25% of the world is either in recession or is going through an economic stagnation

Japan and the United Kingdom have recently fallen into a recession while the Eurozone and Canada economic growth has stagnated

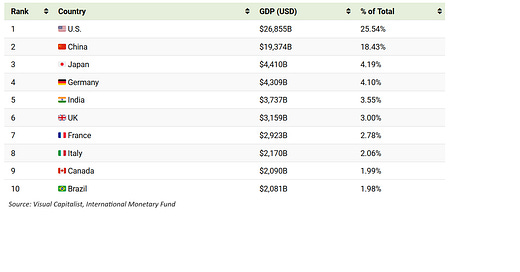

In recent weeks we have seen many economic news headlines about one of the largest economies in the world slipping into a recession, the United Kingdom and Japan. That might be a good (bad) reason to investigate further how other big economies have been performing lately. Using last year’s International Monetary Fund’s (IMF) estimates we learn that the Global Economy has likely exceeded $100 trillion worth in 2023 with the US and China having the largest share of it.

Please note, that given the fact that the Japanese GDP has shrunk in the last two quarters, Germany has now become the third-largest economy in the world.

ECONOMIES IN RECESSION

For the purpose of this reading, we will be using quarter-over-quarter (QoQ) GDP growth instead of annualized as not every country reports the annualized method and QoQ is simpler.

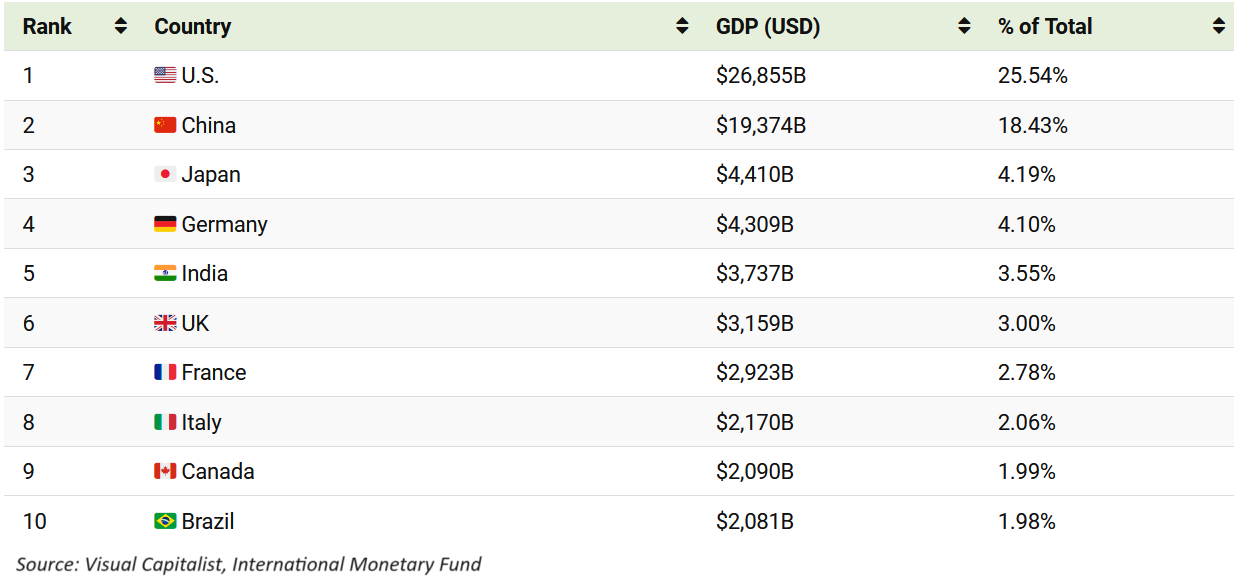

The first large economic bloc that shrank in the past two quarters (technical definition of a recession) is Japan. This has been caused by a slowdown in consumer and business spending. The third quarter of 2023 experienced a 0.8% QoQ decline and the fourth quarter 0.1% QoQ reduction.

