S&P 500 hit its 39th all-time high this year after the Fed's big rate cut. Weekly market recap, trading week 38/2024

Summary of the trading week in several posts from the X platform with the most interactions

In this series, I’ve been bringing out financial posts with the largest number of interactions from my feed on the X platform over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process.

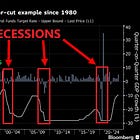

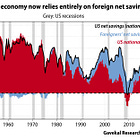

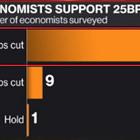

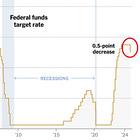

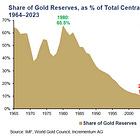

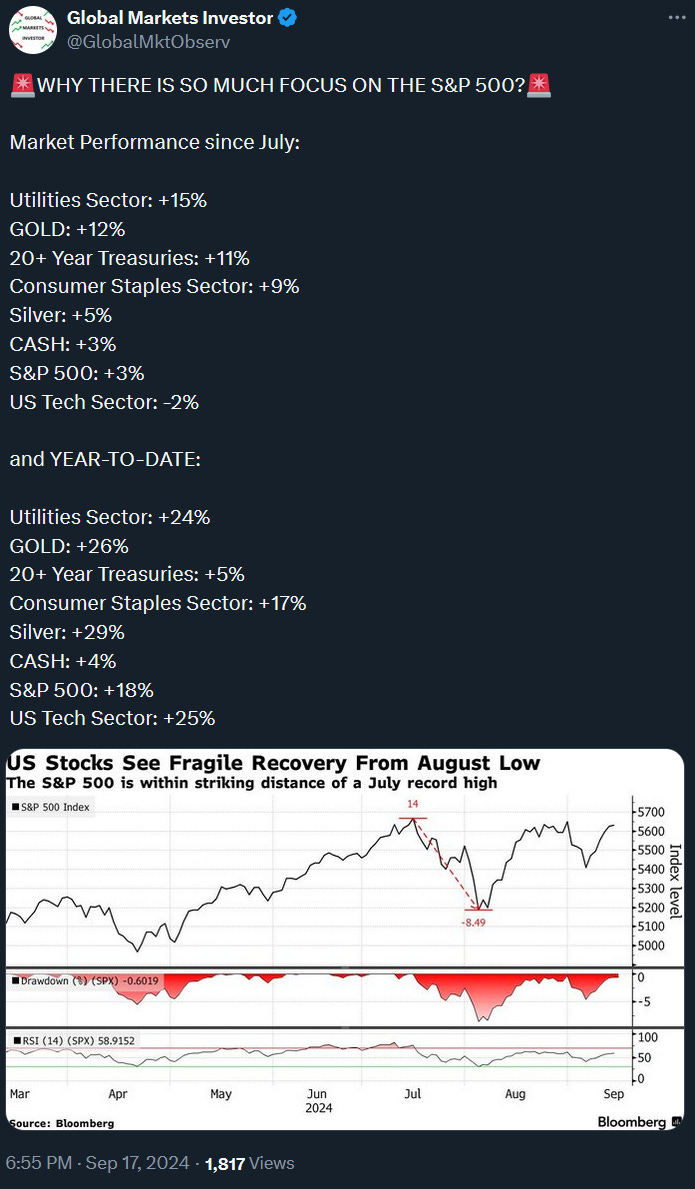

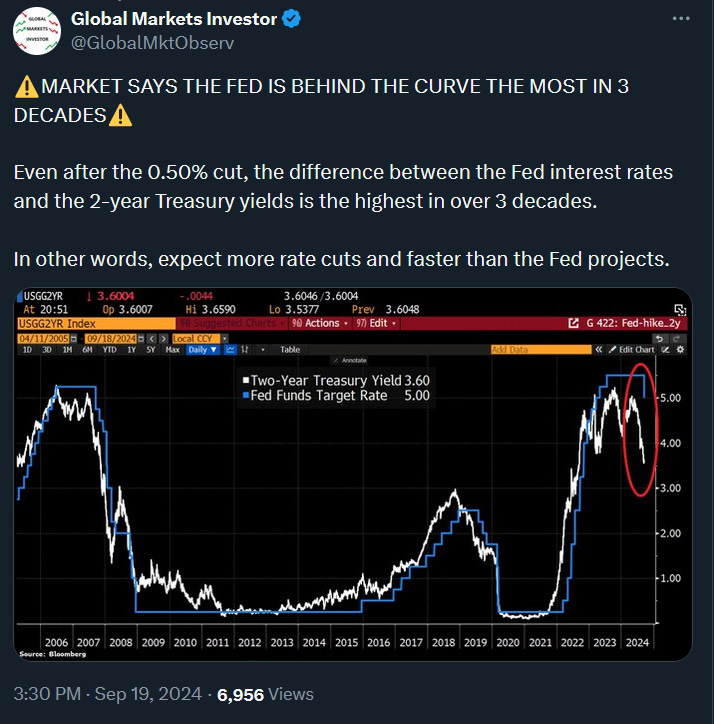

That was a pretty intensive week with the Fed cutting rates by 0.50% which was the biggest market surprise in 16 years. Following the decision, the S&P 500 ended the week higher and hit its 39th all-time high this year on Thursday. Notably, quarter-to-date the S&P 500 is up 4.4% with Magnificent 7 underperforming the index for the first time in nearly 2 years. The group is up by 3.1% so far in Q3. Notably, gold is trading at new all-time highs as expected. The week ended with a massive $5.3 trillion Quadruple Witching (explanation in the link).

