S&P 500 declined last week spurred by US tariffs headlines. Weekly market recap, trading week 05/2025

Summary of the trading week using the most popular posts from the X platform

In this series, you can find financial markets posts with the highest number of interactions from my X platform feed over the most recent week. I am aware that not everybody uses X regularly so I thought it could provide some value to your analysis, and investment process. These posts are also surrounded by commentary and explanations of complicated topics.

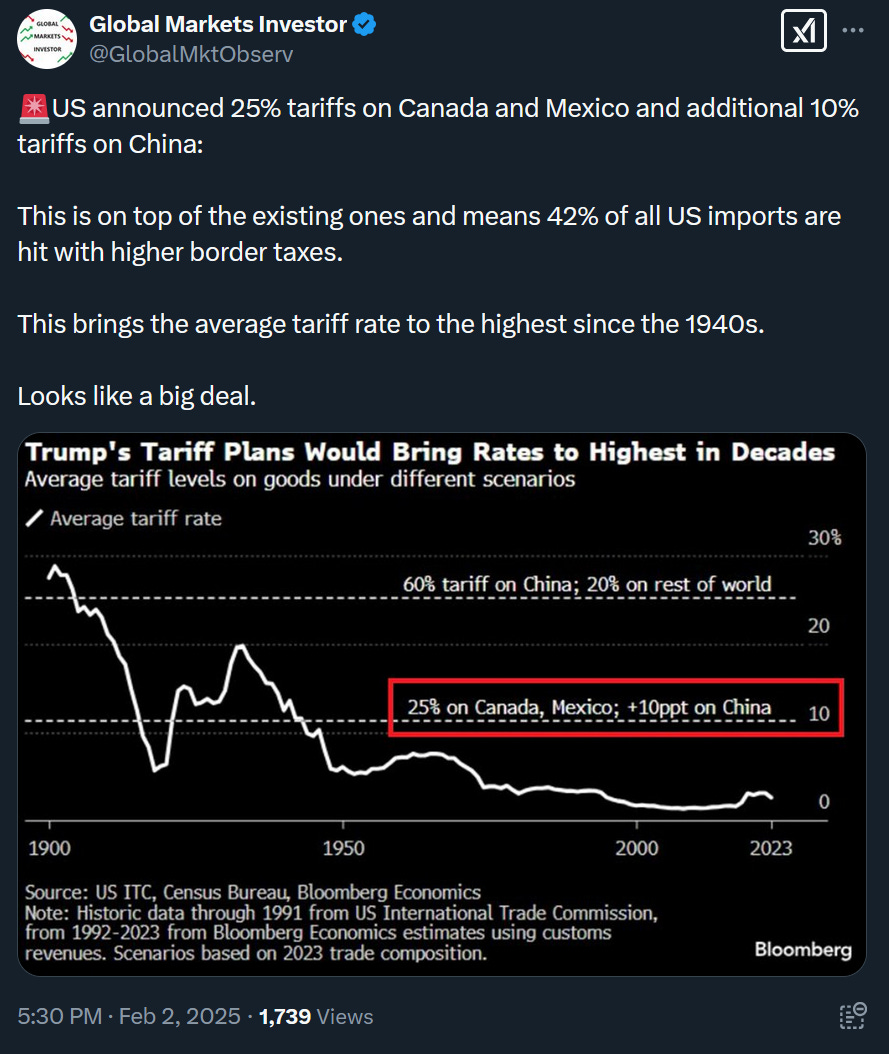

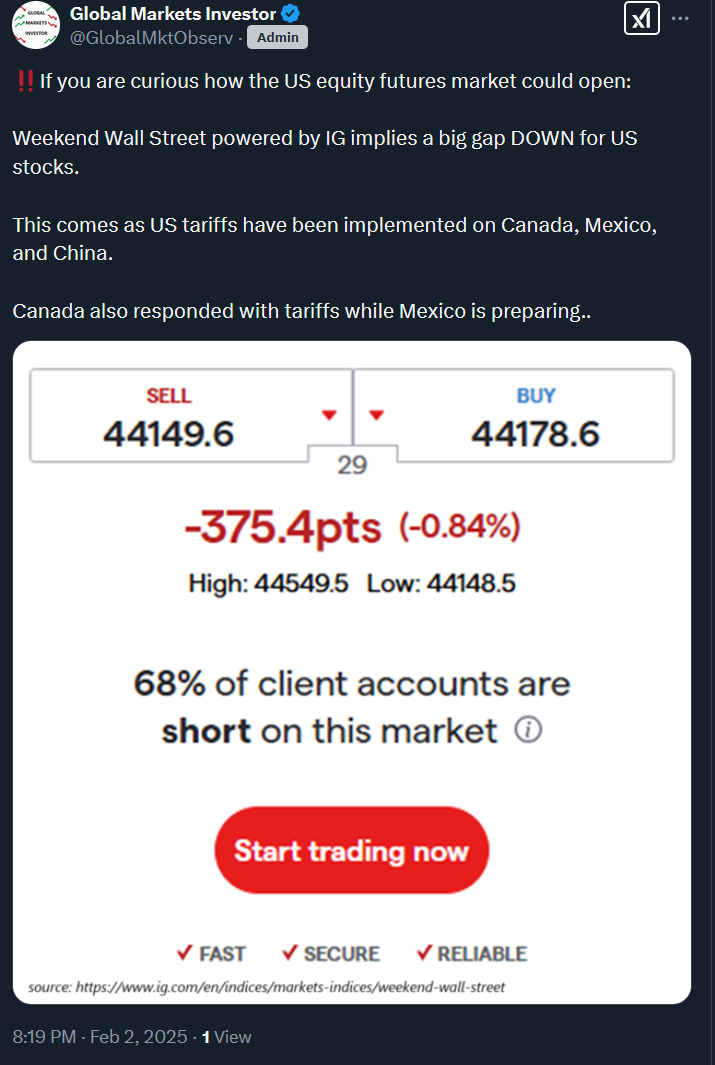

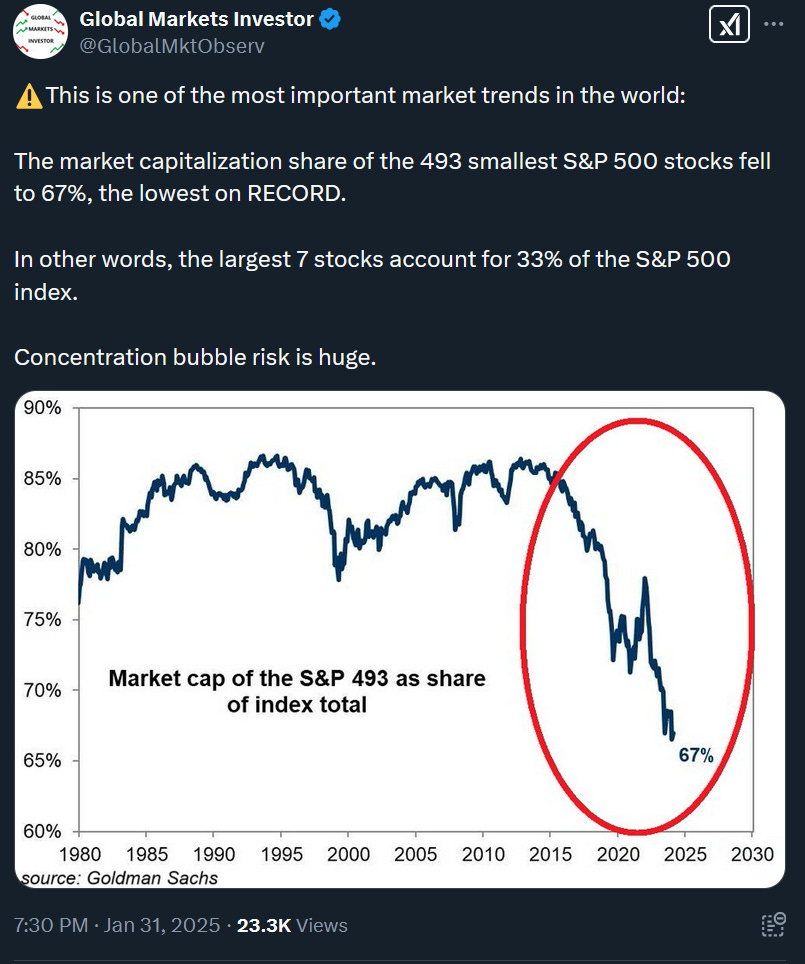

