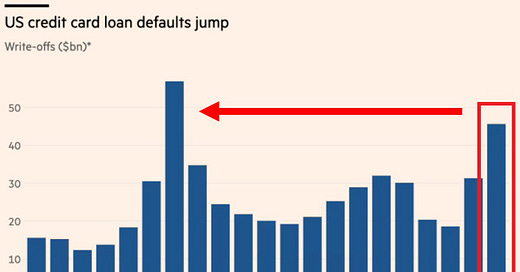

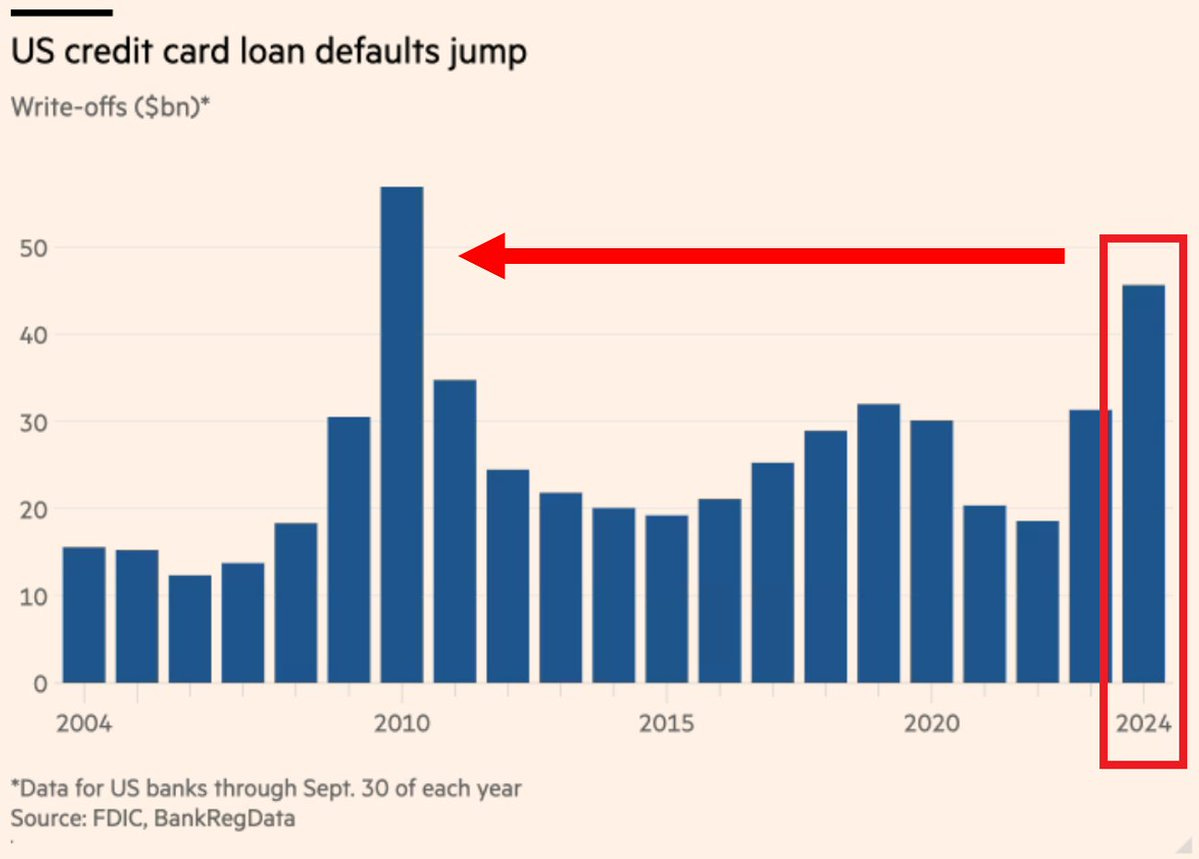

BREAKING: US credit card defaults hit the highest level in 14 years

US consumers are feeling the pain of record prices and historically high interest rates

What a year it has been. We have grown this community to over 2,700 free subscribers with many of them becoming premium ones. Feedback has been absolutely fantastic and this is just the beginning. As we are heading into the end of 2024, as a token of appreciation please find below a 10% discount for an annual subscription.

61,000 - this is the number of views of this content over the last 30 days. This is pretty impressive how fast the overall reach has been growing here and on social media. Unfortunately, inflation has also been rising. The best ways to fight this are investing in financial markets and growing business and its profits.

This is why prices for NEW paid subscribers will go up from the 1st of January 2025 to $19.99 a month and $199 a year. This is still below the pricing of most creators and a decent price for the amount and quality of research you receive. You can secure the current (old) pricing below before December ends.

US credit card defaults in the first 9 months of 2024 spiked 50% year-over-year to $46 billion, the highest since 2010, a year after the Great Financial Crisis.

Credit card write-offs in seriously delinquent loans have doubled over the last 2 years.

As a % of total credit card debt, defaults hit the highest in 13 years.

The most financial pain has been seen in the bottom-income consumers.

Moreover, the savings rate of the bottom third US households is now 0%, according to Moody’s analytics.

If you find it informative and helpful you may consider a paid subscription (or annual if subscribed), become a Founding Member, and follow me on Twitter or Nostr:

Why subscribe?