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 was up by 1.3%

- Nasdaq index jumped by 1.6%

- Dow Jones increased by 1.6%

- Russell 2000 (small caps) was up by 2.1%

- VIX index fell by 3%

- WTI Crude Oil rose by 5.2%

- Gold was up by 1.4%

- Bitcoin rallied 4.5%

For the trading week ending September 27, key events are:

- US S&P Global Manufacturing and Services PMI on Monday

- US Conference Board Consumer Confidence on Tuesday

- US New Home Sales for August on Wednesday

- US Durable Goods Orders for August on Thursday

- US Q2 2024 Final GDP Estimate on Thursday

- Fed Chair Powell Speech on Thursday

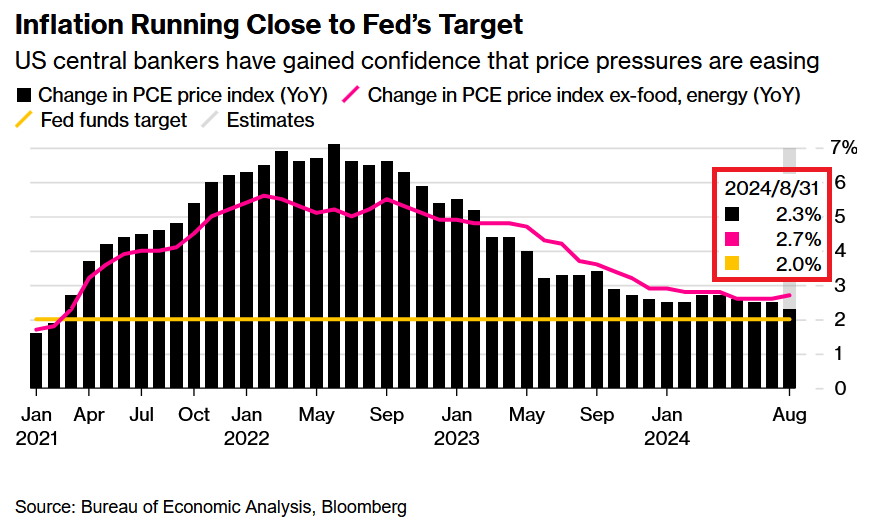

- US PCE Inflation for August on Friday

Investors will be closely watching Chair Powell's Speech on Thursday in anticipation of further guidance about the Fed’s interest rates policy path. On Friday, the Federal Reserve’s preferred inflation metric is scheduled to be released which is also key for markets. Economists expect the PCE price index to rise by 2.3% in August from the previous year, a smaller increase than the one recorded in July. Core PCE (excluding food and energy) is expected to pick up to 2.7% year-over-year.