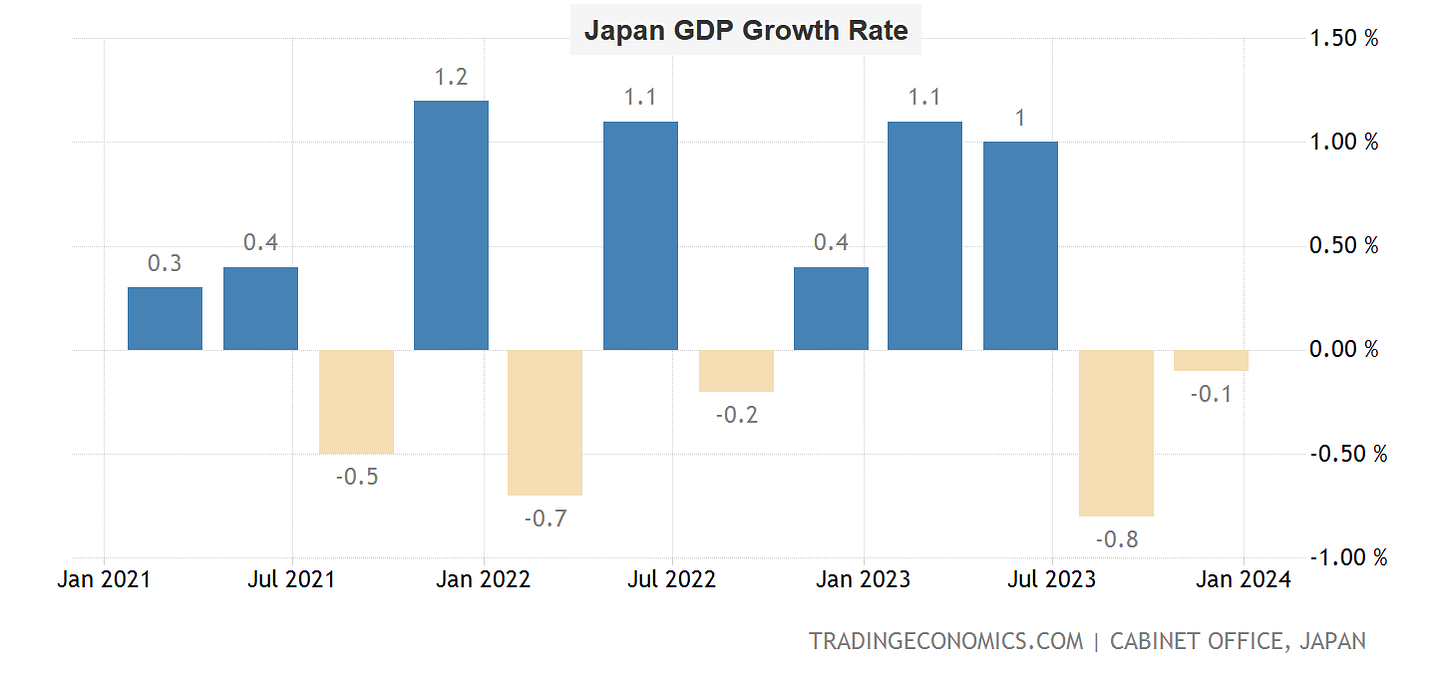

Second today, and the one included in the top six economies on the globe is the United Kingdom. In the third quarter of 2023, the country experienced a 0.1% QoQ decrease in GDP, and in the fourth quarter UK saw a 0.3% QoQ drop. This was driven by all three main economic sectors contracting — services, industrial production, and construction.

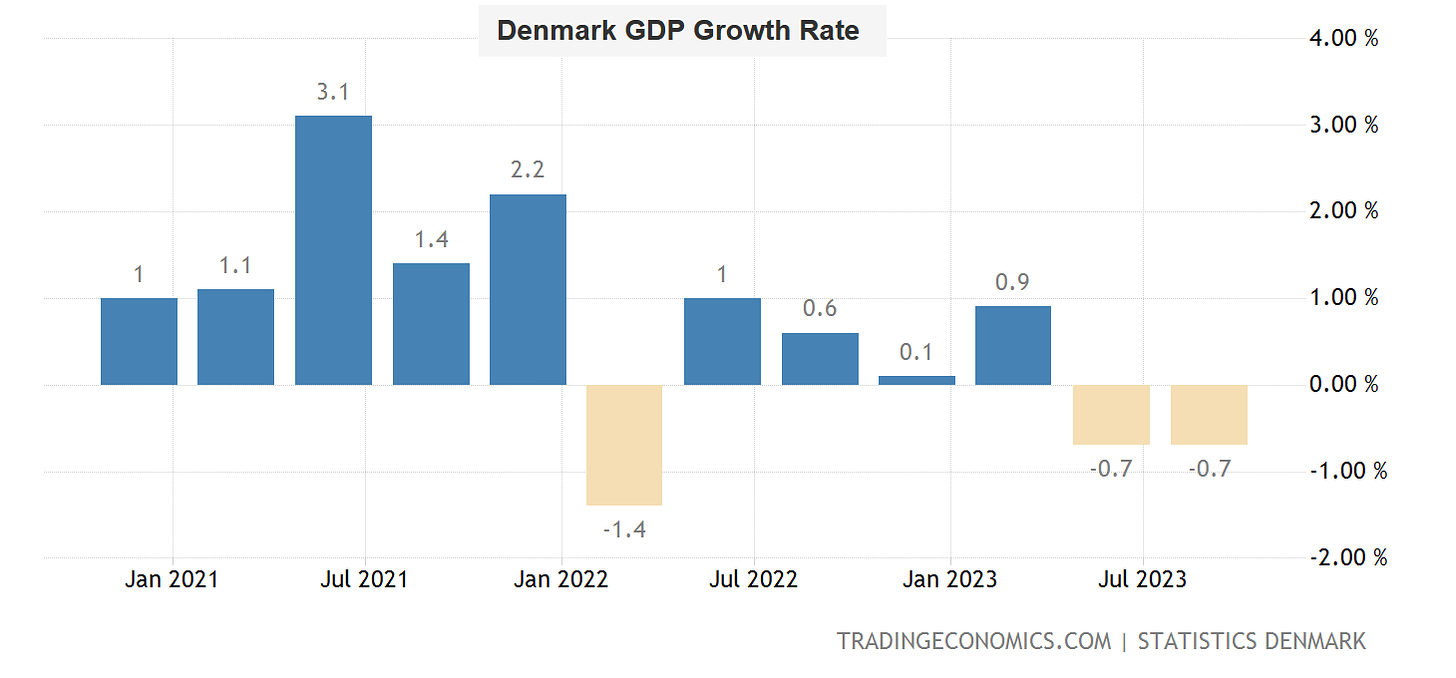

Next is Denmark, a European Union country not included in the Euro Area. In both Q2 and Q3 of 2023, the country’s economic output declined by 0.7% QoQ. This was primarily due to a decline in manufacturing, within the pharmaceutical industry.

