Are US consumers' finances seriously stretched?

Over the last few quarters, the largest driver of the US economy has pulled back their spending due to ever-rising costs of living

Before you move on to the full piece, below you can find updates about the shape of the US consumer, the labor market, and the entire economy. Conclusions out there are not promising:

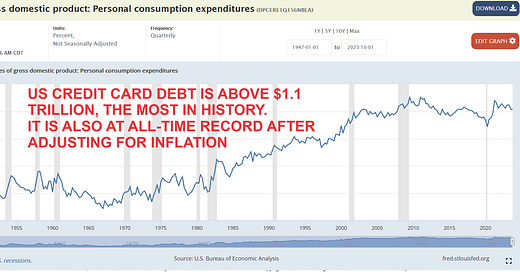

In recent months, we have heard a lot of voices pointing out a material (or upcoming) weakness of the US consumers’ finances which may negatively weigh on the GDP growth of the largest economy in the world. Among those voices, there is a lot of noise and data inconsistencies which often mislead market participants and ordinary people. This piece tries to explain most of them, clarifies the misconceptions, and answers key questions regarding this key US economic engine. It is mentioned as the key because as you can see in the graph personal consumption expenditures accounted for 67.7% of the US GDP as of the end of the fourth quarter of 2024.

To some extent, it is a continuation and data update of the below work which tried to answer whether the US economy is going to avoid a recession (you may read it for free by clicking below).

Let’s therefore find out what the economic reality looks like, if the US consumer shape is deteriorating, and what might be the future implications for the largest economy in the world.