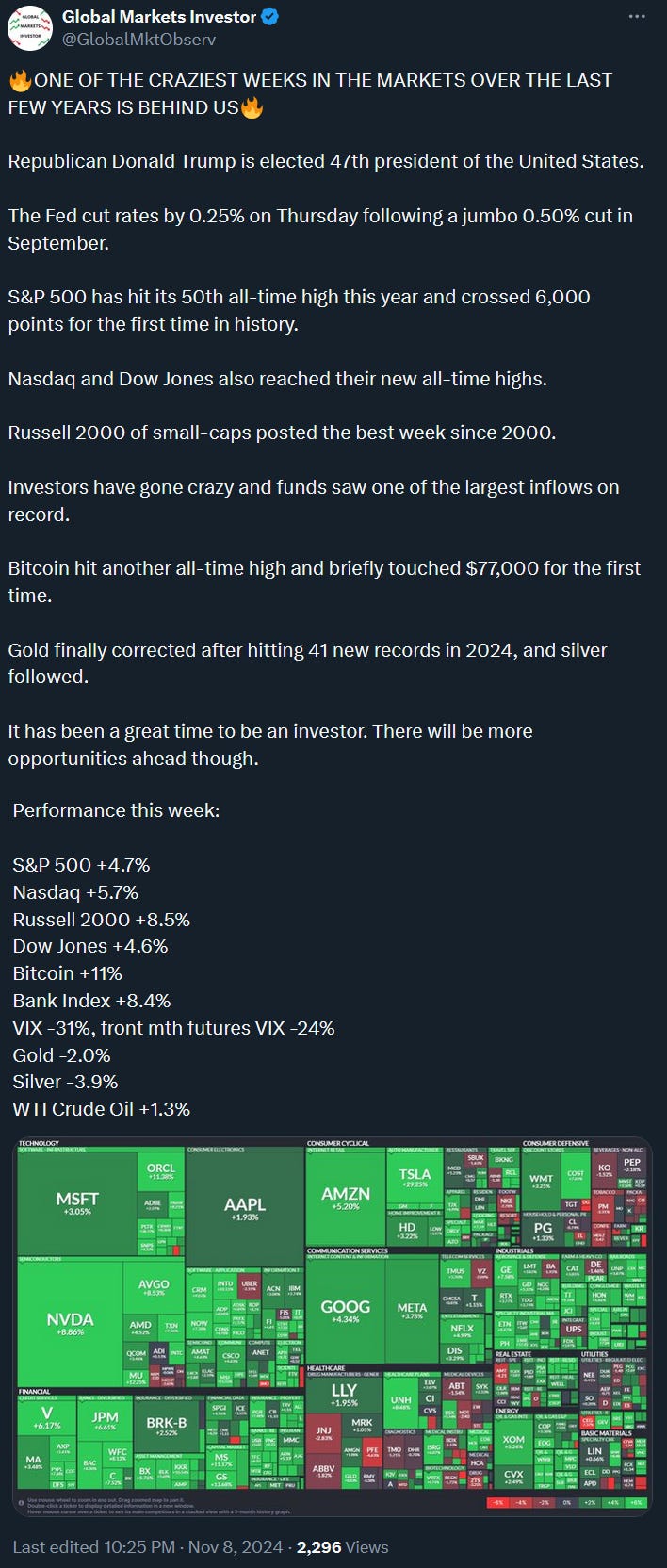

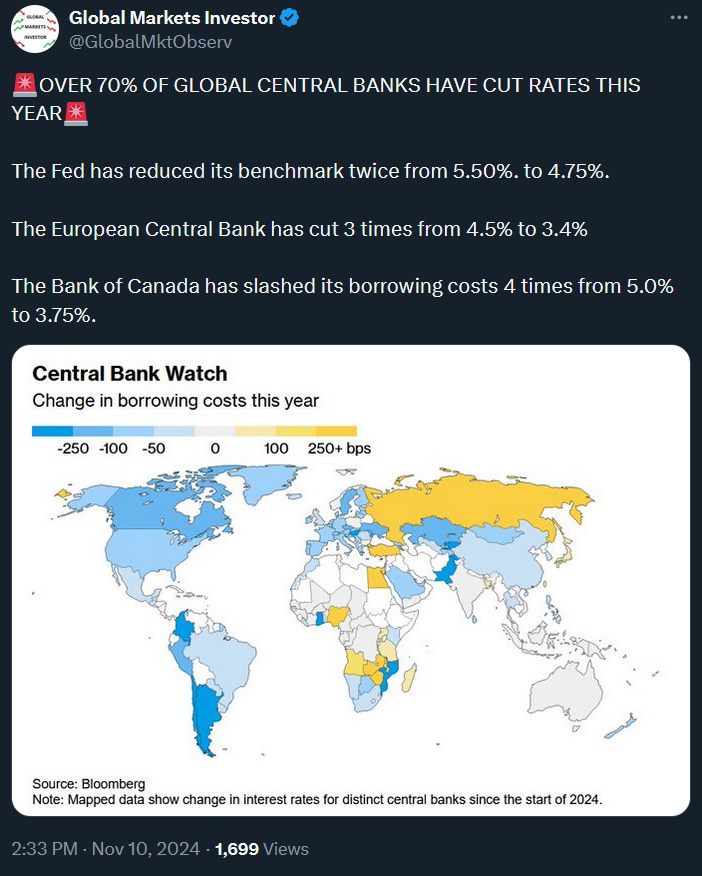

That was a week. Republican Donald Trump was elected the 47th president of the United States. The Fed cut rates by 0.25% on Thursday following a jumbo 0.50% cut in September. The S&P 500 has hit its 50th all-time high this year and crossed 6,000 points for the first time in history.

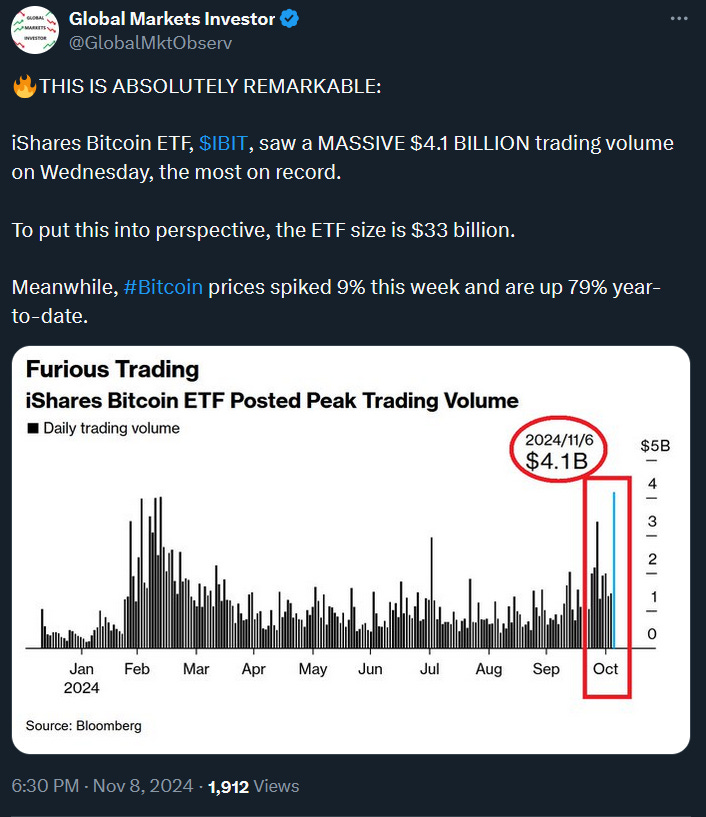

The Nasdaq and Dow Jones indices also reached their new all-time highs. Russell 2000 of small-caps posted the best week since 2000. Exchange Traded Funds saw one of the largest money inflows on record. Bitcoin hit another all-time high and briefly touched $77,000 for the first time. Gold finally corrected after hitting 41 new records in 2024, and silver followed.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was up 4.7%