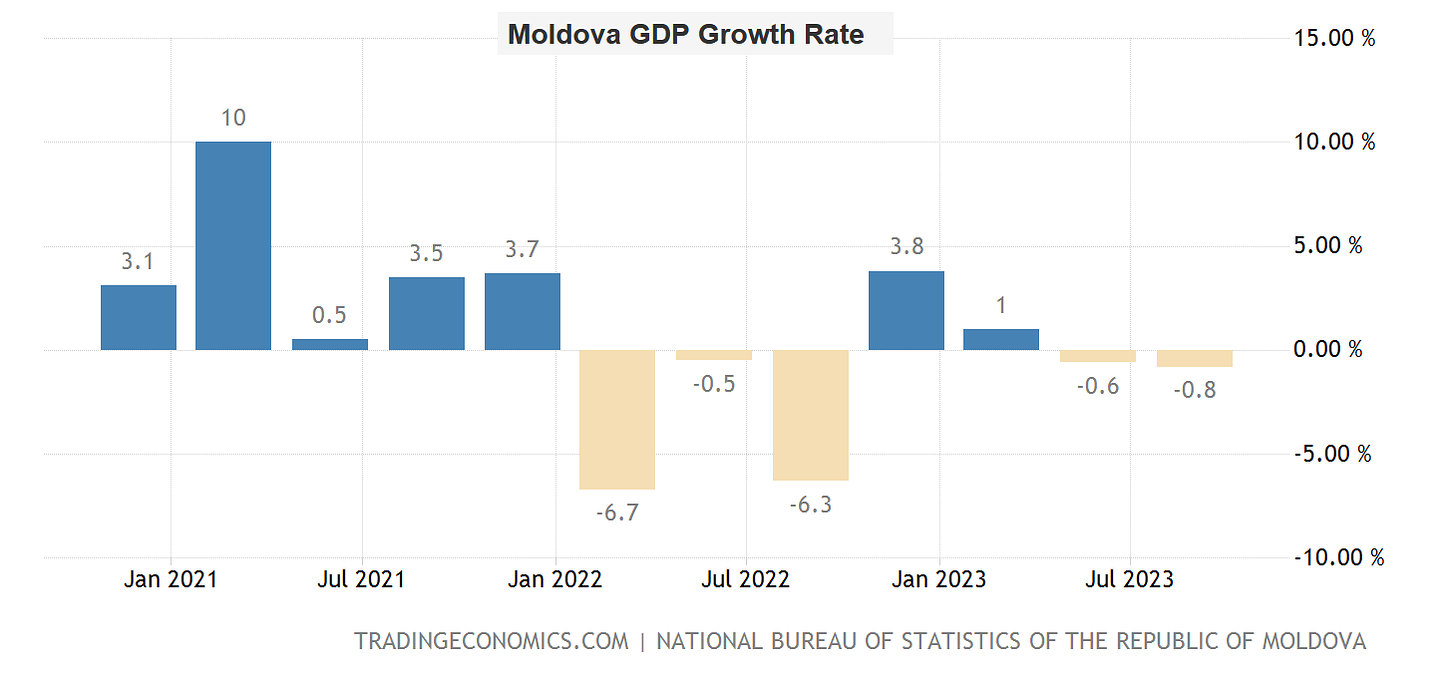

Moldova is a subsequent European country that has fallen into recession. in Q2 and Q3 its economy shrunk by 0.6% QoQ and 0.8% QoQ, respectively.