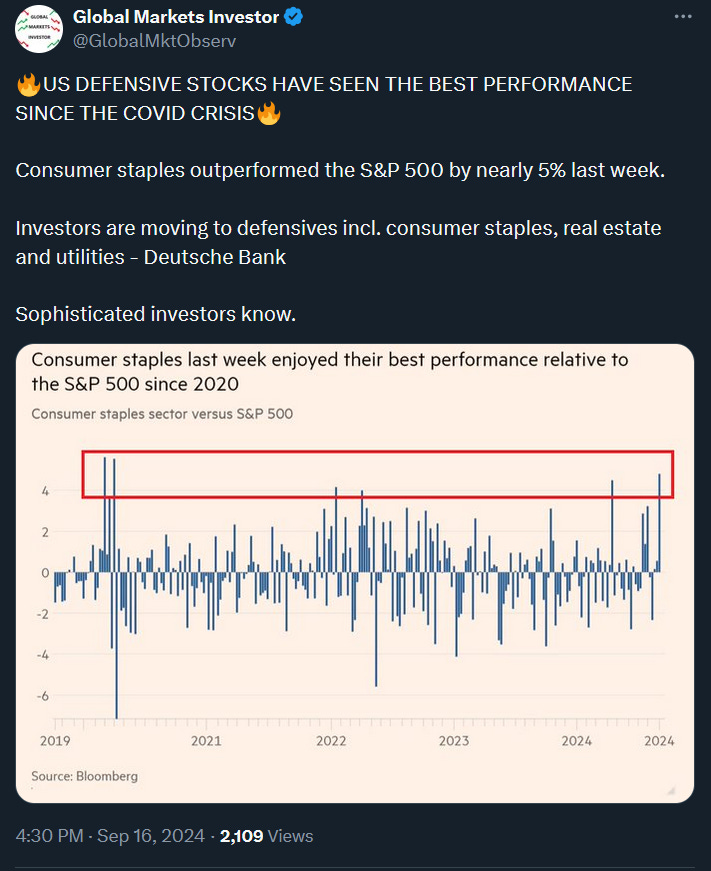

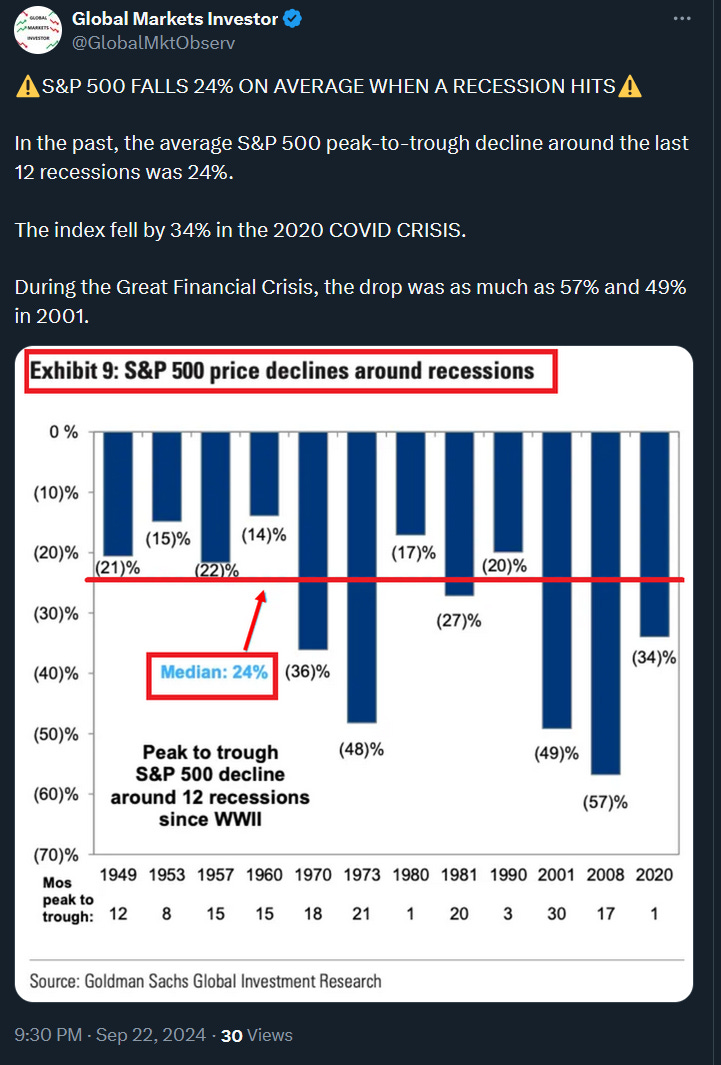

2) Some warning signs for the S&P 500 index and its earnings growth.