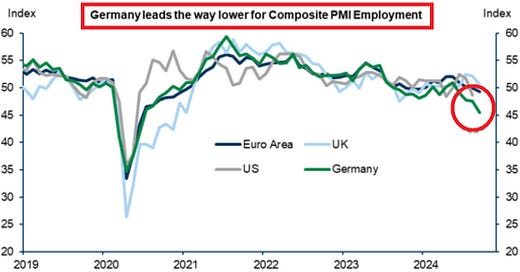

⚠️CHART OF THE WEEK: Major economies' employment is shrinking for the first time since 2020

Leading employment indicators point to further employment deterioration in Germany, the US, the UK and the Euro Area

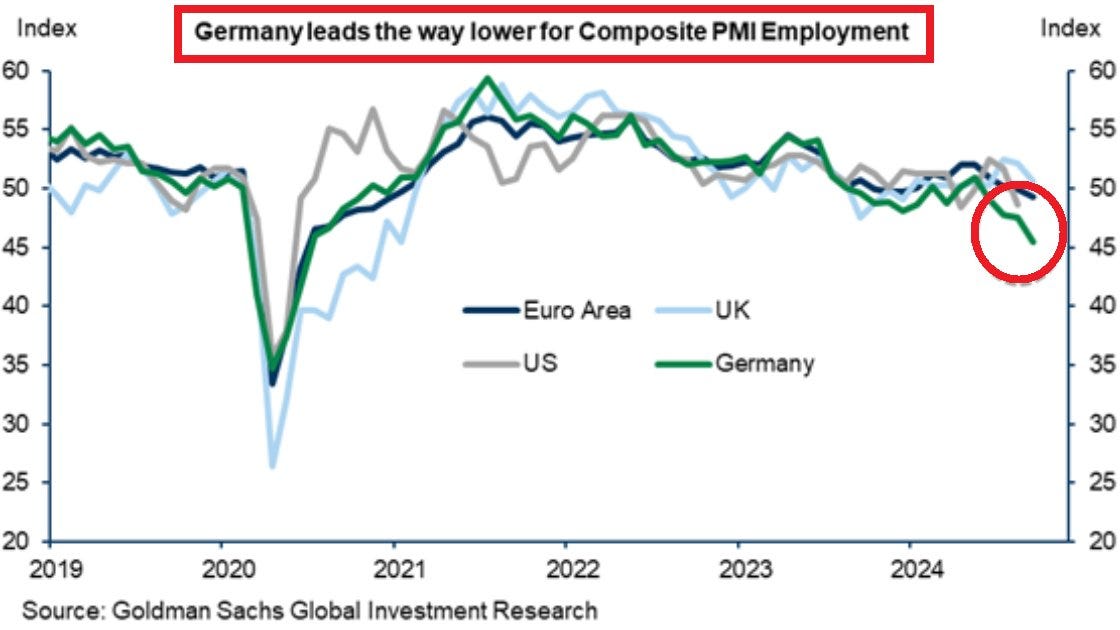

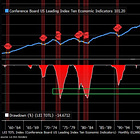

Composite PMI Employment is a leading indicator for the job market and is reported in many countries to get a sense of how the economy could perform in the subsequent months. The composite index consists of the manufacturing and services sector and, therefore is a solid gauge of the future economic conditions.

As you can see in the below graph, the Composite PMI Employment has recently fallen below 50 in the Euro Area, the UK, the US, and Germany. This means employment is contracting simultaneously in major economies for the first time since the COVID CRISIS.

As a reminder, these economies account for nearly 50% of the global GDP.