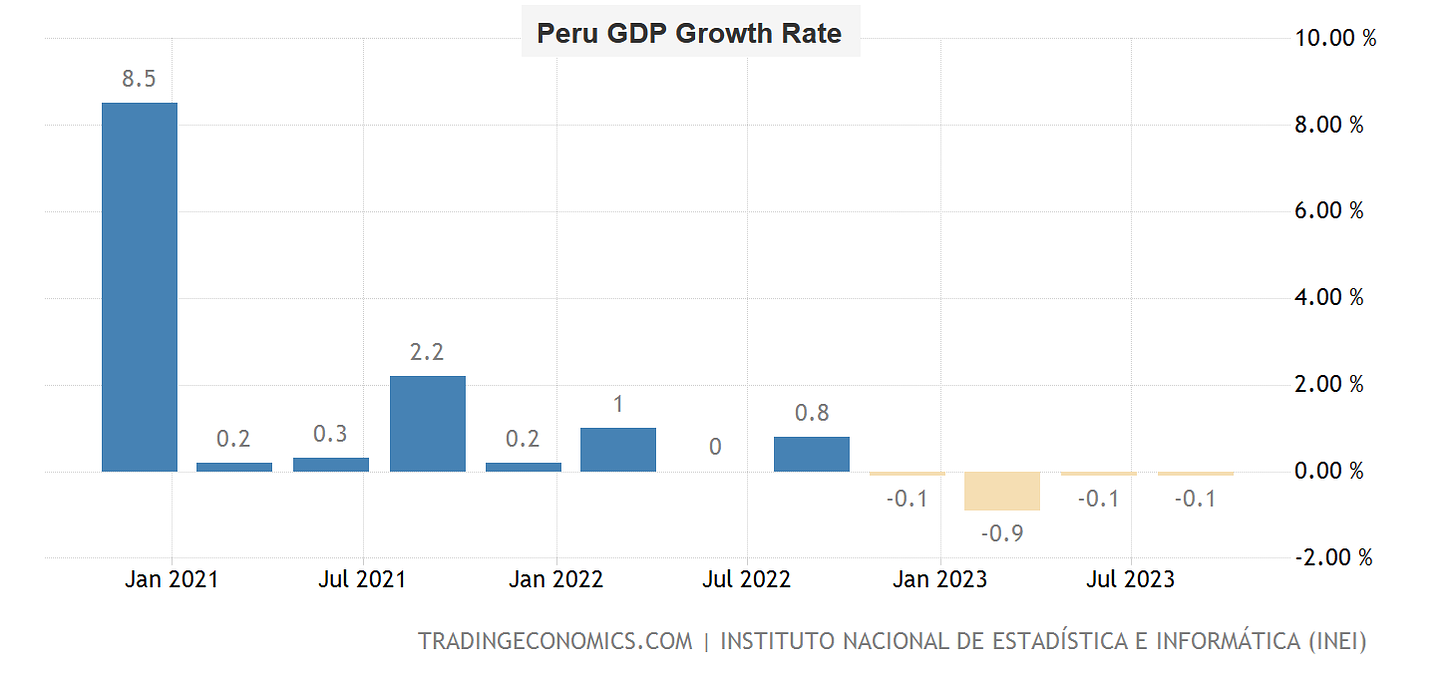

Last but not least on the list is Peru. The Peruvian economy has been contracting for the last four quarters, with Q2 and Q3 of 2023 decreasing slightly by 0.1% QoQ.

There are also a few countries such as Estonia, Luxembourg, and Ireland that have fallen into a recession but will be mentioned in the further section as the entire economic bloc called the Euro Area which has neither been growing nor contracting.

ECONOMIES IN STAGNATION

This section mentions economies that have barely seen any GDP growth over the past couple of quarters on average.

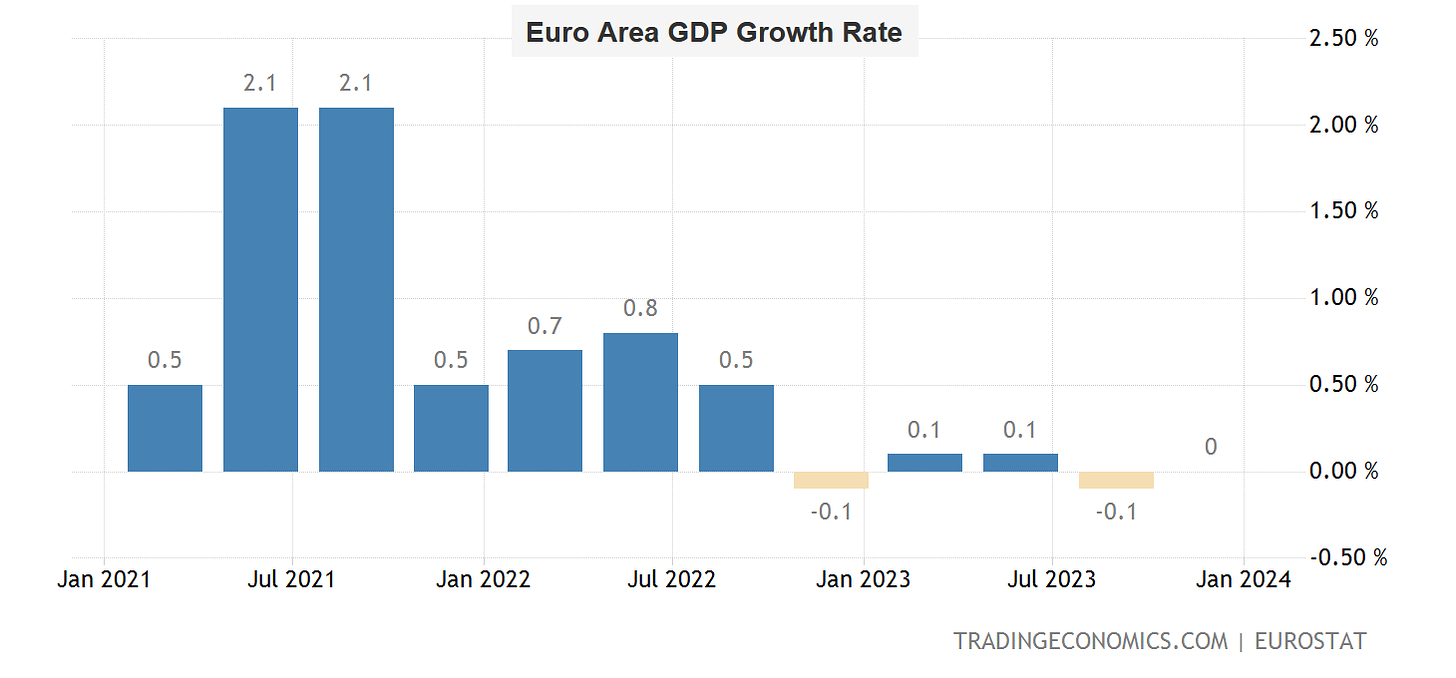

First of all, there is the aforementioned Euro Area, which accounts for roughly 14% of global GDP. As you can see below, over the past five quarters, this large economic bloc has basically not seen any output growth. Q3 of 2023 declined by 0.1% QoQ and Q4 of 2023 was flat.