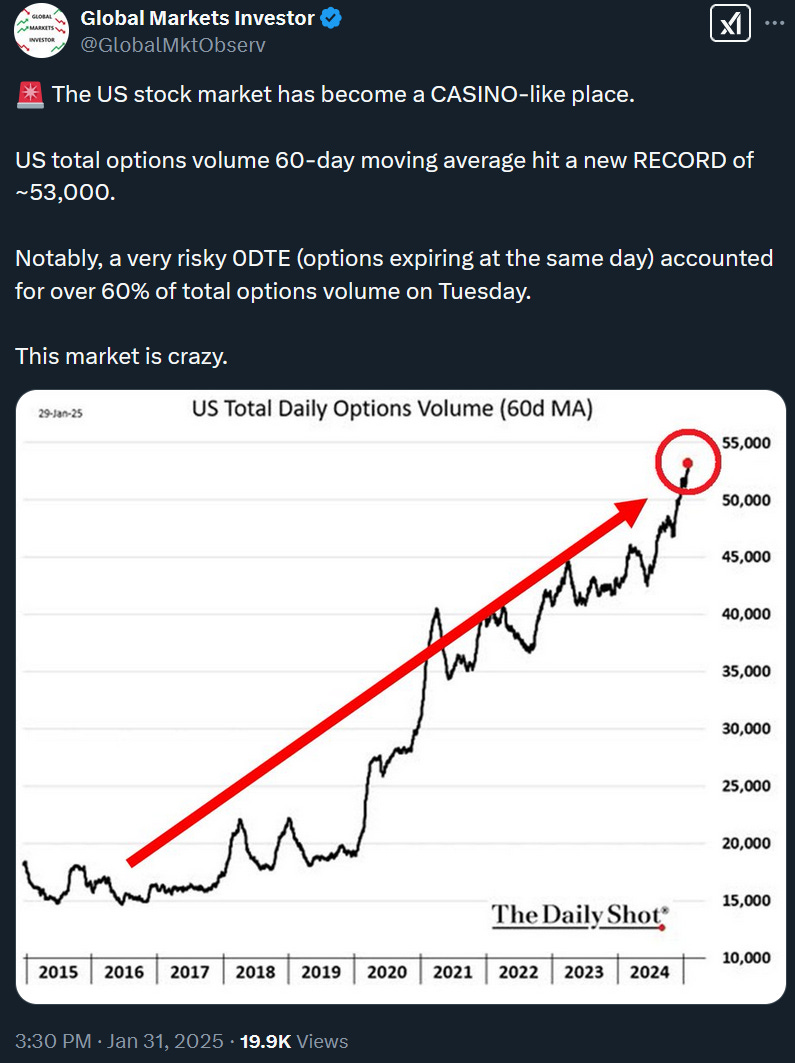

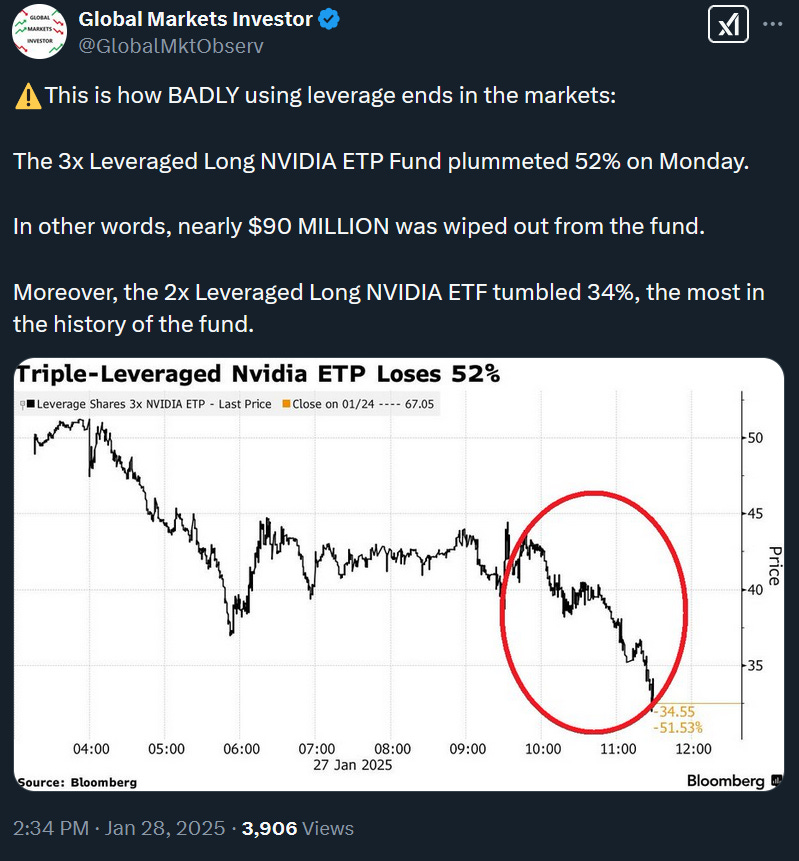

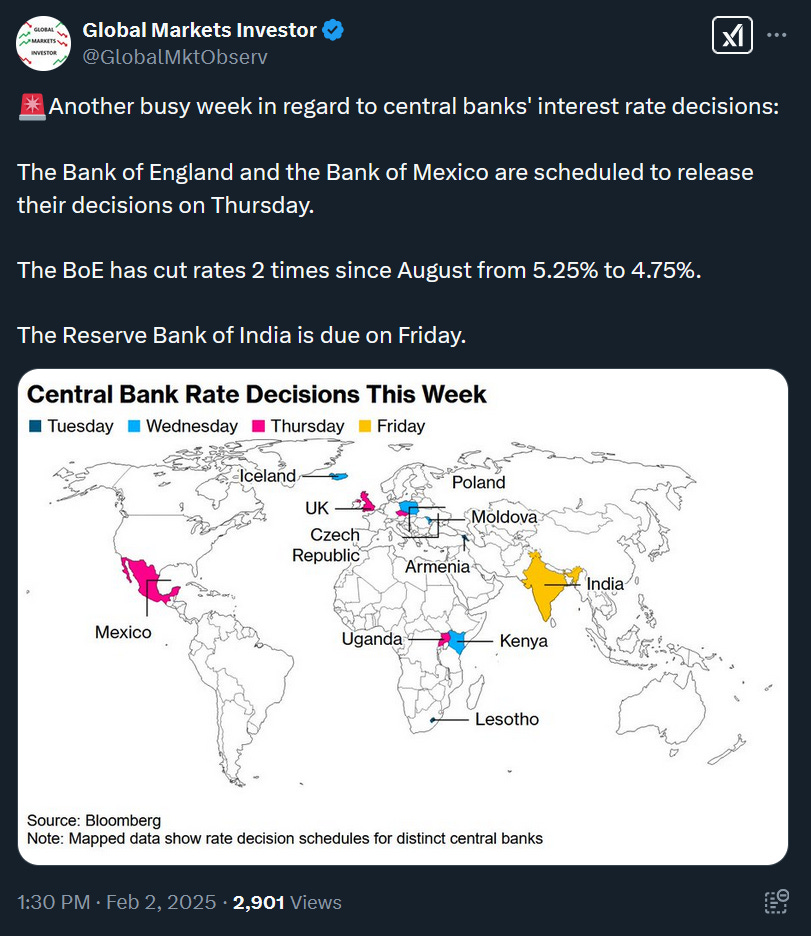

Last week was pretty heavy in terms of the market news. Nvidia’s crash, the Fed meeting, Microsoft, Meta, Tesla and Apple earnings (more below), US PCE Inflation and GDP data as well as new tariffs coming from the US and the retaliatory response. As a consequence, the market saw a lot of ups and down including the most recent dump on Friday. Expect a negative start to the week unless some tariff announcements are taken off due to negotiations between the interested countries. Recommend reading all posts from X attached below with carefulness.

