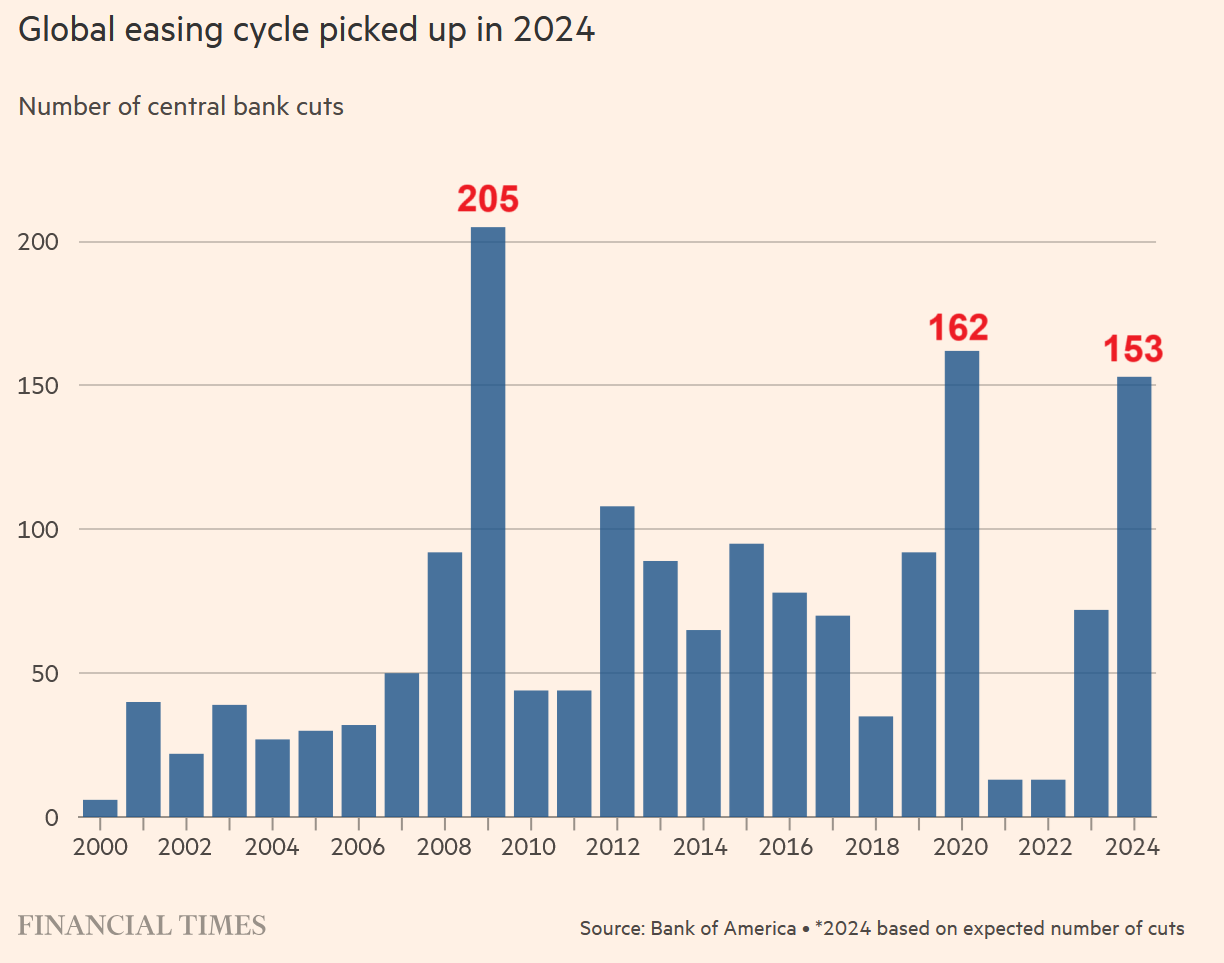

Global central banks are cutting rates at the fastest pace since the 2020 crisis

What is lying ahead for the world's largest central banks?

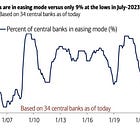

Global central banks cut their rates 153 times in 2024, the most since the 2020 crisis. That was also the second-highest level since the Great Financial Crisis of 2007-2009.

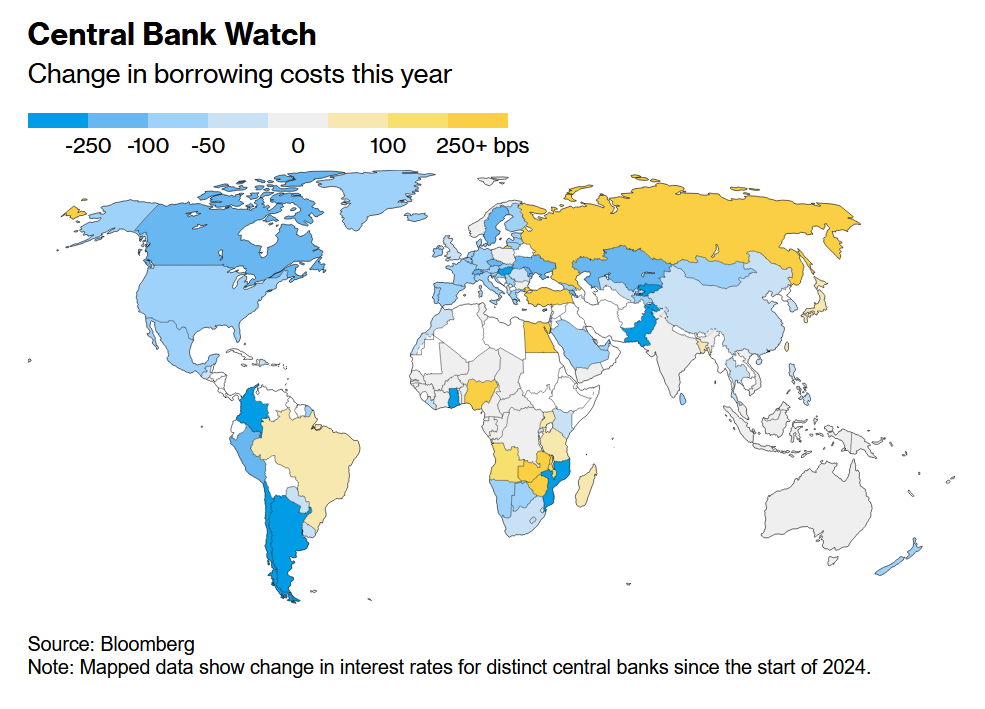

This is an important trend needing further investigation given that changing levels of rates affect the lives of all people around the globe. It affects mortgage rates, deposit rates, and overall borrowing costs for firms and individuals. It also impacts asset prices such as stocks, bonds, currencies, or precious metals.

All things considered, it is time for an update of the following piece and to analyze the most recent moves of the world’s largest central banks and their outlook.

This piece covers: the Federal Reserve, the European Central Bank, the Bank of Japan, the Bank of Canada, the Bank of England, the Reserve Bank of Australia, the Reserve Bank of New Zealand, the People’s Bank of China, the Reserve Bank of India, and the Swiss National Bank.

THE FEDERAL RESERVE