This is because higher interest rates have been negatively impacting consumer and business demand within the bloc. Moreover, a few countries which have already been mentioned in the previous section have fallen into a recession and some of them are on the brink of it such as the largest one, Germany which accounts for ~4% of the global GDP.

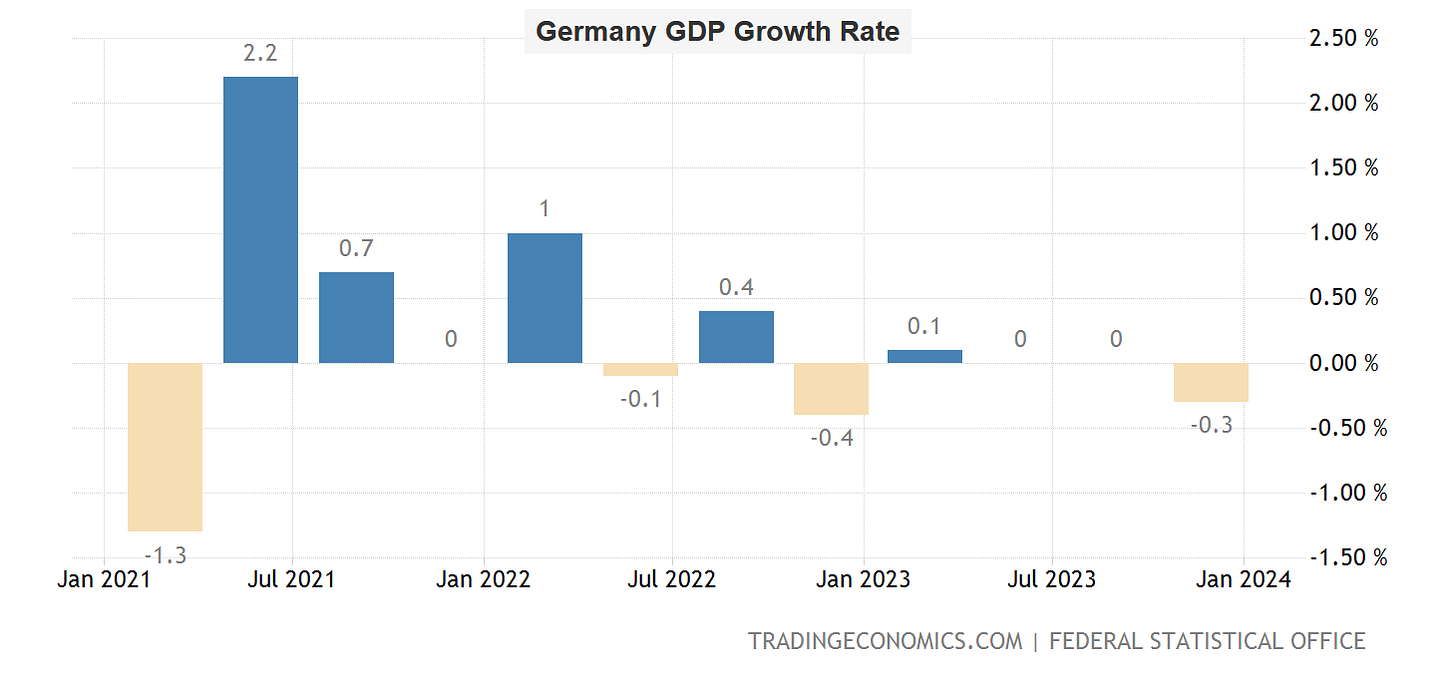

In the graph below it is shown that similarly to the entire Euro Area the German economy has also been struggling for the past five quarters. It is worth mentioning that on a year-over-year basis, the country already entered a technical recession (two consecutive quarters of shrinking GDP) for the first time since 2020-21.

Even the German government is pessimistic about the output and announced that it will downgrade its GDP growth forecast for 2024 to just 0.2% y/y growth.

