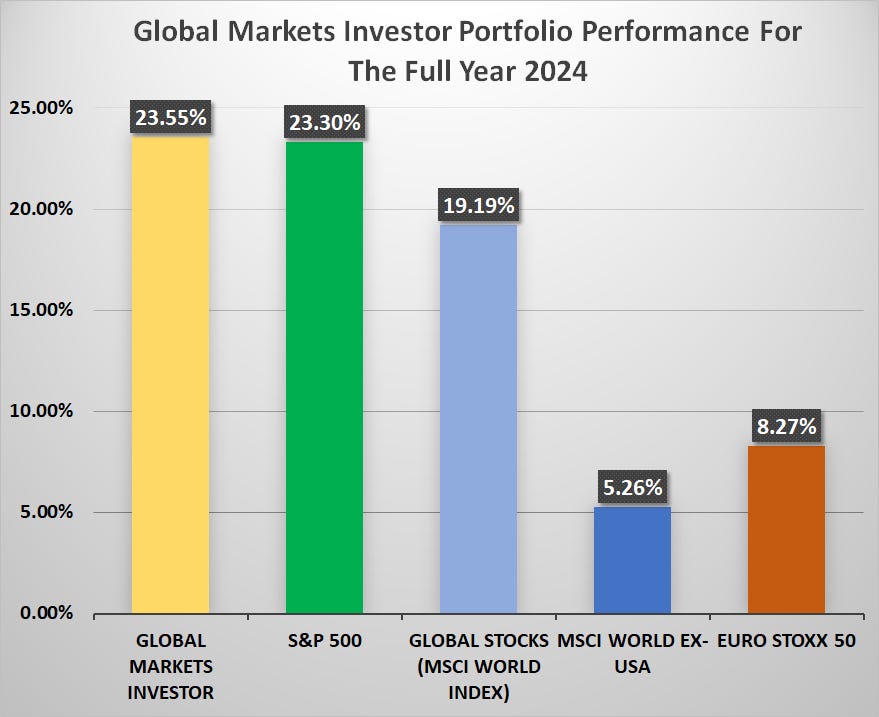

⚠️Portfolio performance review for the full 2024

Assessment of my long-term investment portfolio in 2024

Remember that all information provided here is for educational and entertaining purposes and is not investment advice. By investing in the financial markets I risk my own money. Past performance is no guarantee of future results.

Time for the final review of my long-term investment portfolio performance for the full year 2024.

As you you know, I made some changes to my holdings on July 11 and subsequently on December 9 by buying more defensive assets given what has been happening lately with the market sentiment, valuations and the US economy, especially the labor market. Full portfolio composition is available for Founding Members.

In general, moving to more defensive assets has helped to sleep better. This is because portfolio is now less riskier than holding everything in stocks or other risky assets. Despite a more careful stance, the portfolio still slightly beat the S&P 500 for the full year, and materially the rest of the world.

My long-term investment portfolio ended 2024 up 23.55%, above the S&P 500 gain of 23.30%. This was also above the 19.19% return of the MSCI World Index representing global stocks (they are mostly driven by the US market, 74% weight is the US).

Moreover, the portfolio significantly beat returns of world stocks excluding the US as well as European stocks.

I do not expect such outstanding returns in 2025. However, if my expectations will partially come true, the portfolio should again beat stocks.

The next piece will be about different assets’ performance for 2024 outlining some interesting statistics about the markets.

I hope you find it useful and enjoyable at the same time. Thank you.

Global Markets Investor

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?