- Nasdaq index advanced 5.7%

- Dow Jones jumped 4.6%

- Russell 2000 (small caps) spiked 8.5%

- VIX tumbled 31%

- WTI Crude Oil rose 1.3%

- Silver was down 3.9%

- Gold fell 2.0%

- Bitcoin increased 11%

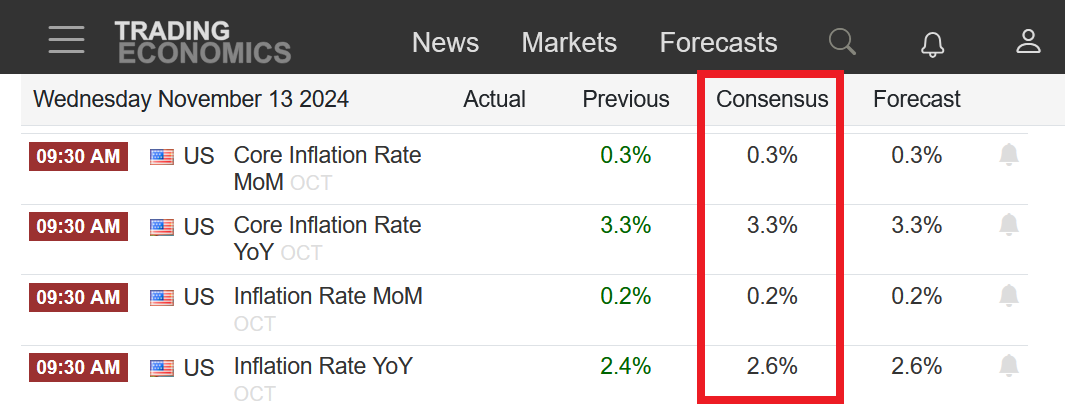

For the trading week ending November 15, key events are:

- US CPI Inflation for October on Wednesday

- US PPI Inflation for October on Thursday

- Fed Chair Powell Speech on Thursday

- US Retail Sales for October on Friday

- ~12 Fed Speeches

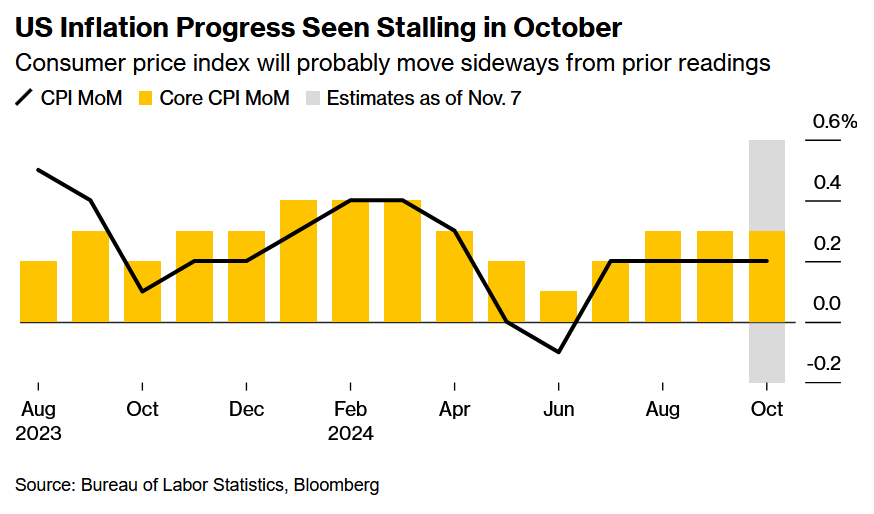

Another busy week ahead with a key focus back on the US economic data. Consensus expects that the headline CPI inflation rate jumped from 2.4% in September to 2.6% in October. Additionally, core CPI is expected to come at 3.3%, which would be above 3% for the 42nd consecutive month. In other words, progress in bringing inflation down is stalling. Anything at and below expectations should be beneficial for the stock market while numbers above expectations could spark a sell-off.

2) Net interest payment on US federal debt hit a new all-time high.