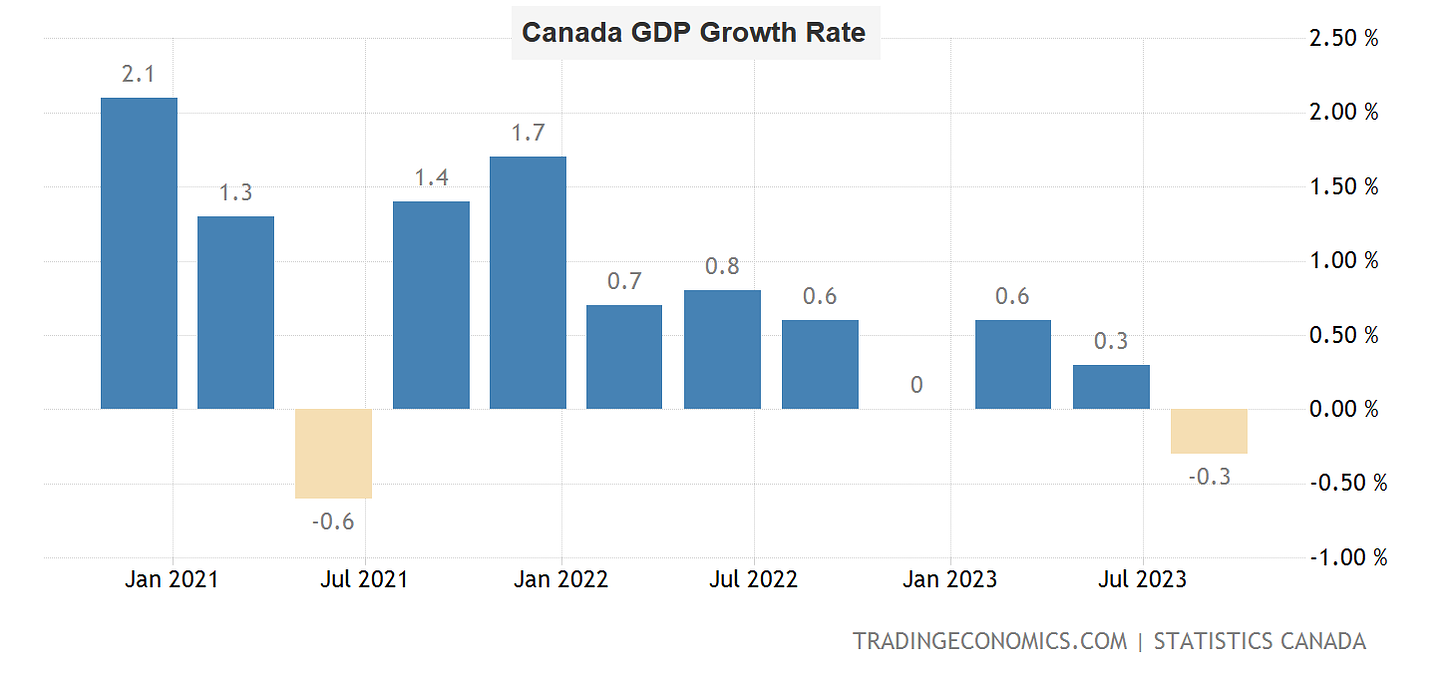

A subsequent country worth mentioning is Canada with its 2% GDP share within the global economy. In the Q3 of 2023, the country experienced a 0.3% QoQ economic output decline. Though in Q2 it saw a 0.3% growth it would be better to look forward at Q4 which is expected by the Bank of Canada to be flat QoQ. Some forecasters such as Trading Economics even expects a slight output slippage. This is why the country has been located in the stagnation section of this reading.