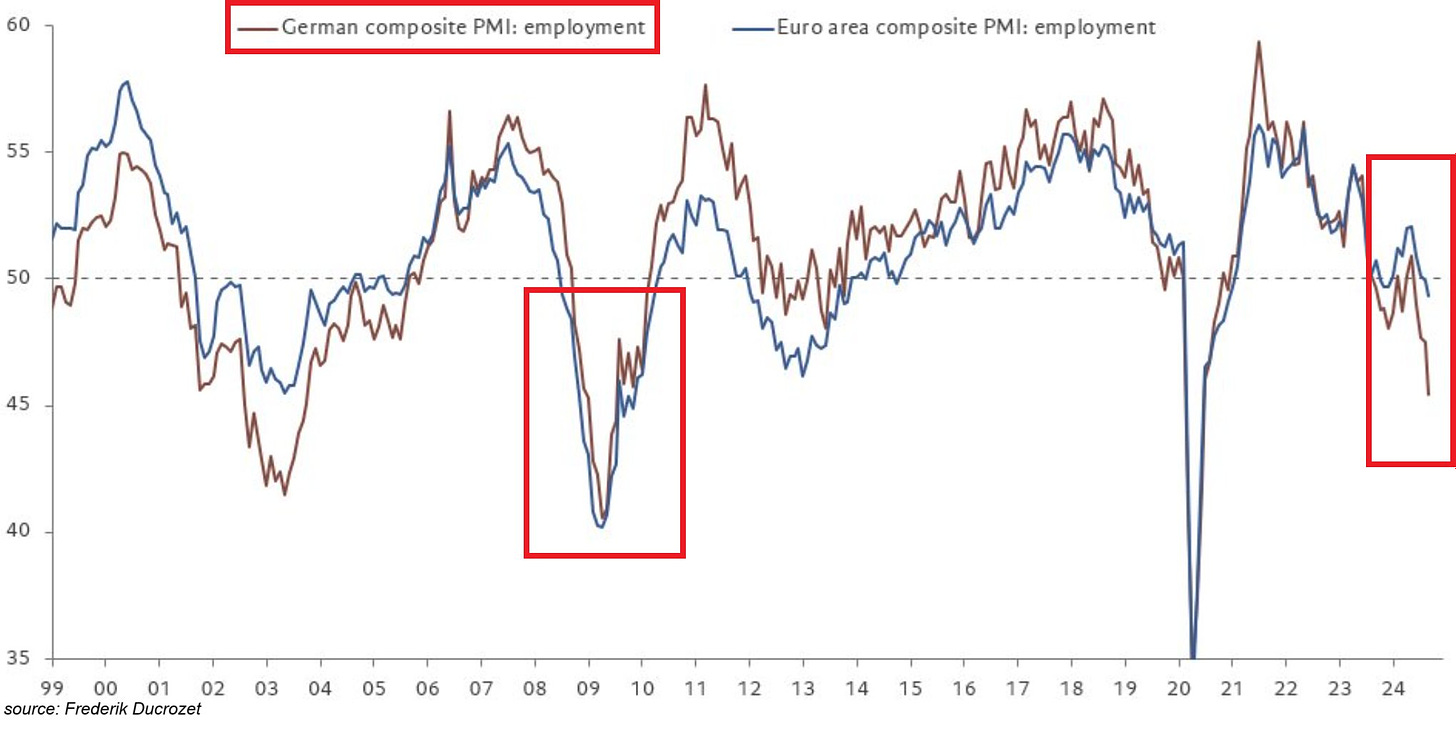

The most dire picture is in Germany, where its PMI employment index plummeted into a deep negative territory, in line with the Great Financial Crisis levels.

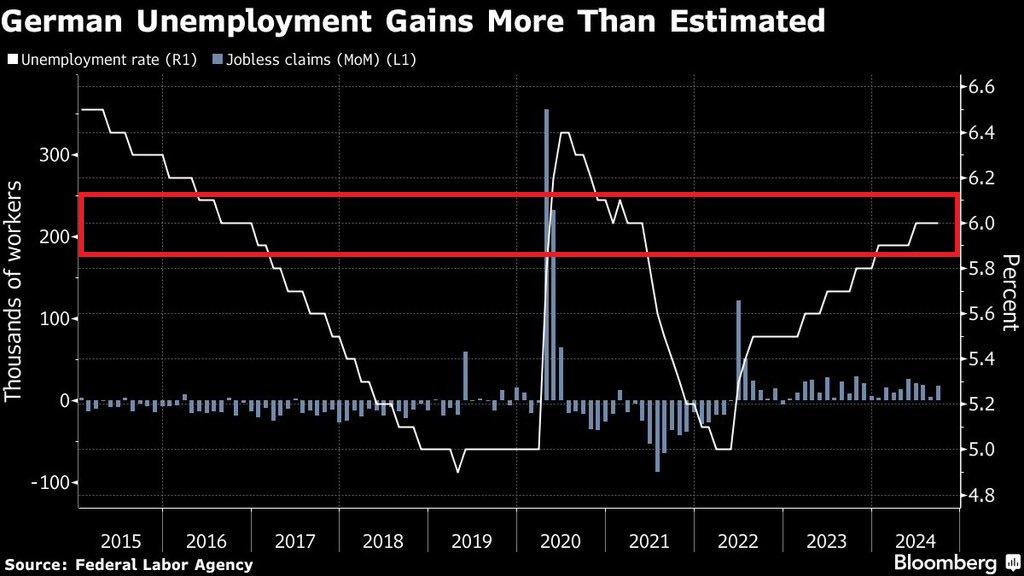

Most recently, joblessness in the world's third-largest economy rose by 17,000 in September above the 13,500 expected by economists. The unemployment rate currently sits at 6.0%, the most in over 3 years, and has risen by 1.0 percentage points over the last 2 years.

Given how the composite PMI employment index has deteriorated, we may expect a further rise in the German unemployment rate in the following months.

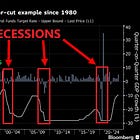

In conclusion, the global economic picture is getting grimmer and the global central banks' rate-cutting cycle will not immediately stop the weakness due to the lag effect (explained in my previous articles about the Fed and the US economy).

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter:

Why subscribe?