1) Weekly performance. In the first screenshot attached, you can see last week’s performance of the major US indexes, the VIX volatility index, gold, and Bitcoin.

- S&P 500 fell 1.0%

- Nasdaq index tumbled 1.6%

- Dow Jones increased 0.3%

- Russell 2000 (small caps) fell 0.9%

- VIX spiked 12%

- WTI Crude Oil fell 2.1%

- Silver jumped 3.8%

- Gold increased 1.3%

- Bitcoin tumbled 2.8%

For the trading week ending February 7, key events are:

- US ISM Manufacturing PMI for January on Monday

- US JOLTS Job Openings for January on Tuesday

- US ISM Services PMI for January on Wednesday

- US ADP Nonfarm Employment for January on Wednesday

- US Jobs Report for January on Friday

- US Consumer Sentiment for February on Friday

- ~15% of the S&P 500 companies reporting their Q4 2024 earnings

Another intensive week ahead with US job market data in focus. It will be also dominated by headlines regarding tariffs coming from the US, Canada, Mexico, China and EU officials. In terms of earnings, we have Google and Amazon to watch.

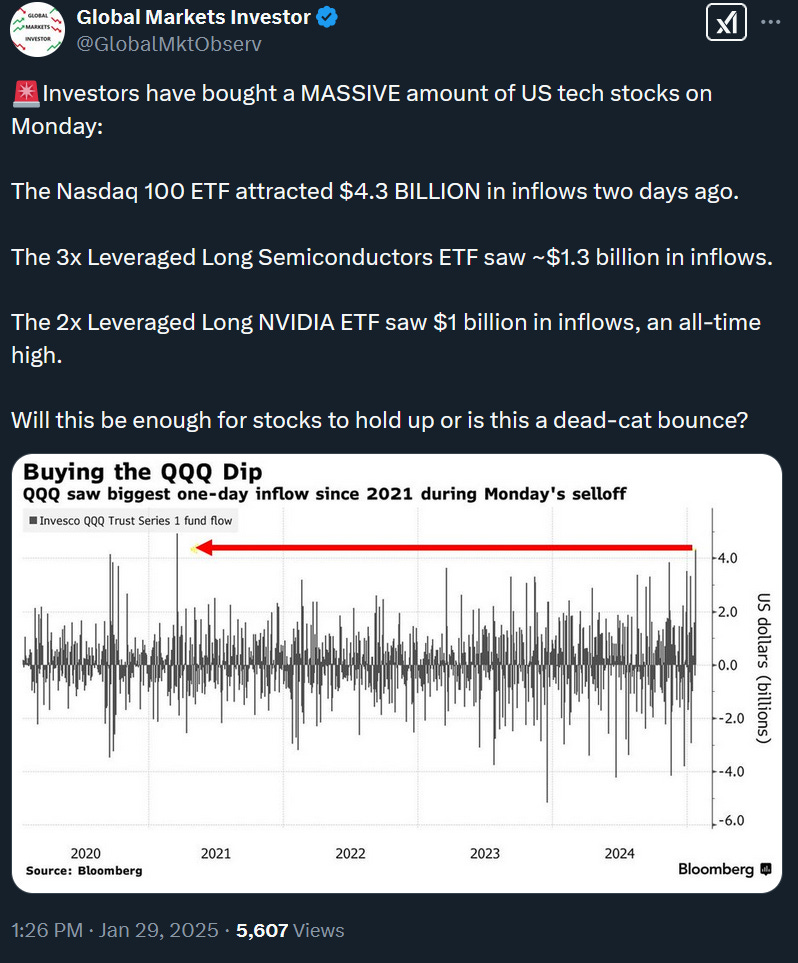

2) Professional investors are selling US stocks quite sharply while retail has been buying like crazy.