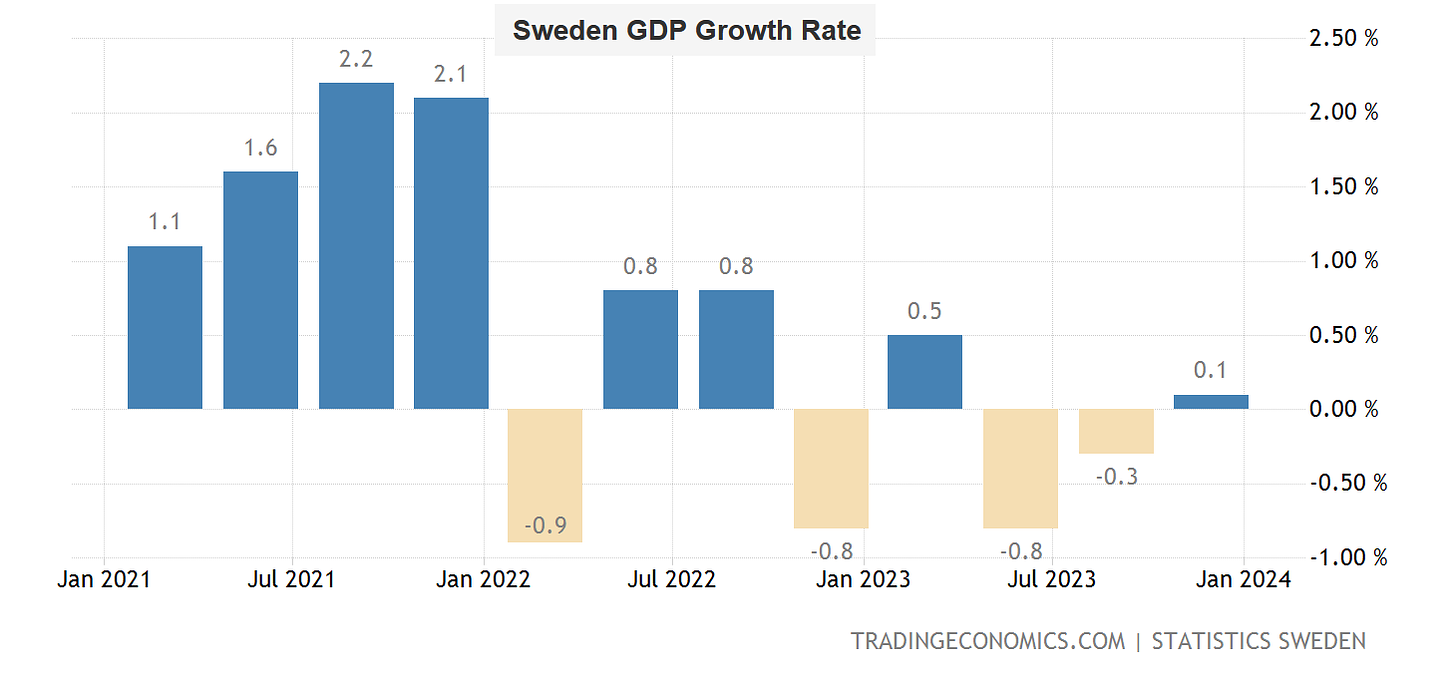

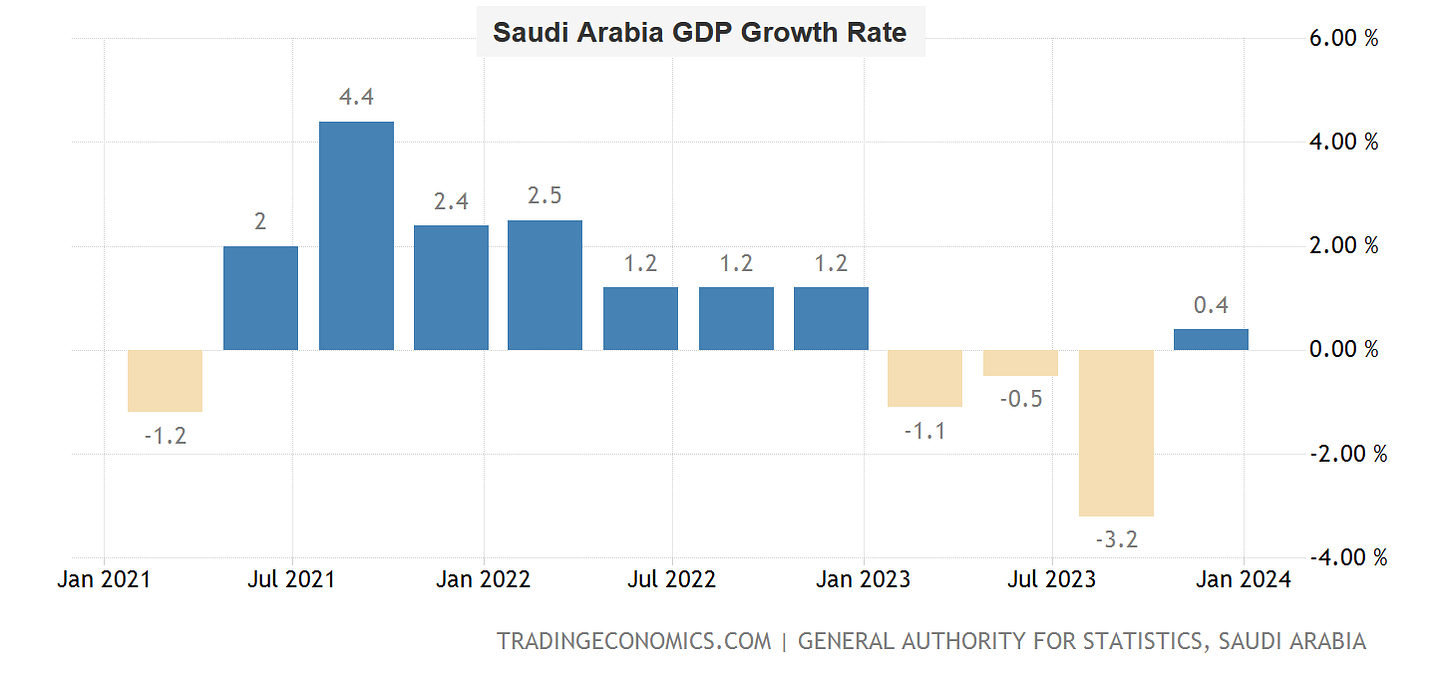

At the end of the section, there are Sweden and Saudi Arabia which in the last couple of quarters have been either shrinking or slightly growing meeting the criteria of economic stagnation. Sweden was hit by higher inflation and interest rates weighing on consumption and housing construction while Saudi Arabia by cuts in oil production and lower crude prices.

SUMMARY

In total when summing all the above-mentioned economies as a share of world GDP, we may conclude that roughly 25% of the global economy has been going either through recession or stagnation. This has been happening due to a weaker consumer and business demand affected by higher inflation and interest rates (except for Japan) weighing on those countries' GDP. This is a worrying sign. At this point, we also should ask ourselves whether we have already felt economic pain or at least our wallets have.

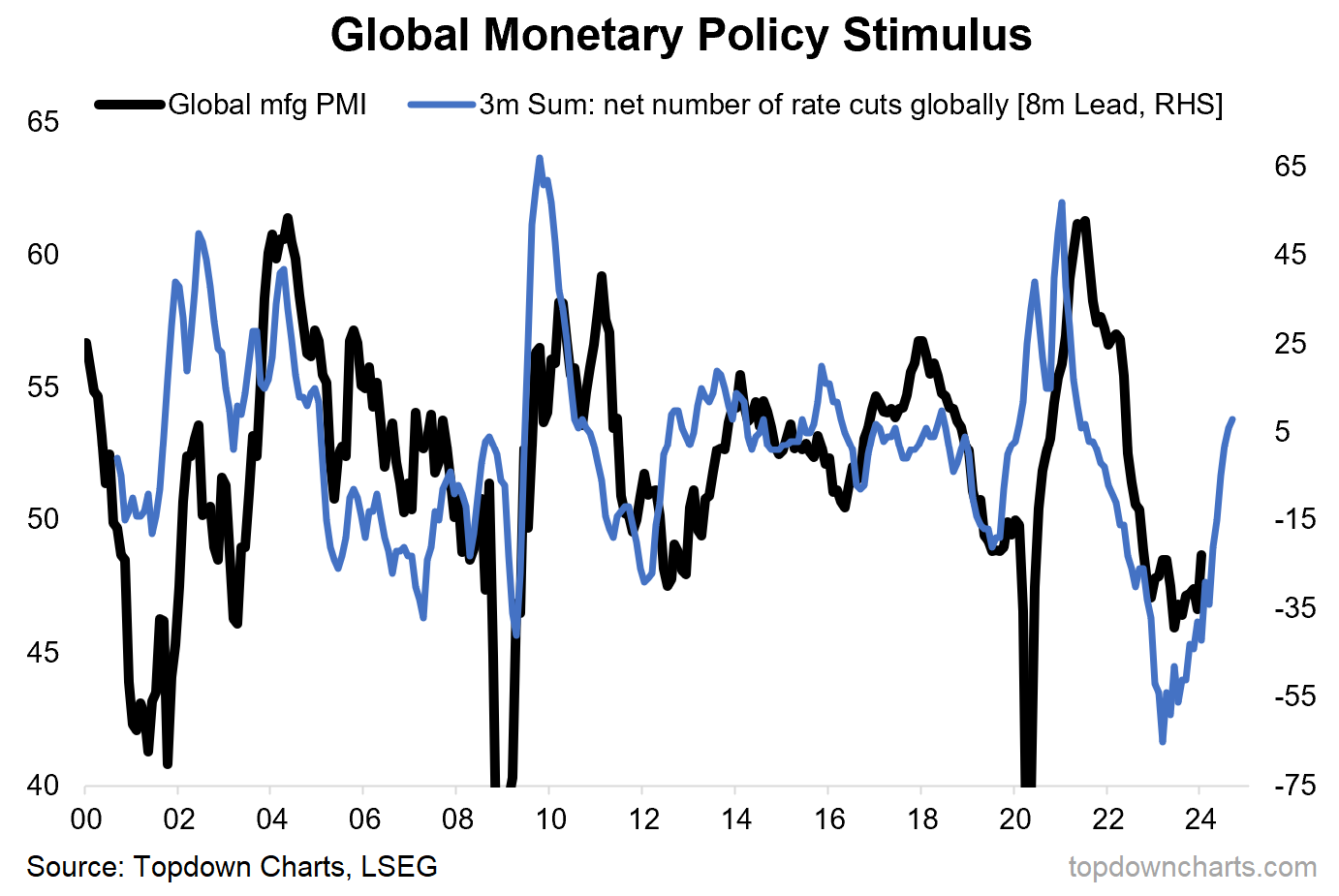

To fight these issues, central banks and governments might want to stimulate economies by lowering interest rates and increasing budget deficits if necessary. In fact, this phenomenon has actually started globally. The blue line below shows the net number of interest rate cuts (rate cuts minus rate hikes) conducted by the world central banks as a 3-month sum being positive. This positive mostly applies to emerging markets countries that are not included in the above analysis but those which have been included should follow in the next few months.

However, those policies come with a lag (as the chart shows of at least 8 months) and until they start working, those economies may find out themselves in bigger trouble.

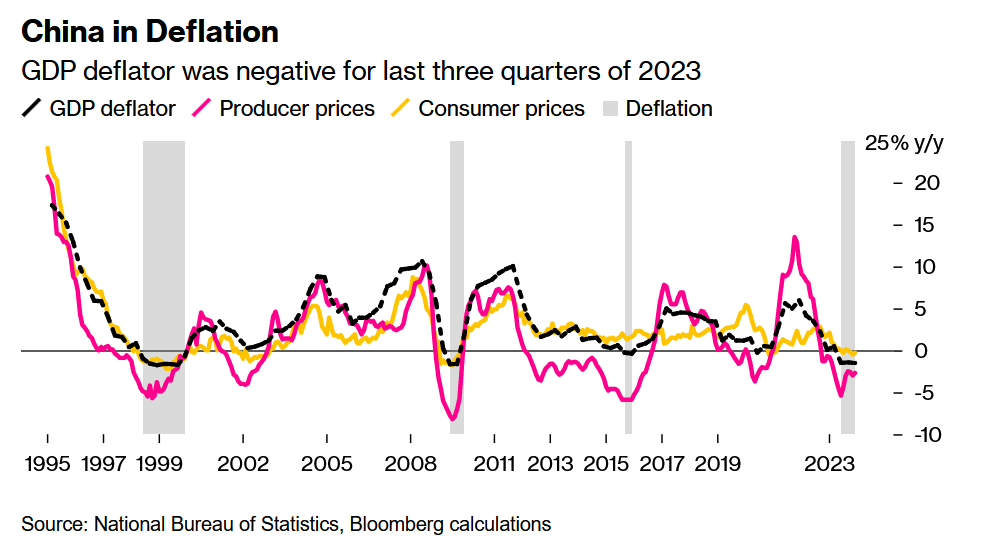

We can not also forget the fact that China, the second-largest economy in the world, has also been slowing and going through a period of deflation.

Deflation of such deepness in both GDP deflator, producer, and consumer prices have recently been seen in the Middle Kingdom during the Great Financial Crisis of 2007-2009 which also met the definition of a global recession.

In turn, the largest economy in the world, the United States has been quite resilient so far despite many leading indicators flashing red signals as you can read in one of the previous articles:

If you find it informative and helpful you may consider buying me a coffee and follow me on Twitter: